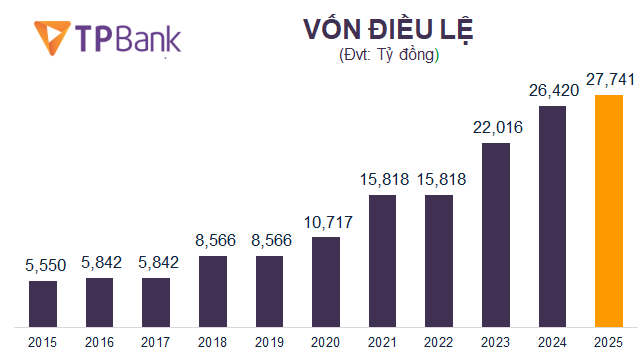

TPBank’s 2025 Annual General Meeting has approved a dividend payment plan involving a 5% stock dividend. This will involve issuing over 132 million shares to existing shareholders.

The source of funding for this dividend will come from undistributed profits after provisioning up to 31/12/2024, as per the consolidated financial statements.

The total value of the issue is nearly VND 1,321 billion. If the issue is successful, TPBank’s charter capital will increase from VND 26,420 billion to nearly VND 27,741 billion.

Source: VietstockFinance

|

The additional capital will be used for investing in technical infrastructure, developing information technology, and expanding the business network, as well as supplementing medium and long-term capital for business activities and the bank’s operations.

Previously, the bank also paid a 10% cash dividend (VND 1,000 per share) from undistributed profits after provisioning up to 31/12/2024, according to the consolidated financial statements.

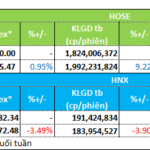

On the HOSE exchange, TPB shares opened the session on 26/08 at around VND 19,100 per share, up nearly 30% since the beginning of the year. Average daily liquidity exceeded 20 million units.

| TPB share price movement since the beginning of the year |

– 09:17 26/08/2025

The Stock Market Royalty: Back and Better than Ever

The domestic stock market rebounded today (August 26th) with a surge of over 53 points for the VN-Index, recovering from two consecutive sessions of losses. A raft of stocks hit the roof, with banking stocks making a strong comeback.

Market Pulse, August 27: Stumbles Under Foreign Investors’ Selling Spree

The VN-Index experienced a back-and-forth session, hovering around the 1,675-point mark throughout the afternoon. Despite significant support from the market heavyweight VCB, which surged to its daily limit, the index couldn’t sustain its gains and ended the trading day on a rather lackluster note. The selling pressure from foreign investors weighed heavily on the market, eroding much of the early gains.