“Sprinting to Avoid Tariffs”: A Second Quarter Profit Boost for Vietnam’s Textile Industry

Dệt may Huế Workers – Illustration

|

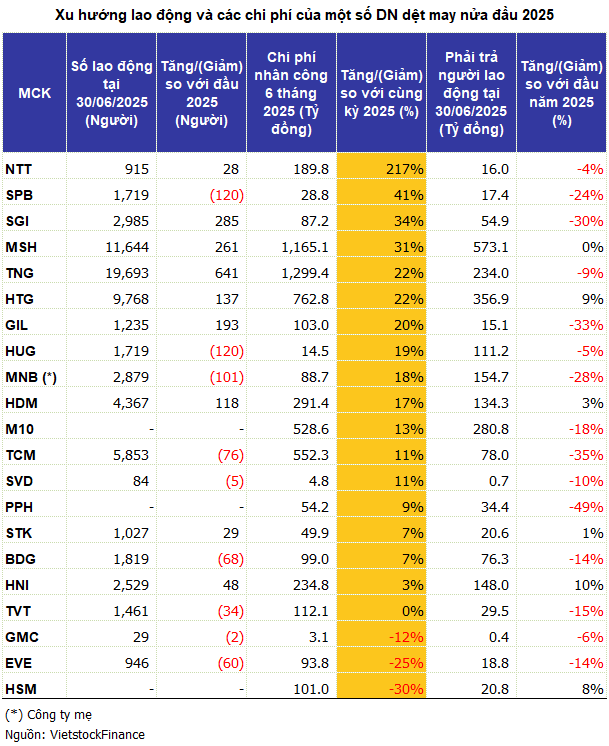

Hiring Spree and Rising Labor Costs as Orders Rebound

According to VietstockFinance, 9 out of 18 surveyed garment companies witnessed an increase in their workforce compared to the beginning of 2025, with TNG taking the lead. They added 641 employees, reaching a headcount of 19,693 by the end of June, as export orders filled their capacity through the fourth quarter. The company had planned to recruit 1,000 new workers and set up 10 new sewing lines at the beginning of the year, prioritizing high-tech orders to improve profit margins.

May Song Hong also witnessed a notable increase of over 260 workers, reaching a total of 11,644 employees after six months, thanks to securing more orders compared to the previous year. Hoa Tho (HTG) and Hue Textile and Garment JSC (HNG) each added hundreds of workers to meet the urgent 90-day delivery schedule from the US during the previous tariff suspension. Meanwhile, Saigon 3 Garment JSC (SGI) expanded their workforce by 285 people to a total of 2,985 employees, reflecting their production expansion plans.

|

This expansion in labor forces led to a significant jump in labor costs for many businesses. Notably, Nha Trang Textile and Garment JSC (NTT) experienced a 217% surge in labor expenses compared to the previous year, reaching nearly VND 190 billion. Despite only adding 28 people to their workforce, their average income rose to almost VND 35 million per person per month, indicating substantial changes in salary and bonus structures, although this remains an isolated case.

The survey also revealed that 13 companies recorded double-digit growth in labor costs, including SGI (+34%), MSH (+31%), TNG, and HTG (+22%), and GIL (+20%). In absolute terms, TNG and MSH led the group, spending nearly VND 1,300 billion and VND 1,165 billion, respectively, in the first half of the year. Their average income ranged from VND 15-17 million per person per month.

The Paradox of Reduced Workforce with Increased Costs

A reverse trend was also observed, with some companies experiencing significant increases in labor costs despite reducing their workforce. Phu Bai Fiber JSC (SPB) saw a 41% rise in expenses, amounting to VND 29 billion, despite decreasing their headcount by 120 to 1,719 employees. The parent company of MNB reduced their staff by 101 but witnessed an 18% increase in costs, while TCM and Binh Duong Garment Corporation (BDG) experienced an 11% and 7% rise in expenses, respectively, despite decreasing their workforce.

