Affordable Housing in Ho Chi Minh City: A Growing Challenge

Once expected to be a supplementary source of reasonably-priced housing for Ho Chi Minh City, the newly incorporated areas, previously known as Binh Duong, are now facing a similar challenge. The search for residential projects offering prices below VND 50 million per square meter has become increasingly difficult.

According to recent observations, the majority of properties entering the expanded Ho Chi Minh City market have experienced rapid price increases. Prices ranging from VND 60-70 million per square meter dominate the current offerings.

For instance, in National Highway 13, the Landmark Binh Duong project by Phu Cuong Group is being marketed at VND 70 million per square meter. TBS Group’s Ho Guom Xanh project is expected to enter the market at VND 65-70 million per square meter, while Urban Green offers units at VND 75-85 million per square meter. Prices at Van Phuc City even reach approximately VND 130 million per square meter. As we move closer to the new urban center, the Midori Park The Glory project by Becamex Tokyu starts at a slightly lower range of VND 58-60 million per square meter.

Meanwhile, projects priced between VND 45-50 million per square meter along National Highway 13 are becoming scarce, despite healthy transaction levels at this price point. It is anticipated that prices below VND 50 million per square meter will gradually disappear from Ho Chi Minh City’s super urban landscape.

Currently, only a handful of developments, such as La Pura by Phat Dat, offer similar pricing. La Pura, located on the frontage of National Highway 13, provides convenient access to various areas, including a 15-minute drive to Hang Xanh intersection and a 30-minute drive to District 1 and Tan Son Nhat Airport. The project is promoting its remaining units in the Zenia subdivision, starting from VND 2.6 billion per 2-bedroom apartment, a rare find in the area.

Similarly, projects like Habitat and The Glory, situated around the VND 55 million per square meter price range, are witnessing strong demand. This price range is also expected to become scarcer in the future.

On the other hand, in the P.Di An area of Ho Chi Minh City, projects such as Phu Dong SkyOne, TT AVIO, and Bcons Binh An Dong Tay continue to offer more affordable options, attracting significant interest from buyers.

The Batdongsan.com.vn market report for July 2025 indicates that real estate interest has been steadily rising in most areas of the expanded Ho Chi Minh City, reflecting a positive response to the planning news. Among all segments, apartments have witnessed the strongest interest, both in the sales and rental markets. Apartment prices have already increased by approximately 10% within three months and are expected to continue this upward trajectory.

Property Prices Show No Signs of Slowing Down

Prior to the incorporation into Ho Chi Minh City, the areas previously known as Binh Duong were known for their abundant housing supply and more affordable price levels, typically 30-50% lower than Ho Chi Minh City. However, according to Mr. Vo Huynh Tuan Kiet, Director of Residential CBRE Vietnam, the post-incorporation era will witness a narrowing of this price gap. This implies that residential projects priced between VND 40-50 million will become a rarity, and even finding apartments at VND 55 million per square meter will be challenging in the future.

In addition to the impact of planning news, infrastructure development plays a crucial role in driving up property prices. Mr. Dinh Minh Tuan, Director of Batdongsan.com.vn Southern Region, highlights the strategic transportation infrastructure projects such as National Highway 13, Ho Chi Minh City Ring Road 3 and 4, Metro Line 2, and the Ho Chi Minh City – Thu Dau Mot – Chon Thanh Highway, which will receive prioritized investment. These projects are expected to boost the city’s real estate market and significantly influence property prices.

