On August 26, Tien Phong Commercial Joint Stock Bank (TPBank, HOSE: TPB) published a document seeking shareholder approval for its plan to contribute capital and purchase shares to make TPS Securities Joint Stock Company (TPS, HOSE: ORS) its subsidiary.

On the same day, TPS also released a document seeking shareholder approval for its private placement plan.

In a letter to shareholders, TPS stated that at the 2025 Annual General Meeting of Shareholders, the company had approved the private placement of a minimum of 350 million shares at a price of VND 10,000 per share.

During the preparation for the implementation, TPBank, currently the largest institutional shareholder, expressed its interest in participating in the private placement, aiming to increase its ownership to 51% and become the parent bank of the Company. This move is considered a strategic step, contributing to the completion of TPBank’s multi-field financial ecosystem.

Becoming a subsidiary of TPBank not only reaffirms the long-term and solid companionship between TPBank and the Company but also opens up superior opportunities and advantages from the synergy of the ecosystem to promote the Company’s business activities, enhance its competitive position in the market, and remain committed to stable and sustainable development, bringing long-term benefits to shareholders.

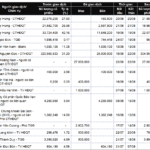

Accordingly, the Board of Directors recognizes the need to obtain shareholder approval in writing for the private placement in 2025, specifically, the private placement of 287.9 million shares to TPBank at a price of VND 12,500 per share (significantly higher than the price of VND 10,000 per share approved at the General Meeting of Shareholders on June 27).

The Board of Directors requests shareholders to consider and cast their votes in writing regarding the private placement plan.

Currently, TPBank holds over 30.2 million TPS shares, representing 9.01% of TPS‘s charter capital.

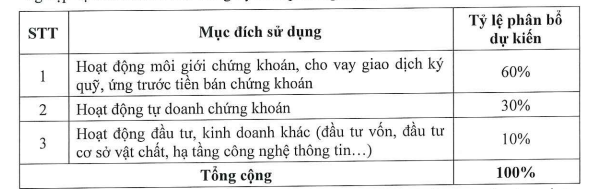

If the private placement is successful, TPS‘s charter capital will increase from nearly VND 3,360 billion to nearly VND 6,240 billion. The expected proceeds of nearly VND 3,600 billion will be used to supplement the Company’s business activities such as brokerage, margin lending, and proprietary trading…

On the stock exchange, ORS shares are trading around VND 14,400 per share (as of August 27). On August 26, TPS announced that ORS shares would be removed from the warning list starting August 28. This is due to the full acceptance of the audit conclusions in the reviewed semi-annual financial statements for 2025. Previously, ORS shares were put on the warning list from April 16 due to exceptions noted by the auditing organization in the 2024 audited financial statements.

| ORS Share Price Movement since the Beginning of the Year |

– 12:00, August 27, 2025

“Taseco Land Seeks Shareholder Approval for Plans to Offer Over 48 Million Private Placement Shares”

Taseco Land seeks shareholder approval to offer 48.15 million private placement shares at VND 31,000 per share, aiming to boost its charter capital to VND 3,600 billion.

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.

“Equity Dividends: A Business Prepares to Share its Success with a 45% Stock Dividend”

The company, Century Yarn, has unveiled plans to issue approximately 43.5 million new shares, equating to a 45% ratio (meaning shareholders owning 100 shares will receive an additional 45 shares).