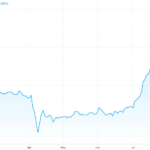

The profit-taking pressure caused the VN-Index to plunge by more than 31 points on August 25th, falling to 1,614 points and marking the second consecutive session of sharp losses. The negative sentiment spread across various sectors, particularly banking and securities stocks, which have been the market’s leading drivers.

Despite the two-day loss of over 70 points, the market is still far from erasing its nearly 600-point surge since April. So, what’s next for the market after this sharp two-day decline?

Mr. Nguyen Anh Khoa, Head of Analysis and Investment Consulting at Agriseco Securities, shared his insights on the recent market movements. After two consecutive sessions of losses totaling 74 points since reaching a new historical peak, the VN-Index is facing a situation where pillar stocks, particularly banking stocks, are showing signs of weakness. These stocks have played a crucial role in driving the market’s upward trend in the past.

Many stocks have fallen below short-term support levels such as MA5 and M10, indicating a short-term downward trend. However, the trading volume of most banking stocks has decreased compared to the previous session, suggesting that selling pressure is not too strong and can be considered a technical correction after the previous upward trend.

Regarding the overall market, Mr. Khoa believes that the VN-Index’s performance in the short term will largely depend on the movement of banking stocks.

In a scenario where these stocks can hold crucial support levels such as MA20, the VN-Index is expected to experience a technical rebound around the 1,590-1,600 point range. This range also serves as a short-term psychological support for the market.

However, the market’s trend depends on various other factors, including foreign capital flows, domestic and international macroeconomic developments, and more.

Given these dynamics, accurately assessing the market’s equilibrium in the current phase is challenging. Investors are advised to focus on their investment portfolios rather than letting their emotions drive their decisions amid the VN-Index’s rapid fluctuations.

The medium-term trend remains upward

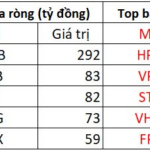

According to updated data from FiinProx, the VN-Index closed on August 25, 2025, at 1,614 points, corresponding to a P/E ratio of 14.66, which is between one and two standard deviations above the three-year average of [14.29-15.45] times.

Mr. Khoa added that considering the P/E ratio of 15.45 as a resistance level, this corresponds to the market facing a double barrier in terms of valuation and psychological resistance at the round number of 1,700 points.

In the short term, as the VN-Index has been rising continuously without a significant pause for accumulation of more than two weeks, it is challenging for the market to break through this resistance level.

Therefore, buying at this point may not be the most appropriate strategy. However, the Agriseco expert opined that the medium-term trend remains upward: “The short-term correction will provide an opportunity for cash flow restructuring, which will then create attractive entry points for many stocks that have not risen sharply in the previous period to attract cash flow.”

Portfolio Management and Restructuring are Key

Regarding the current trading strategy, the expert suggested that investors who have recently purchased stocks should focus on portfolio management and restructuring.

For blue-chip stocks with strong fundamental business foundations and positive profit prospects for 2025, investors can continue to hold onto them as the medium and long-term upward trend of the VN-Index remains intact.

However, for mid-cap or speculative stocks that have fallen sharply, losing their fundamental value and important support levels, investors should consider reducing their holdings and adhering to loss-cutting disciplines to adjust their portfolios to a safer state.

For investors who have not purchased new stocks during this period, caution is advised. The market is still in a short-term correction phase, and the recovery trend is uncertain, so new purchases should be carefully considered.

” If investors have a long-term outlook, they can start participating gradually at strong psychological support levels such as 1,600 points, prioritizing blue-chip stocks and sectors with positive profit prospects for the second half of the year, such as banking, real estate, retail, and construction,” the Agriseco expert emphasized. ” At the same time, they should buy in parts to minimize risks.”

However, for short-term investors, it is advisable to wait until the corrective trend shows signs of ending and there are recovery signals from the pillar sectors, especially banking.

Breaking the Losing Streak: Foreign Block Snaps 13 Consecutive Selling Sessions with Near 1,000 Billion Dong Purchase on HoSE

Foreign investors surprised the market with a net buy-in of nearly VND 742 billion, ending a 13-session long selling streak.

Has the Stock Market Moved Past the ‘Speculative Peak’?

The sharp dip over the weekend caused the VN-Index to lose most of its previous gains, raising questions about whether the market has moved past the “speculative peak”. Analysts believe that after a heated rally and a spread of speculative money, the market may return to reflecting fundamental valuation factors and expectations for Q3 earnings. The pressure to adjust remains in the week ahead.