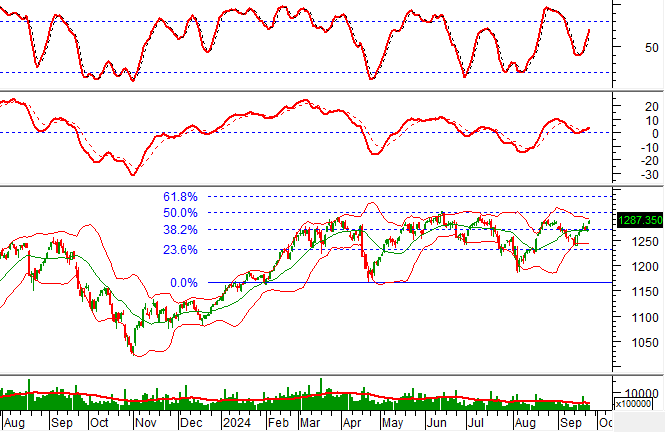

Vietnam’s stock market continued its downward trend on Monday, August 25th. The main index opened in the green, but strong selling pressure at higher prices pushed the VN-Index below the 1,610 threshold at one point. At the close, the index lost more than 31 points, marking the second consecutive sharp decline.

While many sectors that had surged in the past period, such as banking, securities, and real estate, faced profit-taking pressure, with many stocks hitting the daily limit down, some stocks managed to buck the trend and post positive gains, even hitting the daily limit up.

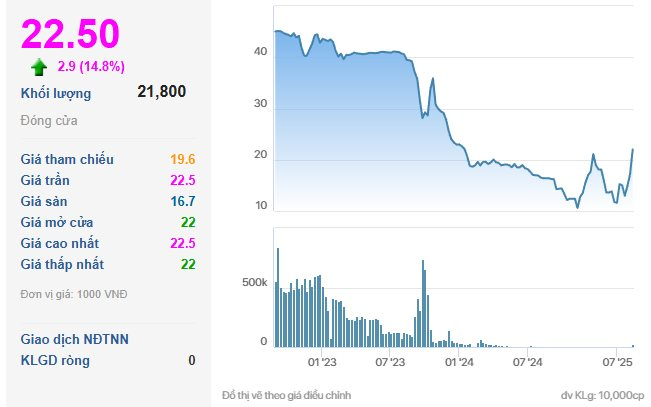

Specifically, the stock code VUA of Stanley Brothers Securities Joint Stock Company recorded a chain of 3 consecutive ceiling sessions, with the closing price on August 25th at the purple price of VND 22,500/cp. This is the highest price of this code since the beginning of January 2024. Trading volume in the first session of the week was also unusually high, with 21,800 shares traded, a stark contrast to the previous year when many sessions had frozen liquidity.

VUA stock price movement

Changes in Key Management and Major Shareholders

The positive performance of VUA stock followed a series of changes in the upper echelons. On August 12th, Stanley Brothers Securities welcomed four new major shareholders, including Thanh Vinh Real Estate Investment and Development Joint Stock Company, Nam Quang Investment and Infrastructure Development Joint Stock Company, Vipico One Member Limited Company, and Gen Cons Vietnam Joint Stock Company. This group holds a total of 29.4 million VUA shares, equivalent to 86.97% of charter capital.

Among the new major shareholders, Thanh Vinh Real Estate Investment and Development Joint Stock Company is the investor of the TNR Stars Thai Hoa project (29 hectares, Nghe An). This company previously held 5.19% of MSB Bank’s capital before divesting in 2023.

Nam Quang Investment and Infrastructure Development Joint Stock Company, dubbed the “Hai Duong KCN mogul”, owns three large projects: Nam Sach KCN (62.4 hectares), Phuc Dien KCN (82.9 hectares), and Tan Truong KCN (198 hectares). These projects are currently managed by TN Property Management, a subsidiary of ROX Key Holdings (code: TN1). Vipico One Member Limited Company (holding 18.34% of Stanley Brothers’ capital) is the investor of the TNR The LegendSea Danang project on the golden land of Vo Van Kiet (11,487 m2).

Gen Cons Vietnam Joint Stock Company (holding 24.64% of Stanley Brothers’ capital) is a construction company within the ROX Group ecosystem, previously operating under the names TNCons and ROX Cons. At the helm of ROX Group are the entrepreneurial couple, Mr. Tran Anh Tuan and Mrs. Nguyen Thi Nguyet Huong.

In contrast, during the same session on August 12th, Chairman of the Board of Directors, Luyen Quang Thang, sold all 300,000 VUA shares he held.

In October, Stanley Brothers Securities is expected to hold an extraordinary general meeting of shareholders for the first time in 2025, with the main content being the dismissal of all three members of the Board of Directors and three members of the Supervisory Board, and the election of replacements. Among them, Chairman of the Board of Directors, Mr. Luyen Quang Thang, has also sold all 300,000 shares he held.

In terms of business results, the company’s second-quarter revenue reached VND 2.1 billion, down 73% over the same period. As a result, the company suffered a post-tax loss of over VND 160 million, bringing the six-month loss to VND 3.4 billion.

“Foreign Block Dumps Over $70 Billion on Monday: Which Stocks Were in the Firing Line?”

“Foreign investors showed strong buying interest in MBB stocks, making it the most actively traded stock on the market. The trading session saw a net buy value of VND 292 billion for this stock alone.”