Some companies underwent more significant downsizing, such as Garmex (GMC), which once had 4,000 employees during its peak, now only has 29 staff members after ceasing garment production in May 2023 due to a lack of orders. They reduced their labor costs by 12% despite only letting go of two employees in the past six months. Hanosimex JSC (HSM) cut their expenses by 30%, amounting to VND 101 billion, as they optimized their operations amid prolonged challenges.

The Automation Conundrum and the Need for Workforce Restructuring

While the increase in labor forces and costs could signal a recovery in orders, it also poses risks if order volumes fail to remain stable. The textile industry, employing 3 million workers and known for its labor-intensive nature, now faces the prospect of 70% of jobs being replaced by robots and AI in the next decade.

Mr. Hoang Manh Cam, Chief of Vinatex’s Board of Management, shares insights on Global Labor and Skill Trends in 2025

|

At the August thematic meeting, Mr. Hoang Manh Cam, Chief of Vinatex’s Board of Management, emphasized that automation, green transition, and demographic shifts are compelling businesses to restructure their workforce. This involves both training and retaining employees as 22% of global jobs are predicted to be affected during 2025-2030.

Meanwhile, Mr. Le Tien Truong, Chairman of Vinatex, candidly shared at the Vietnam Economic Growth Forum 2025 that despite the garment industry’s double-digit growth of 6% over the past six years, the number of workers has not increased proportionally. Recruitment challenges arise due to competition from other industries.

The target of achieving a 10% annual growth in export turnover to reach $75-80 billion by 2030 is deemed unrealistic if the industry continues to rely solely on increasing traditional capacity and headcount. If the sector maintains its 6% growth rate, it will fall short of contributing 0.1-0.2% to the targeted 10% GDP growth, requiring other industries to make up for this gap.

Mr. Le Tien Truong, Chairman of Vinatex, speaking at the Vietnam Economic Growth Forum 2025 (VEGF) – Image source: Vneconomy

|

Mr. Truong believes that the textile industry can substantially contribute to the economy’s double-digit growth even if export turnover increases by only 4-5% annually, provided two main strategies are pursued.

Firstly, improving the trade surplus by reducing the rate of imports and increasing the localization ratio of raw materials and accessories. Even without a 10% increase in turnover, a reduction in import ratio can lead to a trade surplus improvement of over 10%.

Secondly, enhancing labor productivity through automation and technological innovation, thereby increasing workers’ income by more than 10% annually. With improved productivity, wages can be adjusted upward without burdening businesses with additional costs.

Based on these two pillars, the Chairman of Vinatex proposed specific policies such as supporting businesses in investing in raw materials, providing tax incentives for automation, reducing corporate income tax if the trade surplus exceeds 10% of the previous year, or if the wage increase for workers surpasses 10%. He also suggested transitioning to circular raw material production and targeting the market for green products, despite the challenges of costs and output.

In summary, the textile industry faces the dual challenge of seizing current order opportunities while investing in the human resources-technology-raw material foundation for the next phase. The question arises: Who will lead the way as the labor market in the textile industry enters the “era of technology and green practices”?

– 12:00 26/08/2025

“AI’s IR Evolution: Unlocking the Challenges Within”

In recent years, artificial intelligence (AI) has become a buzzword across industries – from marketing and operations to risk management and market research. Investor relations (IR), a specialized field requiring a blend of financial expertise and communication skills, is also embracing this transformative wave.

The Textile Industry’s Workforce Restructuring: Navigating Automation and Labor Shortages

The future of work in the textile industry is undergoing a significant transformation. With automation, green transition, and shifting demographics as key drivers, businesses are rethinking their human resources strategies. The focus now shifts to reskilling and retaining employees, as forecasts predict a significant 22% of global jobs will be impacted in the 2025-2030 period.

The Great Challenge for Vietnamese Businesses: Embracing Automation and AI in Manufacturing

“Even seemingly minor issues, such as loose, broken, or rusted bolts and screws, can significantly impact the customer experience. Businesses may spend tens of millions of dollars annually on component replacement and repairs.”