Stock Market Soars by 53 Points

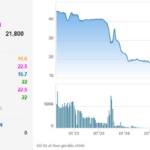

The stock market surprised investors and experts alike on August 26, with a remarkable turnaround after two consecutive sharp declines. Despite pessimistic sentiments and concerns about VN-Index breaching the 1,600-point threshold, the market staged an impressive rally, with VN-Index surging over 53 points to close at 1,667 points—the day’s high. VN30 also broke through, almost reaching 1,850 points, while HNX-Index rose over 9 points to 275 points.

While trading volume fell short of the previous session, the combined value of transactions across all three exchanges remained robust, exceeding VND 42,600 billion, with approximately 1.6 billion shares changing hands.

The morning session saw VN-Index trading sideways, even inducing anxiety among investors. However, the afternoon session witnessed a dramatic influx of capital, with stocks across various sectors, including banking, securities, real estate, steel, and notably, the Vingroup conglomerate, surging. Numerous stocks hit the ceiling price, propelling the overall index upward. Standout performers included VHM, VIC, TCB, CTG, MBB, HPG, and VCB.

Investors rejoice after the market’s strong rally. Photo: Ng.Trang

The mood on investment forums underwent a swift transformation: joy returned to those still holding stocks, while those who had recently cut losses regretted not buying back in time. Others began scouting for stocks to purchase in anticipation of the next upward cycle, visibly invigorating the market.

Latest Predictions Following the 53-Point Surge

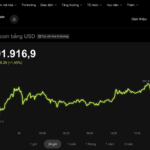

Mr. Vo Van Huy, Head of VIP Clients at DNSE Securities, assessed that this reversal wasn’t entirely unexpected when considering the long-term outlook. The successful test of the critical 1,600-point support level and the return of foreign investors to net buying provided the necessary impetus for the market’s ascent. Although trading volume wasn’t exceptionally high, the presence of capital in leading stocks like SSI and the Vingroup cohort was sufficient to spread optimism among investors.

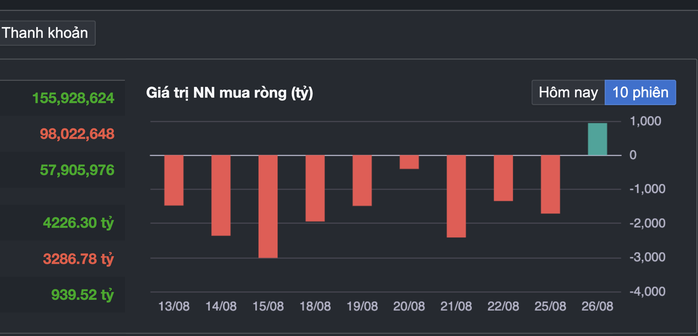

Sharing a similar perspective, Mr. Tran Anh Giau, Investment Advisory Director at Kafi Securities, attributed the market’s resilience to the robust performance of the banking, securities, and real estate sectors. The resumption of net buying by foreign investors, totaling nearly VND 940 billion, with a focus on stocks like MSB, VIX, and MWG, served as a crucial catalyst, setting the stage for VN-Index’s ascent following two days of steep corrections.

According to Mr. Giau, this technical rebound presents an opportunity for investors to restructure their portfolios toward more defensive positions.

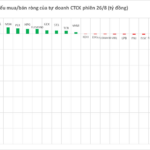

Foreign investors reverse course to net buying after multiple selling sessions.

The Big Sell-Off: Brokerage Offloads Bank Shares Worth a Whopping $700 Million in a Single Trading Session

The domestic securities companies turned net sellers on the Ho Chi Minh Stock Exchange, offloading a total of VND422 billion ($18.2 million) worth of shares.