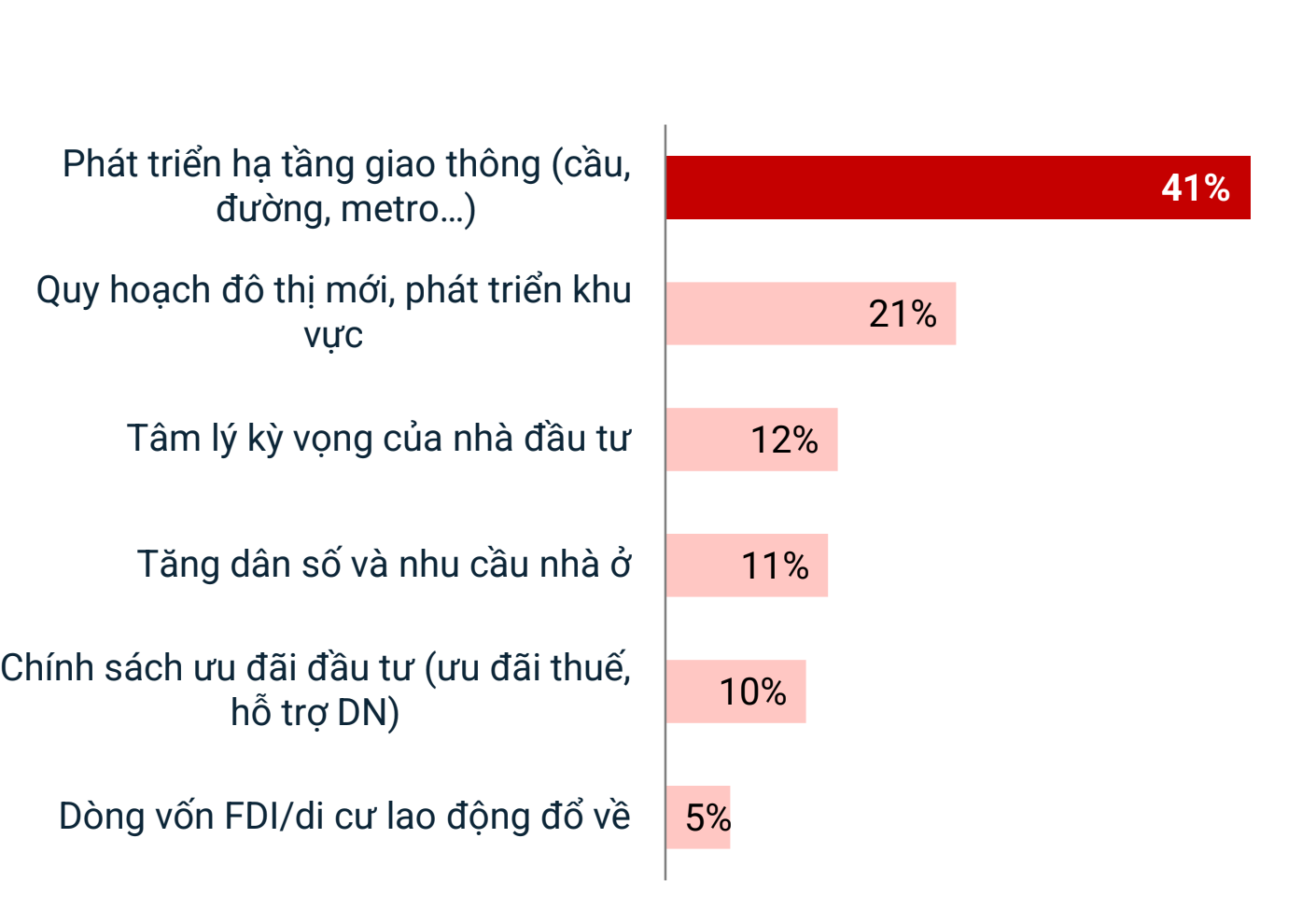

Recent research from Batdongsan.com.vn reveals that transportation infrastructure development (metros, bridges, roads, etc.) is the most critical factor influencing real estate price growth, accounting for 41% of the impact. Other factors, such as urban planning, investor expectations, population growth, and housing demand, also contribute but to a lesser extent.

Transportation infrastructure is the most important factor influencing land price growth. Source: Batdongsan.com.vn

A research institute also points out that the decision to merge the cities has had a significant impact on the real estate market in the first half of the year and is expected to continue doing so. The merger will allow for a more comprehensive and scientific urban planning approach, creating a trend of investment shifts. Investors are focusing on areas with upgraded infrastructure and softer prices, triggering a wave of real estate investment and enhancing the value of assets, particularly land, houses, and apartments in the new central areas.

The merger of the two cities may have an impact on the real estate market.

Looking at the price trends in the first half of 2025, it is evident that apartment projects in the expanded Ho Chi Minh City area will continue to experience price increases in the future.

In the Q2 2025 report by CBRE Vietnam, Ms. Duong Thuy Dung, Executive Director, shared that with abundant future supply and growing demand, there is significant potential for price increases in the markets surrounding Ho Chi Minh City. It is projected that primary sale prices will grow by an average of 9%-11% per year over the next three years in the apartment segment.

According to CBRE Vietnam experts, the demand for housing remains high, but the supply of properties that meet actual needs is decreasing, creating an imbalance in the market. While the post-merger era may bring more diverse housing options, there are no indications of a slowdown in prices.

Historical data has shown that real estate prices tend to rise along with the development of key infrastructure projects. In Ho Chi Minh City, before the merger, projects such as Pham Van Dong, Thu Thiem Tunnel, Saigon Bridge, and Metro Line 1 contributed to significant increases in land and property values. Notably, apartment projects along Metro Line 1 witnessed price increases of 50-70% over 4-5 years, with some locations even doubling in value since the construction began.

Similarly, National Highway 13 has played a pivotal role in shaping the price landscape in both Ho Chi Minh City and Binh Duong over the past two decades. Land prices along this highway have soared, with frontage land on National Highway 13 (in the Hiep Binh – Binh Trieu section) increasing from VND 45-55 million per square meter five years ago to the current range of VND 100-180 million per square meter. Even areas located just 300-500 meters from the frontage have seen significant growth, now reaching VND 60-80 million per square meter, almost doubling in value over the last 3-4 years.

Industry experts assert that real estate prices continue to climb, surpassing the affordability of many potential buyers. However, lowering property prices is challenging due to scarce land resources, rising investment costs, robust demand, and ongoing infrastructure development.

Unveiling the KDC Hiệp Bình Chánh Scandal: Did Tycoon Lưu Quang Lãm Mortgage Sold Land, with the Bank Turning a Blind Eye?

The “red books” of numerous residents in the KDC Hiep Binh Chanh area have been mysteriously included as collateral for loans totaling over VND 208 billion at various banks, all to benefit the wealthy businessman Luu Quang Lam.

The Luxe Life in Ciputra: When Heavy Rains Turn the Affluent Neighborhood into a “Fishermen’s Village”

The heavy rainfall from the night of the 25th to the morning of the 26th of August caused widespread flooding in the Nam Thang Long – Ciputra urban area in Tay Ho, Hanoi. Despite the efforts to clear the water, many areas remained inundated, posing challenges to residents and highlighting the need for improved drainage systems in the area.

“Nam Long ADC: Elevating the Standard of Affordable Living with EHome”

Affordable housing has always been a challenging market with slim profit margins, yet Nam Long ADC remains committed to this sustainable venture. Recently, Mr. Steven Chu, Chairman of Nam Long ADC, revealed the secret formula to transforming this challenging segment into a sustainable business model.

The Big Apple: Scrutinizing Address Details with Precision

The Department of Construction requests that adjacent wards and communes collaborate to maintain stability in the existing house numbering order.