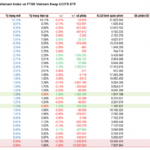

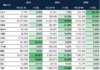

On September 5, 2025, FTSE is expected to announce the constituent stocks of the FTSE Vietnam Index. This will be followed by MarketVector’s announcement of the MarketVector Vietnam Local Index on September 13, 2025.

September 19, 2025, is anticipated to be the completion date for the restructuring of ETFs that reference these indices. The data cutoff date for this process is August 29.

In a recent report, Yuanta Securities (YSVN) provided predictions regarding the constituent stocks and the volume of stocks to be bought and sold for ETFs referencing these indices.

For the

FTSE Vietnam Index (FTSE Vietnam ETF reference),

FPT and HCM stocks are expected to be added. On the other hand, VTP is likely to be removed. Additionally, Yuanta notes that FTS may face removal if it fails to meet the capitalization requirements.

According to YSVN’s forecasts, the FTSE Vietnam ETF could add FPT stock with a weight of 10.6%, corresponding to a purchase of 9.9 million shares. This is the code with the largest net purchase volume during the restructuring. HCM stock is also expected to be added with a weight of 1.14% (equivalent to purchasing an additional 3.4 million shares).

Apart from VTP, which is predicted to be removed with the sale of more than 295,000 shares, the analysts also foresee sales of 8.7 million HPG units, 3.5 million SSI units, 3.7 million VND units, and so on.

On the other hand, Yuanta predicts that the

MarketVector Vietnam Local (VNM ETF reference)

will also add FPT but will not remove any stocks in the Q3 2025 review.

YSVN believes that FPT will account for a weight of 2.44%, equivalent to a purchase value of nearly VND 374 billion, or over 3.8 million shares. In addition to FPT, several other codes are expected to increase their weights, including MSN, VNM, VJC, and POW. On the selling side, VIX, SSI, VND, SHB, and NVL are the stocks expected to experience significant weight reductions.

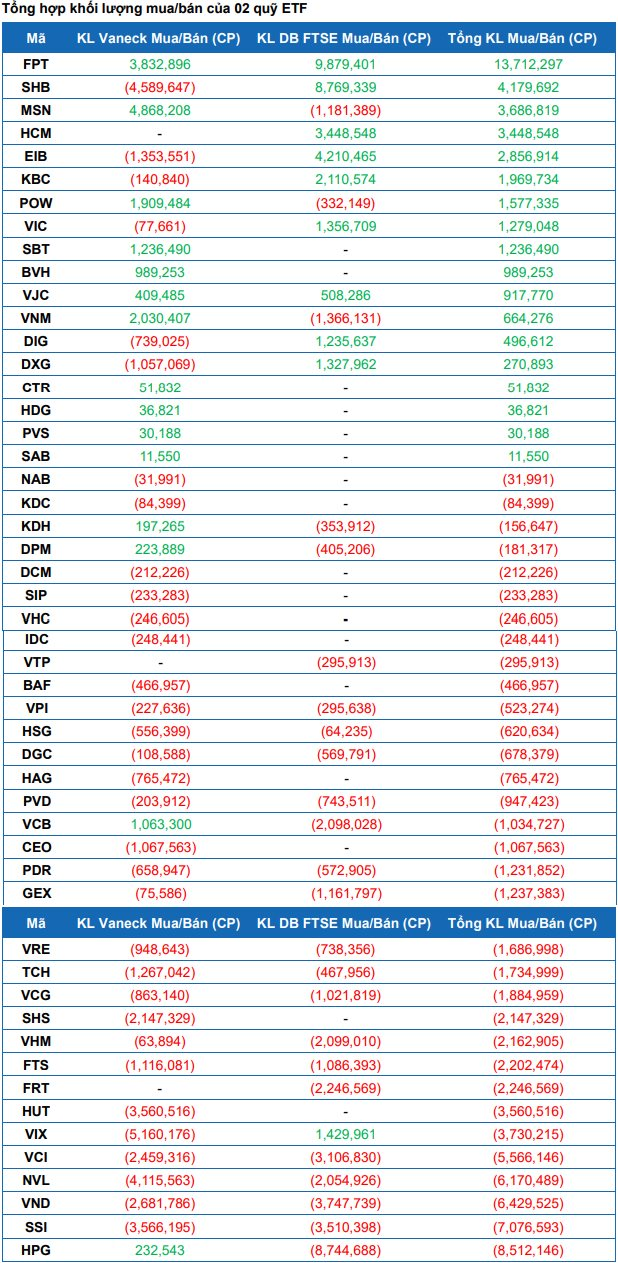

Aggregating the predicted transactions from both funds, FPT stands out with a net purchase volume of over 13.7 million shares. This is followed by SHB with over 4.2 million units, MSN with nearly 3.7 million units, HCM with over 3.4 million, and EIB with approximately 2.9 million.

Conversely, Yuanta forecasts that HPG will lead the top net sales with 8.5 million shares, followed by SSI with over 7 million shares, VND with approximately 6.4 million, NVL with nearly 6.2 million, and VCI with almost 5.6 million.

Figure 1: Illustration providing additional context or data related to the topic.

In the stock market, FPT shares closed up 1.2% at VND 100,000/share on August 26, with more than 5.8 million matched orders. FPT’s market capitalization increased to over VND 170,000 billion.

Figure 2: Chart or graph providing visual representation of data or trends mentioned in the article.

FPT’s Triumph: Prime Minister’s Trust in Truong Gia Binh Propels Stock to Impressive Heights

FPT’s stock has declined by over 34% since the beginning of the year. This significant drop has investors concerned about the future performance of the company. With a poor outlook for the upcoming quarters, it’s essential to understand the factors contributing to this decline and whether there are any potential upsides to this downward trend.

Yuanta Securities Adjusts 2025 Business Plan

On August 12, the Board of Directors of Yuanta Securities Vietnam JSC convened a meeting to discuss and approve significant matters, including the adoption of a new business plan for 2025. This revised strategy projects an average margin lending balance of VND 5.042 trillion and a total revenue of VND 793.6 billion, reflecting a 9% and 4% decrease, respectively, from the initial plan.

Yuanta Securities Revises 2025 Business Plan Amidst First-Half Setbacks

On August 12, the Board of Directors of Yuanta Securities Vietnam Joint Stock Company met and approved several key matters, including the adoption of a new business plan for 2025. The revised plan projects an average margin lending balance of VND 5.042 trillion and total revenue of VND 793.6 billion, representing a 9% and 4% decrease, respectively, from the initial targets.

The Two Large-Scale ETFs Gear Up to Purchase Tens of Millions of Shares in the Securities Group

Two large-scale ETFs, comprising of diverse stocks such as VIX and VCI, are set to make a significant impact on the market. With a combined worth of tens of millions of shares, these ETFs are poised to offer a unique opportunity for investors seeking exposure to a wide range of industries and sectors.