Taseco Land JSC (Taseco Land, stock code: TAL, listed on HoSE) has recently released a document to seek shareholders’ approval for a private placement to increase its charter capital.

Specifically, Taseco Land plans to offer 48.15 million shares to professional securities investors, with an expected issue price of VND 31,000 per share. The number of prospective investors is expected to be fewer than 20.

With this private placement, the company aims to raise nearly VND 1,492.7 billion. The proceeds from the offering will be used to enhance the company’s financial capacity and restructure its debt obligations.

Illustrative image

The shareholders’ meeting authorized the Board of Directors to decide on the detailed plan for utilizing the proceeds based on the company’s needs.

The offering is expected to take place in the third or fourth quarter of 2025, following the completion of the book-building process and approval from the State Securities Commission of Vietnam (SSC).

If the issuance is successful, Taseco Land’s outstanding shares will increase from 311.85 million to 360 million, resulting in a charter capital increase from VND 3,118.5 billion to VND 3,600 billion.

The deadline for receiving shareholder opinions on this matter is 5:00 PM on September 3, 2025.

Taseco Land’s plan for a private placement comes shortly after its successful debut on the HoSE on August 1, 2025. The decision to move to HoSE was approved by shareholders at the 2025 Annual General Meeting held on April 21, 2025. As of now, its parent company, Taseco Group Joint Stock Company (TASC), holds a 72.89% stake in TAL.

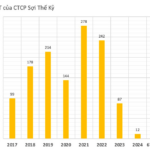

In the second quarter of 2025, Taseco Land recorded a 11.5% year-on-year decrease in revenue, amounting to VND 557 billion. However, thanks to a 19% reduction in cost of goods sold, gross profit increased by VND 15 billion to VND 185 billion.

During this period, financial expenses decreased by 36% to VND 51.2 billion, offsetting the threefold increase in selling expenses, which totaled VND 34 billion.

Consequently, Taseco Land reported a five-fold surge in after-tax profit, reaching VND 37.6 billion for the quarter.

For the first half of 2025, the company’s revenue slightly decreased by VND 6 billion to VND 933 billion. However, with improved gross profit margins, Taseco Land’s after-tax profit reached VND 60 billion, a 3.51-fold increase compared to the same period last year.

For the full year 2025, Taseco Land targets consolidated revenue of VND 4,332 billion and after-tax profit of VND 536 billion. The real estate segment is expected to contribute VND 3,709 billion, while the construction and industrial infrastructure and services segments are projected to generate VND 239 billion and VND 384 billion, respectively.

“HOSE Issues Urgent Alert to Investors Regarding Fake Documents”

The Ho Chi Minh Stock Exchange (HOSE) has issued a warning about fraudulent documents circulating that entice investors with enticing fixed investment package schemes. These documents are a deceptive ruse designed to lure unsuspecting investors into risky ventures.

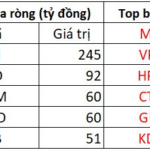

“Foreign Block Sells Off Nearly VND 2.5 Trillion as VN-Index Hits New Peak”

The SSI stock witnessed a significant net foreign purchase on the afternoon of the trade, with a value of 245 billion VND, making it the most actively bought stock by foreign investors in the entire market.