Cashless payments have become a habit for tens of millions of Vietnamese, from urban to rural areas. Along with the popularity of QR codes, e-wallets, and digital banking, the volume of online transactions has been growing by tens of percentages annually.

However, alongside the convenience comes a worrying rise in fraud schemes, from impersonating police and banks to creating fake accounts and luring people into quick loans. These tactics are becoming increasingly sophisticated, making many people cautious during transactions.

In this context, restoring trust has become a top priority for both regulatory authorities and service providers.

A “double shield” is being formed: SIMO (System for Important Money Operations), a centralized management mechanism of the State Bank combined with proactive technology from banks and payment intermediaries.

SIMO: A Synchronized Mechanism to Combat Fraud

Previously, each bank or e-wallet could only detect and manage risks within its internal system. The loophole was that the same suspicious account could be easily rotated through multiple organizations to commit fraud.

SIMO is implemented by the State Bank as an anti-fraud solution for online transactions. Photo: Linh Le |

SIMO is deployed by the State Bank as a comprehensive solution to this weakness. It is a centralized system that collects data on suspicious accounts and connects closely with the Ministry of Public Security, banks, and payment intermediaries.

Each transaction going through the system will be cross-referenced with SIMO’s database. If there are any abnormal signs, the transaction may be blocked immediately or additional identification may be required. With this mechanism, instead of localized supervision, the financial sector has moved towards synchronized supervision across the system, creating an additional layer of protection to prevent risks.

Business Engagement

In reality, many banks and financial organizations have quickly put SIMO into operation. Among payment intermediaries, MoMo is one of the pioneers, early to integrate this system into its infrastructure serving over 30 million users and 70,000 business partners nationwide.

The implementation is designed with a “two-layer shield” model: the first shield from SIMO, where transactions are cross-referenced with the industry’s centralized database to detect fraud, and the second shield from MoMo’s artificial intelligence (AI) and big data analytics, which continuously learn and analyze abnormal behaviors to refine risk levels.

Information from these two sources is converted into intuitive alerts on the application with three levels: Red – high risk, Yellow – needs further attention, and Green – potentially safe.

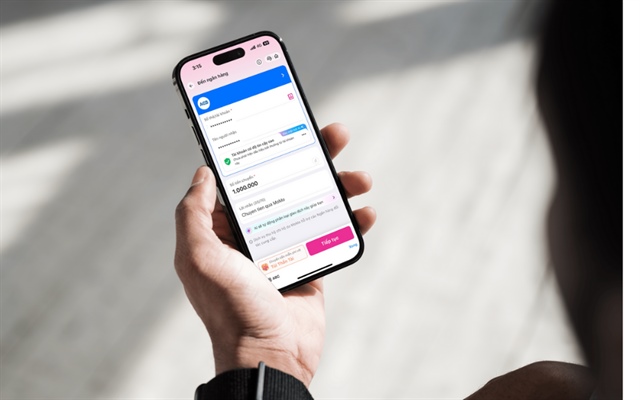

MoMo has quickly implemented SIMO to ensure the security of online transactions for users and business partners. Photo: Linh Le |

Thanks to the combination of centralized supervision by the State Bank through SIMO and risk prevention technology from businesses, the online transaction experience becomes both transparent and user-friendly, providing users with a clear basis for deciding whether to continue or stop a transaction.

On a broader scale, the operation of SIMO, along with the efforts of pioneering units, has contributed to strengthening the trust of the people in digital payments, which is crucial to promoting the government’s goals of financial inclusion and digital economic development.

HA QUYEN

The Cashless Revolution: How Vietnam’s Expanding Ecosystem Enables a Seamless Digital Payment Experience, From Groceries to Luxury Shopping.

With a swift embrace of a cashless ecosystem and a robust push towards digital payments, this trend has seamlessly woven itself into the very fabric of Vietnamese daily life.

“Association of Banks Emphasizes on Member Organizations’ Compliance with Biometric Authentication Regulations”

On December 20, the Banking Association convened a meeting with its member organizations to review and emphasize the importance of complying with the regulations on biometric authentication as per Circulars 17/2024/TT-NHNN and 18/2024/TT-NHNN. During the meeting, the Banking Association continued to urge customers to complete their biometric authentication before January 1, 2025, to prevent any disruption to their online banking services.

What Happens to Your Money if Your Biometrics Are Not Verified?

Unfortunately, we cannot perform cash withdrawals if the account holder has not completed biometric authentication by January 1, 2025. This measure is in place to ensure the security of our clients’ funds and to comply with regulatory requirements. We apologize for any inconvenience this may cause, and we encourage you to complete your biometric authentication as soon as possible to avoid any disruptions to your banking services.

SHB Customers: Complete Your Biometric Data Update by December 31, 2024

In just over three weeks, Circulars 17 and 18 from the State Bank will come into force. To ensure a seamless financial transaction experience, SHB once again encourages its valued customers to complete their biometric updates as soon as possible and no later than December 31, 2024.

“Vietnam: The Rising E-Commerce Dragon of Southeast Asia”

The Vietnamese e-commerce market is projected to experience a compound annual growth rate (CAGR) of 28% from 2025 to 2033, underpinned by rising internet and mobile penetration, and the growing adoption of digital payments. The government’s digitalization agenda is also a key driver of this growth, setting the stage for a vibrant and dynamic online retail landscape in the country.