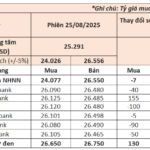

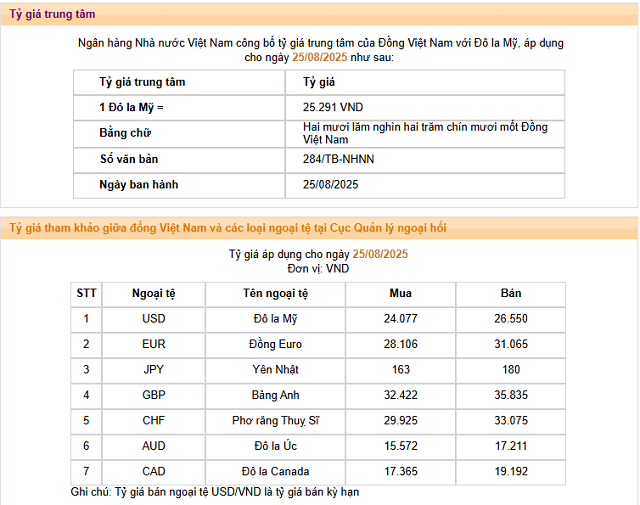

On August 25, 2025, the State Bank of Vietnam (SBV) announced the central exchange rate at 25,291 VND/USD, a decrease of 7 dong compared to the previous week’s closing rate.

Source: SBV

|

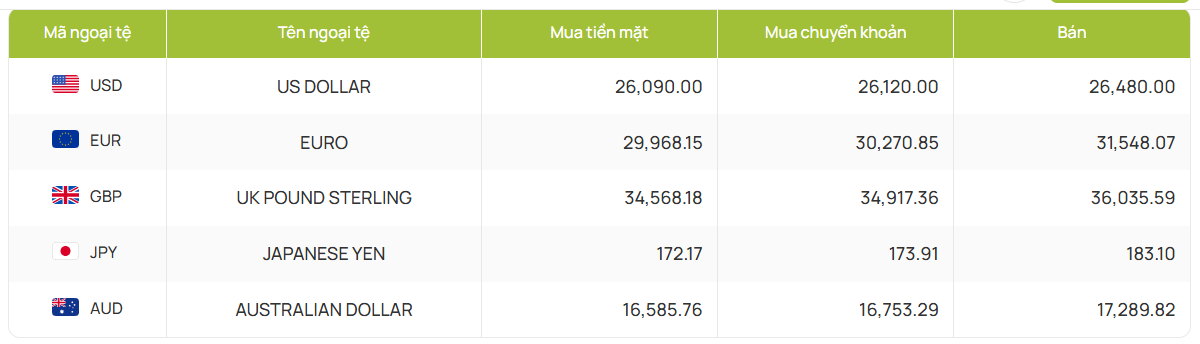

The USD rates at commercial banks also decreased, with Vietcombank’s buying and selling rates dropping by 40 dong each to 26,120 and 26,480 dong, respectively.

Source: Vietcombank

|

On August 22, 2025, the SBV announced its plan to sell foreign currencies through forward contracts with a cancellation option within 180 days. The implementation period is set for August 25-26, with a selling rate of 26,550 VND/USD. The eligible buyers are credit institutions with a negative foreign currency status, and the maximum limit is set to balance their foreign currency status.

The SBV’s market intervention comes as the exchange rates in the market have been on a continuous rise. On the previous weekend of August 22, the SBV had increased the central exchange rate by 25 dong to a record high of 25,298 VND/USD.

In the past, the SBV has frequently used the tool of selling and buying foreign currencies with a cancellation option. In late 2015, the SBV offered 90-day forward contracts with a cancellation option, along with the application of the central rate mechanism.

In early 2021, the SBV also implemented the purchase of foreign currencies through 6-month forward contracts with a cancellation option, replacing the previous 3-month contracts. The forward rate was set at 23,125 VND/USD. This measure was introduced amid Vietnam’s efforts to increase foreign reserves and respond to allegations of “currency manipulation” from the United States.

Most recently, in early 2025, the SBV demonstrated its flexibility in managing the USD/VND exchange rate amid mounting pressure from the international market. The SBV implemented a policy of selling foreign currencies with a cancellation option at a rate of 25,450 VND/USD from January 3-6, 2025. From January 8, 2025, the SBV continued to sell foreign currencies on Mondays, Wednesdays, and Fridays, with a maximum transaction limit of 100 million USD per day for each credit institution to ensure flexibility in liquidity management.

