SMC, a well-known steel manufacturer and distributor in Southern Vietnam, has faced challenges since 2022 due to difficult-to-recover debts and a weak real estate market. As of the close of the August 27, 2025, trading session, SMC’s stock price was 71% lower than its peak nearly four years ago.

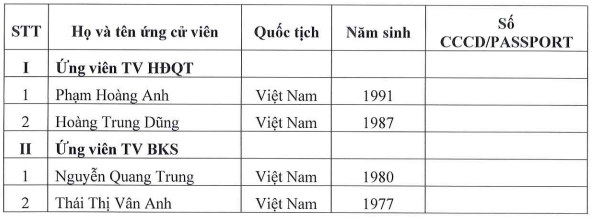

According to a document released on August 27, the Board of Directors will propose to the shareholders the election of two additional members to the Board of Directors and two members to the Supervisory Board for the 2021-2025 term.

|

List of candidates for SMC’s Board of Directors and Supervisory Board for the 2021-2025 term

Source: SMC’s Extraordinary General Meeting Documents

|

Mr. Pham Hoang Anh has a background in finance and has worked in investment banking at MBS Securities and OCB Bank. He is currently the Vice President at ConnectLog Vietnam, a company specializing in cold storage.

Mr. Hoang Trung Dung is the Vice Chairman of Haiduong Road and Bridge Joint Stock Company and also the Head of Investment Advisory at Bao Viet Securities.

The candidates for the Supervisory Board include Mr. Nguyen Quang Trung, CEO of ConnectLong Vietnam, and Ms. Thai Thi Van Anh, Director of KTC Audit Company.

SMC shareholders can submit additional nominations and applications to the Company before 4:00 PM on September 20, 2025.

Thừa Vân

– 6:00 PM, August 27, 2025

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.

“Technical Analysis for August 25: Navigating a Volatile Market”

The VN-Index and HNX-Index witnessed a downward trend, accompanied by the emergence of less-than-favorable candle patterns during the morning session. If technical factors do not show signs of improvement in the afternoon, the risk of a downward adjustment looms large.

“Viconship Unveils Plans to Boost Profits to 1,250 Billion VND by 2025”

Viconship seeks to impress shareholders with an ambitious revision to its 2025 pre-tax profit plan. The new proposal projects a staggering 3.1-fold increase, surging from 400 billion VND to 1,250 billion VND. This bold revision sets a new benchmark, surpassing the previously approved plan.