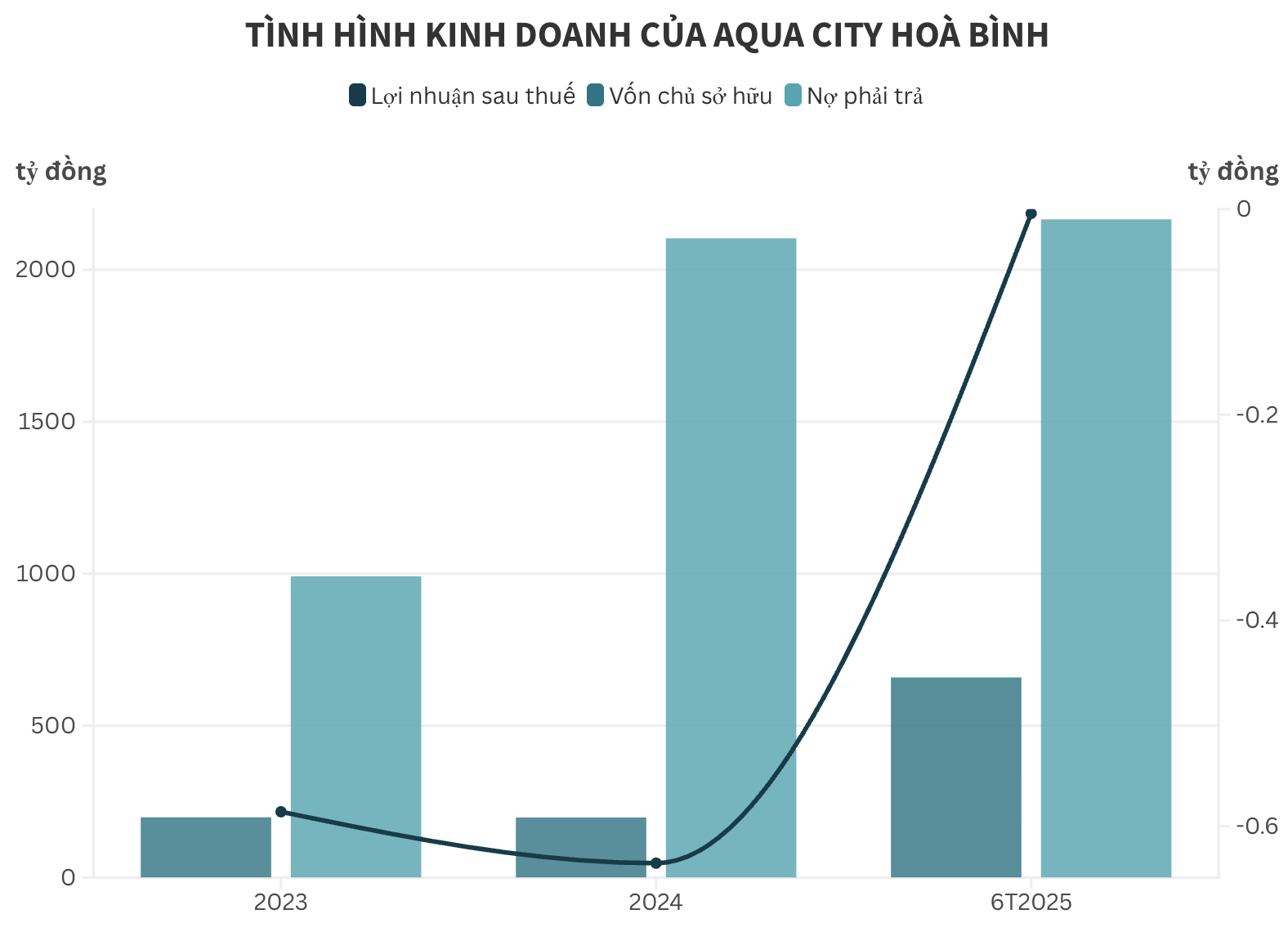

Aqua City Hoa Binh JSC has released its financial report for the first half of 2025, revealing an after-tax loss of over 4.3 million VND, an improvement from the 658.7 million VND loss in the same period last year.

As of June 30, 2025, the company’s owner’s equity stood at 658.8 billion VND, a three-fold increase compared to the previous year. The debt-to-equity ratio was 3.29, indicating a debt of over 2,166 billion VND. The majority of this debt comprises bond issuances of 999 billion VND and bank loans of over 851.7 billion VND.

According to the Hanoi Stock Exchange (HNX), Aqua City Hoa Binh currently has two bond issues circulating in the market.

The first, with the code AHBCH2328001, was issued at a value of 600 billion VND on December 29, 2023, and completed on January 2, 2024. It has a five-year term and will mature on December 29, 2028. In the first half of 2025, the company paid nearly 37.7 billion VND in interest to bondholders.

The second bond issue, AHBCH2429001, was issued at a value of 400 billion VND on September 30, 2024, with a five-year term maturing on September 30, 2029. The registering/depository organization is HD Securities (HDBS). For this issue, the company paid over 23.8 billion VND in interest during the first half of 2025.

Aqua City Hoa Binh is a member of Le Van Vong’s La Vong Group. Established on November 6, 2020, the company primarily operates in the real estate business. Its initial chartered capital was 199 billion VND, with two members, New House Trading JSC and La Vong Group JSC, each holding a 50% stake.

In March 2025, La Vong Group increased Aqua City Hoa Binh’s capital to 350 billion VND. Following this capital increase, La Vong Group’s ownership in Aqua City Hoa Binh rose to 71.57%, while the remaining shareholder, New House, decreased its stake to 28.42%.

New House and La Vong Group are also the consortium implementing the Trung Minh B New Urban Area project in Trung Minh Ward, Hoa Binh City, Hoa Binh Province. The project covers an area of nearly 59 hectares, with a total investment of nearly 780 billion VND. The project implementation contract was signed on November 30, 2020.

“Highway Investor Reports $156 Million Profit in H1 2025”

The Hanoi Highway, a prominent BOT enterprise within the CII ecosystem, witnessed a slight uptick in profits, surpassing 156 billion VND in the first half of 2025.