Billionaire Pham Nhat Vuong has an impressive track record in terms of total wealth. Photo: VIC

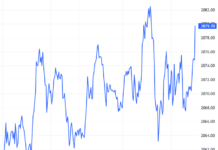

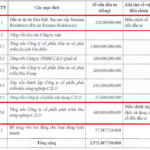

According to Forbes data (as of August 26, 2025),

the total wealth of billionaire Pham Nhat Vuong, Chairman of Vingroup, has reached US$13.4 billion, an increase of half a billion dollars in just 24 hours.

This achievement has solidified his position as the richest person in Vietnam. Pham Nhat Vuong is currently ranked 205th on the list of the world’s billionaires.

This is also the first time that a Vietnamese citizen has recorded a net worth exceeding US$13 billion.

Previously, Pham Nhat Vuong also set records as the first Vietnamese to surpass the US$10 billion and US$11 billion marks in total wealth.

According to Forbes’ calculations, Pham Nhat Vuong’s wealth has increased by approximately US$6.9 billion since the publication of the 2025 list of world billionaires in early April this year. This achievement has propelled the Vingroup Chairman more than 320 places up the ranking of the world’s richest people.

Total wealth of billionaire Pham Nhat Vuong, according to Forbes on August 26. Screenshot

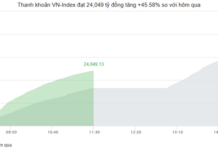

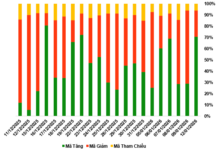

The impressive growth in billionaire Pham Nhat Vuong‘s wealth is attributed to the unexpected developments in the stock market on the first day of the week (August 25). Specifically, towards the end of the trading session, the VN-Index adjusted sharply, falling more than 31.4 points to 1,614 points. Moreover, the trading value of the two exchanges exceeded VND 44,500 billion.

Notably, the group of stocks related to billionaire Pham Nhat Vuong witnessed significant increases, such as VIC (Vingroup) and VHM (Vinhomes). Among them, VIC (Vingroup) rose 5.56% to VND 142,500 per unit, the highest ever.

In reality, VIC stock surged after Vingroup was recently recognized as the largest private enterprise contributing to the state budget, with a total amount of over VND 56,200 billion. This figure accounts for nearly 40% of the total budget contributions of the Top 10 leading enterprises and 23% of the Top 100 PRIVATE 100 recently published, and nearly 40% of the total budget contributions of the Top 10 leading enterprises.

Earlier, on August 11, 2025, Vingroup announced two new pillars: Infrastructure and Green Energy. These pillars include high-speed railways, bridges, ports, logistics, solar power, wind power, and energy storage systems.

Additionally, within the Vingroup ecosystem, VinFast has announced plans to deploy 150,000 battery swap stations nationwide within three years, with a scale declared to be “many times larger than the current gas station system.” It is expected that by October 2025, about 1,000 stations will be operational, reaching 50,000 by the end of the year before completing the full deployment.

Another Vingroup subsidiary, VinSpeed, is studying the investment in a high-speed railway project between Ho Chi Minh City and Can Gio, with a length of 48.5 km and an operating speed of 350 km/h, reducing travel time to just 15 minutes. In the 2030-2050 period, the expected frequency of this route is one train every 20 minutes.

The high-speed railway project between Ho Chi Minh City and Can Gio will have two stations, including Tan Thuan Station (starting point) located on the median strip of Nguyen Van Linh Street and Can Gio Station (end point) located on a 39-hectare land plot. Each train will consist of 8 carriages, with a capacity of 600-800 passengers.

Vietnam Has a New Half-Million Billion Dong Company

Vingroup, the corporation owned by billionaire Pham Nhat Vuong, surpasses VND 508,000 billion in market capitalization for the first time. Photo: VIC

With a remarkable performance on August 25,

Vingroup’s market capitalization surpassed VND 508,000 billion (approximately US$19.5 billion) for the first time.

On that day alone, the market capitalization of the corporation owned by billionaire Pham Nhat Vuong increased by approximately VND 27,000 billion. Thus, Vingroup, along with Vietcombank, is currently one of the two companies with the largest market capitalization on the Vietnamese stock market.

According to experts, if the upward trend continues for one more session, Vingroup could surpass Vietcombank to become the largest listed company on the Vietnamese stock market.

Apart from Vingroup, three other listed companies within the ecosystem of billionaire Pham Nhat Vuong maintain their market capitalization in the billions of dollars. Specifically, Vinhomes is valued at VND 404,100 billion (US$15.5 billion), Vincom Retail at VND 68,100 billion (US$2.6 billion), and Vinpearl at VND 144,900 billion (US$5.5 billion). These four enterprises hold a combined market capitalization of over VND 1.1 quadrillion (US$43.2 billion), accounting for approximately 16% of the total value of the HoSE stock exchange.

Mastering the Five Global Languages at Vietnam’s Top 10 World-Class Attraction

The United Nations, a global organization advocating for international cooperation, utilizes five official languages to facilitate communication and understanding among its diverse member states. These languages, carefully selected to represent the world’s linguistic diversity, are English, French, Arabic, Chinese, and Spanish. Each language holds significant historical and cultural value, serving as a powerful tool for diplomacy and global dialogue.

“Agribank: Facilitating Vietnam’s Carbon Credit Strategy on the Global Stage”

Carbon credits have emerged as a valuable “green asset”. However, to turn this potential into a tangible benefit, Vietnamese enterprises need a robust financial foundation and professional support, as well as market connections.