SJC Gold Bar Price Breaks 5 Peaks in August 2025

The domestic gold market today continues to attract great interest from investors as SJC gold bar prices hit a new all-time high. Major brands such as SJC, DOJI, and Bao Tin Minh Chau have listed gold bar prices at record highs, with some small shops even pushing SJC gold bar selling prices beyond the 128 million VND/tael mark.

It’s not just the SJC gold bar price that has increased, but the plain 9999 gold ring price has also fluctuated strongly, setting new price peaks, surpassing the 122 million VND/tael threshold at many stores.

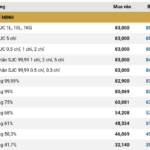

As of 5:00 PM on August 25, 2025, SJC gold bar and gold ring prices in Hanoi and Ho Chi Minh City continued to be listed at high levels.

At SJC Gold and Jewelry Company, gold bar prices were listed uniformly nationwide at 125.6 million VND/tael (buying) and 127.1 million VND/tael (selling).

Meanwhile, at Bao Tin Minh Chau Gold and Jewelry Company in Hanoi, gold prices were listed as follows: SJC gold bars at 125.6 million VND/tael (buying) and 127.1 million VND/tael (selling).

Plain gold rings, Thang Long Dragon Gold, were maintained at this brand at 119.2 million VND/tael (buying) and 122.2 million VND/tael (selling).

SJC gold bar reference price for today, August 25.

According to NLD, in the market, some small shops in Ho Chi Minh City have even pushed SJC gold bar prices up to 127.5 million VND/tael for buying and 128.3 million VND/tael for selling, an increase of 300,000 VND/tael compared to yesterday.

If calculated at this rate, the SJC gold bar price has increased by 3.6 million VND within a week since August 18, when gold was trading at 124.7 million VND/tael, and increased by 1.7 million VND/tael compared to the historical peak of 126.6 million VND/tael on August 23, 2025.

Since the beginning of the year, in terms of selling prices, SJC gold bar prices have increased by about 44 million VND/tael (from 84.3 million VND/tael on January 1, 2025) or about 52.2%.

In August 2025, gold prices have repeatedly broken old records to set new price peaks up to five times.

This sudden increase has made keywords such as “gold price today”, “SJC gold price”, and “9999 gold price” the most searched terms on online platforms. Experts predict that this trend may continue as macro and geopolitical factors worldwide continue to drive demand for precious metals.

Gold Price Forecast: Will the Record-Breaking Rally Persist?

Commenting on today’s gold price trend and outlook for this week, experts believe that precious metals will continue to closely follow global markets, presenting both opportunities and risks. The sharp upward momentum has pushed SJC gold bar prices to new heights, but it also raises questions about the sustainability of this trend.

According to many experts, domestic gold bar prices, especially SJC gold bars, are likely to continue their upward trajectory and may soon reach the 130 million VND/tael mark. Safe-haven demand and herd mentality are the main factors driving this rally. However, this rapid increase also comes with warnings about significant risks. The price difference between SJC gold bars and global gold prices has reached nearly 20 million VND/tael. This disparity poses a potential risk of substantial losses for investors if the market undergoes significant corrections.

Domestic gold prices are approaching the 130 million VND/tael threshold.

Regarding global gold prices, some Wall Street analysts provided positive forecasts. In the Kitco survey, no predictions of a decline in gold prices were made. Specifically, among the participants, eight analysts were optimistic about gold for the next week, while the rest remained neutral. Similarly, retail investors (Main Street) shared this positive outlook, expecting gold prices to maintain their upward momentum in the near term.

Analysts attributed the primary driver of the strong gold price performance to signals from the US Federal Reserve (Fed) about a potential easing of monetary policy. Geopolitical tensions also provided support for this precious metal. However, some argued that the market is in a delicate balance. If the Fed only gradually loosens its policies, investors may return to the US dollar, putting downward pressure on gold prices.

Overall, the gold price trend for this week is still expected to be positive. However, investors should closely monitor SJC gold bar and global gold price movements and remain cautious about the risks associated with price differentials to make informed investment decisions.

The Golden Opportunity: Unveiling the Latest Proposition on Gold Bullion

“We propose the integration of QR code technology into the packaging and sealing of gold bars. This innovative approach will revolutionize the management and tracking of these valuable assets, offering unparalleled convenience and security. With a simple scan, authorized personnel will have instant access to crucial information, enhancing efficiency and transparency in the industry.”

The Underground Gold Rush: How Small Jewelry Shops are Driving Record-High Gold Prices with Quiet SJC Gold Bar Trades

“According to regulations, businesses trading in artistic gold jewelry are not permitted to buy and sell SJC gold bars. This restriction is in place to maintain a clear distinction between the artistic gold jewelry market and the SJC gold bar market, ensuring that each operates within its own distinct parameters.”

The Golden House Raises Buying Price for Gold Bars

This morning, several gold shops adjusted their buying prices for gold bars, with an average increase of VND 200,000 per tael compared to the same time yesterday morning.