This week, 20 businesses announced record closings to pay dividends, with 16 companies paying dividends in cash, 2 paying in stocks, 1 offering stock rewards, and 1 paying a hybrid dividend.

Over 1,000 shareholders traded

Vietravel Joint Stock Company (Vietravel – stock code: VTR) has just reported the results of its offering of shares to existing shareholders. Accordingly, Vietravel successfully distributed all 28.66 million shares, equivalent to 100% of the offering, to 1,137 shareholders, raising nearly VND 344 billion.

Ms. Thuy Tien spent VND 144 billion to acquire an additional 6 million VTR shares.

After deducting expenses, Vietravel’s proceeds amounted to over VND 343 billion, and its chartered capital has now increased to VND 573 billion. The raised funds will be used to repay the company’s debts.

Previously, VTR approved the plan to offer shares to existing shareholders at a ratio of 1:1, with an offering price of VND 12,000 per share. According to the company’s shareholder list, Ms. Nguyen Thuy Tien is currently the largest shareholder, holding 12 million shares, equivalent to a 20.94% stake. With the offering price of VND 12,000 per share, Ms. Thuy Tien invested VND 144 billion to acquire an additional 6 million VTR shares.

In mid-March, Hung Thinh Group sold 6 million VTR shares. After the transaction, Hung Thinh no longer holds any stake in Vietravel, despite previously owning 20.94% and being the largest shareholder.

Conversely, Vietravel noted an individual named Nguyen Thuy Tien purchasing 6 million shares worth VND 168 billion. This individual is described as holding no position in the company and having no relationship with any individuals or entities related to Vietravel.

Vietnam Maritime Commercial Joint Stock Bank (stock code: MSB) has just announced a resolution on the record date for implementing the right to receive dividends in shares, set as September 9. Specifically, MSB will issue 520 million new shares as dividends, with a ratio of 20%. After the issuance, MSB’s chartered capital will increase from VND 26,000 billion to VND 31,200 billion, an increase of VND 5,200 billion.

Hodeco aims to raise VND 500 billion from bond issuance

Ba Ria-Vung Tau Housing Development Joint Stock Company (Hodeco – stock code: HDC) has just passed a resolution on private bond issuance. Accordingly, Hodeco will issue non-convertible private bonds in VND, without warrants, secured by assets, and with a direct repayment obligation of the issuing organization, with a maximum value of VND 500 billion in two offering batches.

Dong A Steel Joint Stock Company issues over 34 million shares as dividends.

Dong A Steel Joint Stock Company (stock code: GDA) announced that August 26 is the ex-dividend date for 2024, with a dividend ratio of 30%. This means that for every 100 shares held, shareholders will receive 30 new shares. With over 114 million shares currently in circulation, GDA is estimated to issue over 34 million new shares as dividends.

August 28 will be the record date for Ha Giang Minerals and Mechanics Joint Stock Company (stock code: HGM) to finalize the list of shareholders for the first 2025 interim cash dividend payment. The implementation ratio is 45%, meaning that for every 1 share held, shareholders will receive VND 4,500. With 12.6 million shares in circulation, HGM will spend about VND 57 billion on dividend payments.

Vietnam National Gas Corporation (PV GAS – stock code: GAS) announced that August 29 will be the record date for shareholders to receive 2024 dividends and new issued shares. Accordingly, PV GAS will pay a cash dividend of 21%. With over 234.2 million shares in circulation, GAS will spend nearly VND 4,920 billion on dividend payments. At the same time, GAS will carry out a bonus share issuance with a ratio of 100:3.

“MB Capital Pays 12% Dividend, MB to Receive Nearly VND 40 Billion”

MB Capital plans to distribute nearly VND 43 billion in dividends over the period of September-October 2025. The main beneficiary is the Military Bank (MB), which directly owns 90.77% of MB Capital’s capital.

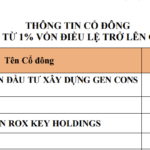

The ‘Shadow’ of Rox Group on Stanley Brothers Securities

The four major new shareholders who collectively hold 86.97% of the capital at Stanley Brothers are closely associated with Rox Group, helmed by the prominent businesswoman Nguyen Thi Nguyet Huong.