Government Decree Lifts Monopoly on Gold Bar Production

Gold bars

The government has just issued Decree No. 232/2025/ND-CP dated August 26, 2025, amending and supplementing a number of articles of Decree No. 24/2012/ND-CP dated April 3, 2012, on the management of gold business activities. Notably, Decree 232/2025/ND-CP has abolished Clause 3, Article 4 of Decree 24/2012/ND-CP, removing the state monopoly on gold bar production, export of gold materials, and import of gold materials for gold bar production.

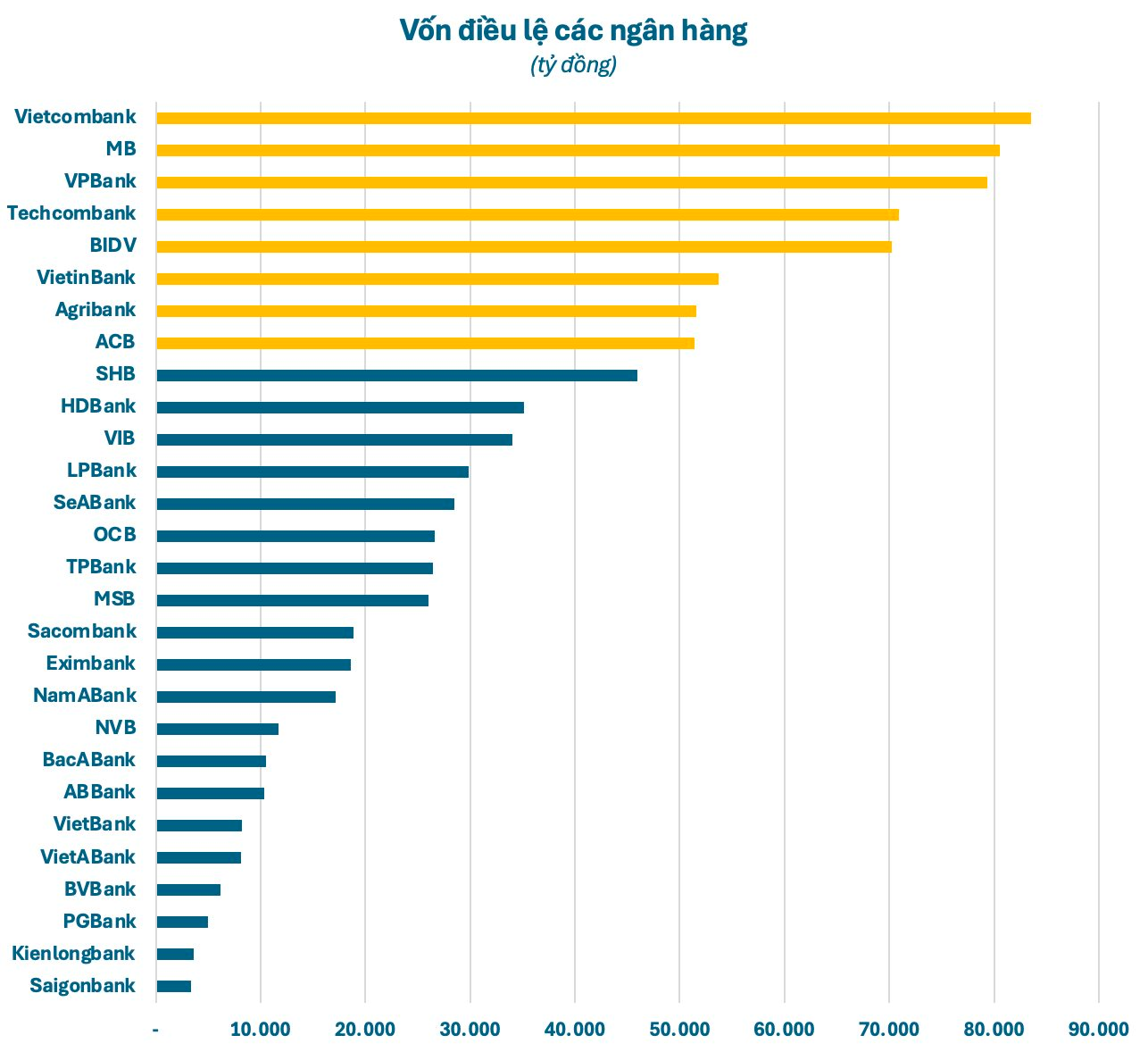

Accordingly, enterprises wishing to be licensed to produce gold bars must have a minimum charter capital of VND 1,000 billion, and banks VND 50,000 billion. These units must be on the list of those granted a license by the State Bank of Vietnam to trade in precious metals and must not have been subject to disciplinary action or must have rectified any violations.

Considering the current charter capital scale, only a few leading enterprises with a charter capital of VND 1,000 billion or more come to mind, such as PNJ, DOJI, and SJC. In the banking group, names like Vietcombank, MB, VPBank, Techcombank, BIDV, VietinBank, Agribank, and ACB meet the charter capital requirement of over VND 50,000 billion.

