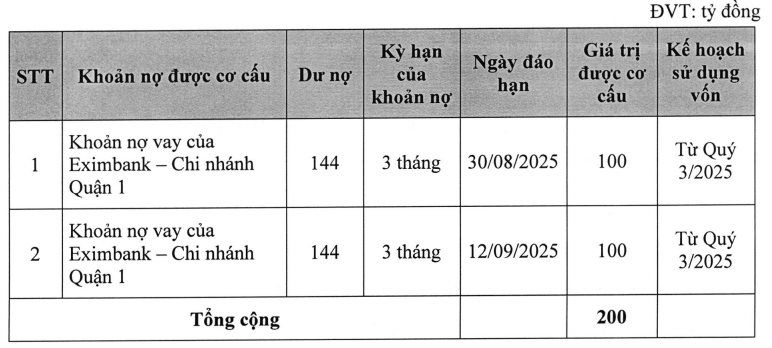

ACBS Securities has recently announced the results of its offering of 200 bonds with the code ASS12501, issued on August 18, 2025.

The professional investor who purchased this entire bond lot is Mobile World Investment Corporation (code: MWG). ACBS is a securities company wholly owned by Asia Commercial Joint Stock Bank (code: ACB).

These are non-convertible bonds, without warrants and without collateral. This bond lot has a term of 2 years, maturing on August 18, 2027. The fixed interest rate is 6.5% per annum, with interest payments made semi-annually and principal repayment due at maturity.

ACBS plans to use the entire proceeds from this issuance to repay a loan at Eximbank – Branch of District 1, Ho Chi Minh City.

Mobile World Group is not only a leading retailer but also a well-known financial investor.

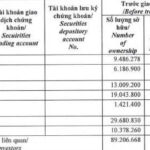

As of June 30, 2025, their total cash and cash equivalents, financial investments, and short-term investments reached a record high of VND 40,333 billion, an increase of over VND 6,100 billion compared to the beginning of the year.

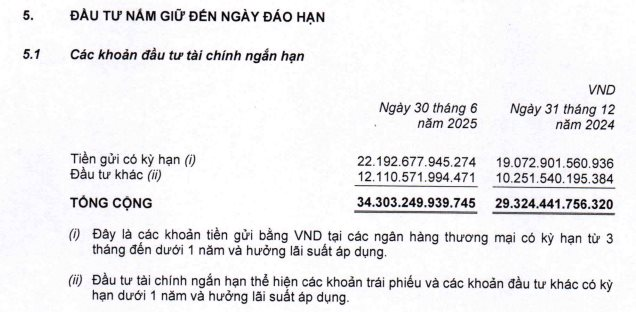

Specifically, MWG deposited VND 22,193 billion in banks with terms ranging from 3 months to less than 1 year, and invested VND 12,111 billion in bonds and other investments with terms of less than 1 year. MWG also has a long-term bond investment of VND 850 billion.

As a result, the financial investment segment has contributed significantly to MWG’s business results over the years.

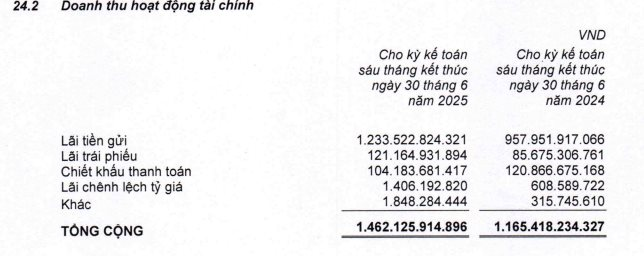

In the first half of 2025, financial activities alone generated VND 1,462 billion in revenue, contributing more than one-third to the pre-tax profit of VND 3,963 billion. Interest income from bank deposits and bond investments accounted for VND 1,234 billion and VND 121 billion, respectively.

MWG’s 2025 Mid-year Consolidated Financial Statements

MWG’s 2025 Mid-year Consolidated Financial Statements

For the first seven months of 2025, MWG reported revenue of VND 86,507 billion, up 13% from the same period in 2024, completing 58% of the full-year plan.

In July 2025, MWG’s revenue is estimated to exceed VND 12,850 billion, an increase of nearly 18% year-on-year. On average, the company earned nearly VND 415 billion per day during this period.

For the full year 2025, Mobile World Group targets revenue of VND 150,000 billion and after-tax profit of VND 4,950 billion. At a recent Investor Meeting, MWG’s CEO Vu Dang Linh shared that they are on track to achieve these targets earlier than planned, and if there are no unexpected events, they expect to fulfill the full-year profit plan by October.

“Dominating the Market: The Gioi Di Dong Claims 50% of Vietnam’s iPhone Market Share”

With over 1,000 The Gioi Di Dong and Topzone stores nationwide, MWG is a powerhouse in Vietnam’s Apple product market, commanding a substantial share of up to 50% for the tech giant’s key offerings.

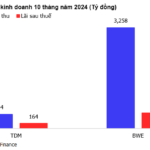

The Soaring Profits of the Two Water Industry Giants

TDM is a prominent private water company in Binh Duong Province and a strategic shareholder, owning over 37% of Biwase – the largest water company with a complete water value chain in the province. These two enterprises have recently reported a decline in profits for the first ten months of 2024.