Why “forward contracts with a cancellation option” instead of “spot sales”?

With spot sales, the SBV would have to release foreign currencies immediately, potentially causing temporary liquidity tension and pushing up interbank interest rates. On the other hand, forward contracts allow for the actual transaction to take place in the future (in this case, 180 days later). This gives the SBV more time to balance its foreign currency sources, especially when inflows such as remittances and FDI are expected to improve towards the end of the year.

The “cancellation option” clause enables commercial banks that have signed forward contracts to buy foreign currencies from the SBV to cancel the contract if they can purchase USD at a better rate in the market at a later date.

For example, a bank registers to buy USD at a forward rate of 26,550 VND/USD. However, two months later, the market rate drops to 26,400 VND/USD. With the cancellation option, the bank can cancel its contract with the SBV and purchase USD at a lower rate in the market, optimizing its costs. This encourages banks to proactively manage their risks, allowing the market to self-regulate more effectively.

Therefore, it can be said that the use of forward contracts with a cancellation option, instead of spot sales, is a flexible tool for the SBV. This measure not only provides a directed supply of foreign currencies to the market but also sends a message that the SBV is ready to intervene, thus reducing expectations of further exchange rate hikes.

From an expert’s perspective, Assoc. Prof. Dr. Nguyen Huu Huan – Senior Lecturer, University of Economics Ho Chi Minh City believes that the SBV’s move to sell foreign currencies through forward contracts with a cancellation option is a professional measure to increase the supply of foreign currencies in the market and cool down the exchange rates. The shift from spot sales to forward contracts indicates a longer-term intervention approach, providing stability and assurance to the market regarding the future supply of USD.

The pressure on the exchange rate in the past has mainly been due to a slightly negative overall balance of payments. Despite a surplus in the trade balance and current account, the financial account deficit has been larger, resulting in an overall shortage of USD supply.

With the SBV’s actions and signals from the Fed, a potential Fed rate cut would weaken the USD in the international market, bringing two direct benefits to Vietnam. A weaker USD would automatically ease the pressure on the VND, and lower USD interest rates would narrow the interest rate differential with the VND, reducing the attractiveness of holding USD and curbing capital outflows from Vietnam.

According to Mr. Huan, the combination of the SBV’s intervention and the Fed’s easing signal will significantly reduce the pressure on the exchange rate. This also creates additional room for Vietnam to maintain its loose monetary policy to support economic growth.

However, it is important to note that selling foreign currencies to intervene in the market will deplete foreign reserves, which are not abundant. In a volatile global economic and financial environment, preserving and increasing foreign reserves at opportune moments is crucial for ensuring national monetary security. Sometimes, accepting a certain level of exchange rate fluctuation can be a reasonable choice to protect this resource.

Sharing the same view, Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University believes that the SBV’s use of forward contracts with a cancellation option is not only a short-term intervention tool to relieve immediate pressure on the exchange rate but also a way for the SBV to maintain policy flexibility. In times of market tension, this tool helps calm market psychology and provides the necessary foreign currency supply to the system. However, when conditions improve, the SBV can preserve its reserve resources by utilizing the cancellation option.

This proactive approach is even more meaningful considering the Fed’s rate cut cycle, which will significantly reduce pressure on domestic exchange rates. In such a scenario, the forward contracts signed by the SBV can be canceled, keeping the “reserve vault” intact. In other words, domestic policies and the international environment can work together to maintain macroeconomic stability while freeing up resources to support economic growth.

Looking ahead, this strategy clearly demonstrates a principle of stability first, then loosening, but always maintaining proactiveness. Strengthening exchange rate stability and market confidence are prerequisites for the SBV to confidently implement more relaxed policies, such as lowering interest rates or selectively expanding credit in the future.

– 11:44 25/08/2025

Dollar and Yuan Continue Their Rise: August 27th Exchange Rates

As of 8:30 am this morning, Vietcombank posted its USD exchange rate at 23 VND higher for both buying and selling compared to the rates on August 26, standing at 26,176-26,536 VND/USD.

The Greenback Slides, but Domestic Rates Remain Lofty

“The US dollar continued its downward trajectory in the week of August 18-22, 2025, as markets reacted to hints of potential interest rate cuts from Federal Reserve Chair Jerome Powell. This development marked a significant shift in the currency’s performance, setting the stage for a potentially volatile period in global markets.”