DX Group Joint Stock Company (Code: DXG, HoSE) has just announced a report on the results of trading in shares of insiders and related persons of public companies.

Accordingly, in the period from August 4, 2025, to August 26, 2025, Ha Duc Hieu – a member of the Board of Directors of DX Group, successfully sold nearly 6.4 million registered shares.

After this transaction, Mr. Hieu’s ownership of DXG shares decreased from nearly 6.8 million shares to 414,033 shares, equivalent to a reduction in ownership ratio from 0.66% to 0.04% of the capital of DX Group.

Illustrative image

Assuming the share price on August 4, 2025, was VND 20,000/share, it is estimated that the Member of the Board of Directors of DX Group earned approximately VND 127.1 billion from the above-mentioned share sale transaction.

In a similar vein, Mr. Bui Ngoc Duc, CEO of DX Group, also sold 744,418 DXG shares from July 24, 2025, to August 19, 2025, by agreement/order matching. After the transaction, Mr. Duc’s ownership decreased to 952,000 DXG shares, equivalent to 0.09% of the company’s charter capital.

Previously, Ms. Do Thi Thai – Vice President of DX Group registered to sell 413,300 DXG shares to reduce ownership. The transaction is expected to take place from August 15, 2025, to September 13, 2025, by agreement and order matching.

If the transaction is successful as registered, Ms. Thai will reduce her ownership of DXG shares from 893,085 shares to 479,785 million shares, equivalent to a decrease in ownership ratio from 0.09% to 0.05% of the capital in DX Group.

In another development, DX Group recently announced a resolution on the implementation of the plan to offer private placement shares approved at the 2025 Annual General Meeting of Shareholders.

Accordingly, DX Group plans to offer 93.5 million private placement shares to a maximum of 20 professional investors. The issued shares will be restricted from transfer for one year. The expected implementation time is in the third and fourth quarters of 2025.

With an offering price of VND 18,600/share, DX Group expects to raise VND 1,739.1 billion from this offering. The entire amount will be used to contribute capital to Ha An Real Estate Business Investment Joint Stock Company (a subsidiary of DXG). The purpose is for Ha An Real Estate to contribute capital to its subsidiary, Phuoc Son Investment Joint Stock Company.

Phuoc Son Investment Joint Stock Company will use this amount to contribute capital to its subsidiary, Hoi An Invest Joint Stock Company, to implement the investment project for the High-rise Residential Area – Commercial Services Green Vision (DatXanh Homes Parkview).

It is known that DXG plans to offer the above 93.5 million private placement shares to foreign investors. Therefore, to ensure the regulation on the maximum foreign ownership ratio of 50%, DXG temporarily freezes the maximum foreign ownership ratio for 46.5 million shares that have been privately placed, with a freezing ratio of 45.42%.

The freezing period is from the time the SSC receives the registration dossier for private placement of DXG shares until the end of the offering period.

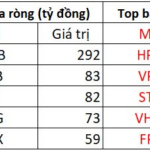

“Foreign Block Dumps Over $70 Billion on Monday: Which Stocks Were in the Firing Line?”

“Foreign investors showed strong buying interest in MBB stocks, making it the most actively traded stock on the market. The trading session saw a net buy value of VND 292 billion for this stock alone.”

Market Pulse, August 27: Stumbles Under Foreign Investors’ Selling Spree

The VN-Index experienced a back-and-forth session, hovering around the 1,675-point mark throughout the afternoon. Despite significant support from the market heavyweight VCB, which surged to its daily limit, the index couldn’t sustain its gains and ended the trading day on a rather lackluster note. The selling pressure from foreign investors weighed heavily on the market, eroding much of the early gains.

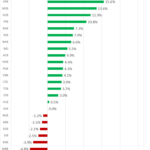

The Stock Market’s Best-Kept Secret: Banking on Big Gains

Last week, from August 18 to 22, 2025, a slew of bank stocks witnessed an impressive surge, with gains exceeding 10%. This significant upward trend underscores the robust performance and resilience of the banking sector, highlighting its potential for investors seeking lucrative opportunities in the financial realm.