Mr. Pham Trung Kien, Chairman of the Board of Directors of Lam Dong Pharmaceutical Joint Stock Company (Ladophar, stock code: LDP, on HNX), has recently registered to sell over 1.08 million LDP shares for portfolio restructuring purposes.

The transaction is expected to be executed through a matching and/or negotiation method between August 29 and September 27. If successful, Mr. Kien’s ownership will decrease to 88,792 shares, equivalent to 0.7% of the charter capital, and he will no longer be a major shareholder of Ladophar.

As of the market close on August 26, LDP shares were trading at VND 14,000 per share. Assuming this price for the transaction, Mr. Kien is estimated to receive over VND 15 billion.

Mr. Pham Trung Kien, Chairman of the Board of Ladophar at the Annual General Meeting in April 2025. Photo: Ladophar

Mr. Kien’s decision to divest comes as Ladophar is in the process of offering 13.64 million shares to three private investors.

Among them, the Dynamic Investment Vision Fund (VIF) plans to purchase 4.25 million shares, holding 16.13% of LDP’s charter capital post-issuance;

HD Capital Joint Stock Company registered to buy 4 million shares, equivalent to 15.18%, and APC Holdings Joint Stock Company intended to buy 5.39 million shares, equivalent to 20.46% of Ladophar’s capital.

None of these three organizations held LDP shares before this offering. After the transaction, this group of three shareholders will collectively own up to 51.77% of Ladophar’s charter capital.

With an offering price of VND 11,000 per share, Ladophar expects to raise more than VND 150 billion if the issuance is successful.

Upon completion of the offering, Ladophar’s charter capital will increase from VND 133.38 billion to nearly VND 270 billion.

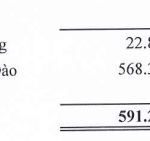

In the first half of 2025, Ladophar recorded a revenue of VND 111 billion, a 19% increase compared to the same period last year, and a pre-tax profit of over VND 2 billion, a nearly 16% rise.

This is the second consecutive year that the company has reported half-year profits after a long streak of losses from 2018 to 2023.

For the third quarter of 2025, LDP sets a target of VND 94 billion in revenue and nearly VND 3 billion in profit, along with implementing a plan to reduce 15% of operating costs and control ineffective expenses. In the fourth quarter of 2025, the company expects to achieve a revenue of approximately VND 104 billion and a profit of nearly VND 3 billion.

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.

“Real Estate Tycoon with Thousands of Hectares of Land, Dang Thanh Tam, Flourishes with Trump International Hung Yen Development”

The urban development giant, Kinh Bac, is projected to reach staggering figures in revenue and profit for the year 2025. According to a securities analysis by DSC, the corporation is estimated to attain a revenue of VND 6,213 billion and a profit of VND 2,054 billion. This impressive performance is attributed to the strategic launch and sale of real estate projects, which have injected significant capital into the company’s coffers.

A Profitable Retreat: TIG Eyes Exit from Hungarian Subsidiary After Q2 Profits Plummet Nearly 90%

The Thang Long Investment Group JSC (HNX: TIG) has announced its decision to divest its entire stake in real estate firm REG in Hungary. This move comes amidst a sharp decline in second-quarter profits, plunging nearly 90% from the previous year’s figures to just over $3.3 million.