VietinBank headquarters

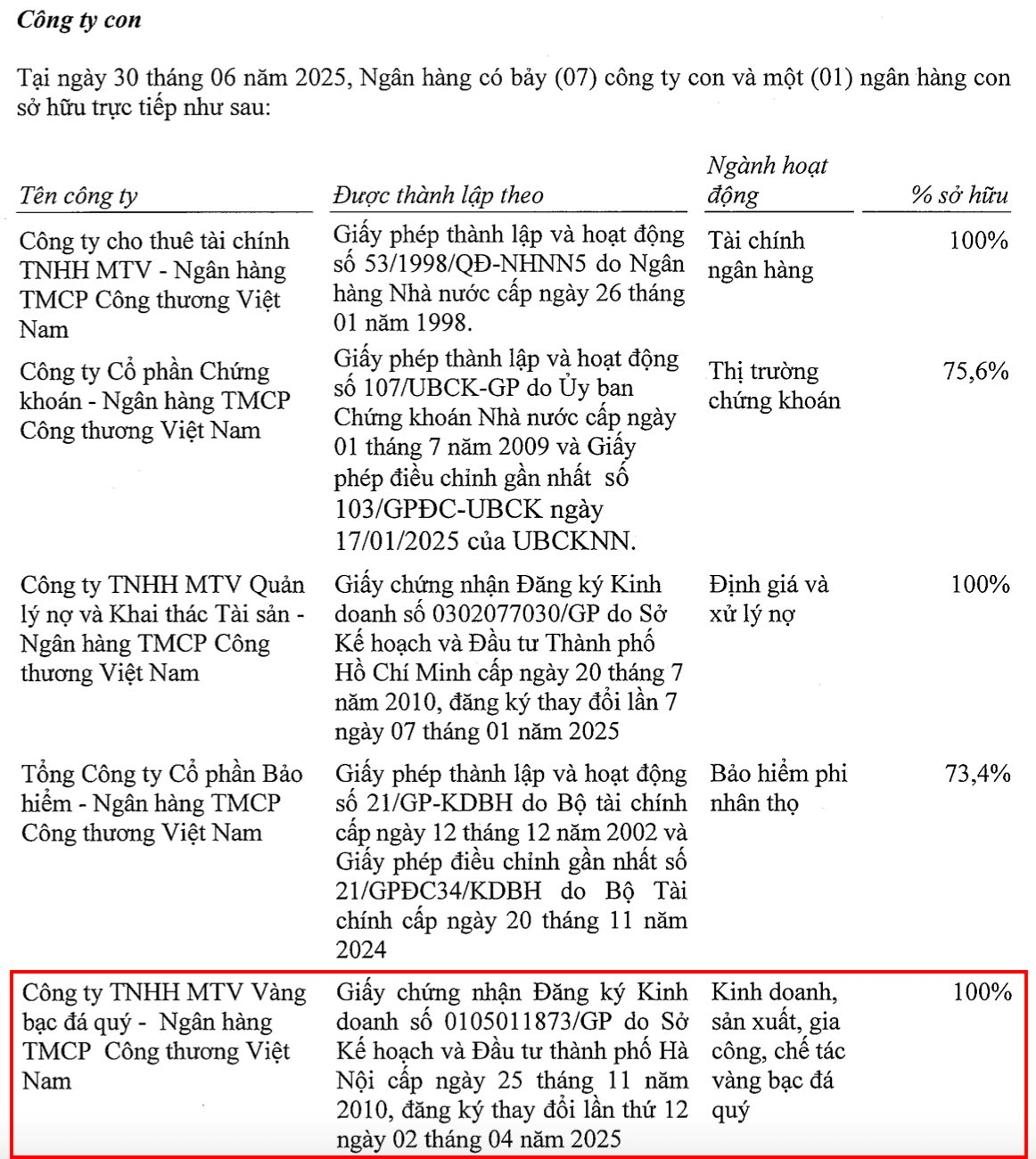

In fact, the ecosystem of some banks already includes member companies operating in the field of gold, silver, and gem business. A typical example is VietinBank Gold, a subsidiary of VietinBank, which has been granted a business license since November 2010 and is accounted for as a subsidiary in the financial statements, with VietinBank (CTG code) holding 100% of the capital.

Similarly, Sacombank (STB code) also has a subsidiary operating in the field of gold, silver, and gem business, Sacombank-SBJ. This entity was established in 2008 with a charter capital of VND 200 billion, wholly owned by Sacombank.

Meanwhile, although not directly reflected in the financial statements, some banks have close relationships with companies operating in the gold, silver, and gem business. A typical example is TPBank (TPB code), where Doji Gold and Gems Group Joint Stock Company is a major shareholder, holding more than 5.9% of the bank’s capital. Mr. Do Minh Phu – Chairman of TPBank’s Board of Directors is also the Chairman of the Doji Founding Council.

Another case is that of SeABank (SSB code) and ASEAN Gold and Gems Joint Stock Company (AJC). AJC, formerly known as Agribank Gold and Gems Fine Arts Company, was established by Agribank as a dependent accounting unit of the bank. In September 2008, the company conducted its initial public offering and had two strategic shareholders: SeABank and Nam Cuong Group, along with many other common shareholders.

After Agribank successfully divested its capital of over 12.6 million AJC shares in late 2017, three new major shareholders appeared in AJC, one of which was King Valley Company Limited, which held 18.16% of the charter capital. Notably, this company is a member of the BRG Group of Mrs. Nguyen Thi Nga – Permanent Vice Chairman of SeABank.

In addition, ACB is also a notable name with a large charter capital scale and experience in operating a gold exchange and gold trading in the past.

Overall, with the current situation, VietinBank seems to be the most potential candidate to enter the gold bar production playground, meeting the charter capital requirements and having a subsidiary operating in the field of gold, silver, and gem business.

What New Heights Will Domestic Gold Prices Reach?

The price of gold has been soaring, and many experts believe that this upward trajectory will continue, with gold set to conquer new heights.

The Golden Opportunity: Can Gold Prices Keep Surprising Us?

Today’s gold price surge, following a steep decline earlier this morning (November 27), has triggered a rush of buying activity from investors. While many seized the opportunity to buy, others opted to sell and cut their losses.