The Ministry of Finance has proposed adjustments to the scope of tax debt forgiveness in the draft Law on Tax Administration (amended), applying only to cases of genuine force majeure.

Specifically, the debt forgiveness will apply to enterprises or cooperatives that have gone bankrupt under the Bankruptcy Law and have no assets to pay off their debts; individuals who are deceased or incapacitated and have no assets, including inherited assets, to fulfill their tax obligations. In addition, tax debts lasting over 10 years, despite enforcement measures, will also be considered for write-off.

Taxpayers affected by natural disasters, calamities, or widespread epidemics that cause serious damage and loss of production and business recovery may also be exempt from their tax liabilities. However, those who have had their debts written off after 10 years and resume their business will have to repay the previously forgiven debt.

By the end of June 2025, the total tax debt managed by the tax industry was estimated at nearly VND 240,000 billion.

Concurrently, the draft also supplements regulations to tighten the mechanism for tax determination. The tax authority will have the right to apply this measure when detecting taxpayers using documents or evidence that does not accurately reflect the nature of the transaction; intentionally reducing tax liabilities; conducting transactions that do not reflect the economic substance to evade taxes; or using illegal invoices, even if the goods are genuine and revenue has been declared.

The Ministry of Finance believes that these amendments will enhance transparency and feasibility in tax administration, while also providing a clear legal framework for tax authorities to determine tax obligations strictly and in line with international practices.

The draft also stipulates a supervision mechanism, whereby the Chairman of the Provincial People’s Committee reports to the Provincial People’s Council on the results of debt write-offs. The Ministry of Finance reports to the Government for synthesis and presentation to the National Assembly during budget settlement. The Government will provide specific guidance on competence, time limits for handling dossiers, coordination responsibilities, and the Ministry of Finance will promulgate detailed regulations on dossiers, order, and procedures for debt write-offs.

As of the end of June this year, the total tax debt managed by the tax industry was estimated at VND 239,800 billion.

According to the Tax Department, the total tax debt recovered in the first six months was more than VND 43,100 billion, of which VND 2,000 billion was recovered through enforcement measures.

The Tax Authority has completed the deployment of an automatic tax debt enforcement system nationwide. At the same time, the system has been directly connected to the Ministry of Public Security and commercial banks to transmit and receive notifications of temporary suspension of exit and account freezing electronically. As a result, debt management has been comprehensively renewed towards automation and technology integration, improving processing speed and increasing deterrence.

“For those who deliberately delay, dispose of assets, or abscond, the tax industry will resolutely handle them strictly,” affirmed the representative of the Tax Authority.

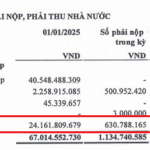

Recently, Hanoi Tax Department publicly announced a list of 41 units with tax debts and other debts belonging to the state budget, totaling more than VND 195 billion as of June 30.

“Renowned Property Developers of Aria Danang and Lagi New City Among Tax Defaulters in Ho Chi Minh City”

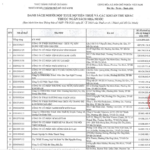

The Ho Chi Minh City Department of Tax has released a list of 679 businesses and individuals who owe taxes as of June 30, 2025, with a staggering total of over VND 2,125 billion in debt. The majority of these debtors are real estate companies, owing hundreds of billions in taxes.

What Are the Consequences of Renting Out an Undeclared House?

“Renting out properties, whether it’s residential, commercial, or even industrial spaces, has become a significant source of income for many. The rental market is thriving, and for good reason – it offers a steady stream of revenue and can be a lucrative venture for those with the right assets. From cozy apartments to sprawling warehouses, there’s a demand for it all. It’s an exciting time to be a landlord, that’s for sure!”