The Vietnamese stock market rebounded strongly on August 26 after a sharp decline earlier in the week. After the initial volatility, buying interest returned, spreading gains across various sectors. The VN-Index extended its advance, surging over 50 points to near the 1,670 level. While liquidity eased considerably compared to the previous sessions, the matched order value on the HOSE still reached approximately VND 35 trillion.

The market breadth was positive, with around 600 gainers, including over 30 stocks hitting the daily limit-up, far outnumbering the roughly 160 losers.

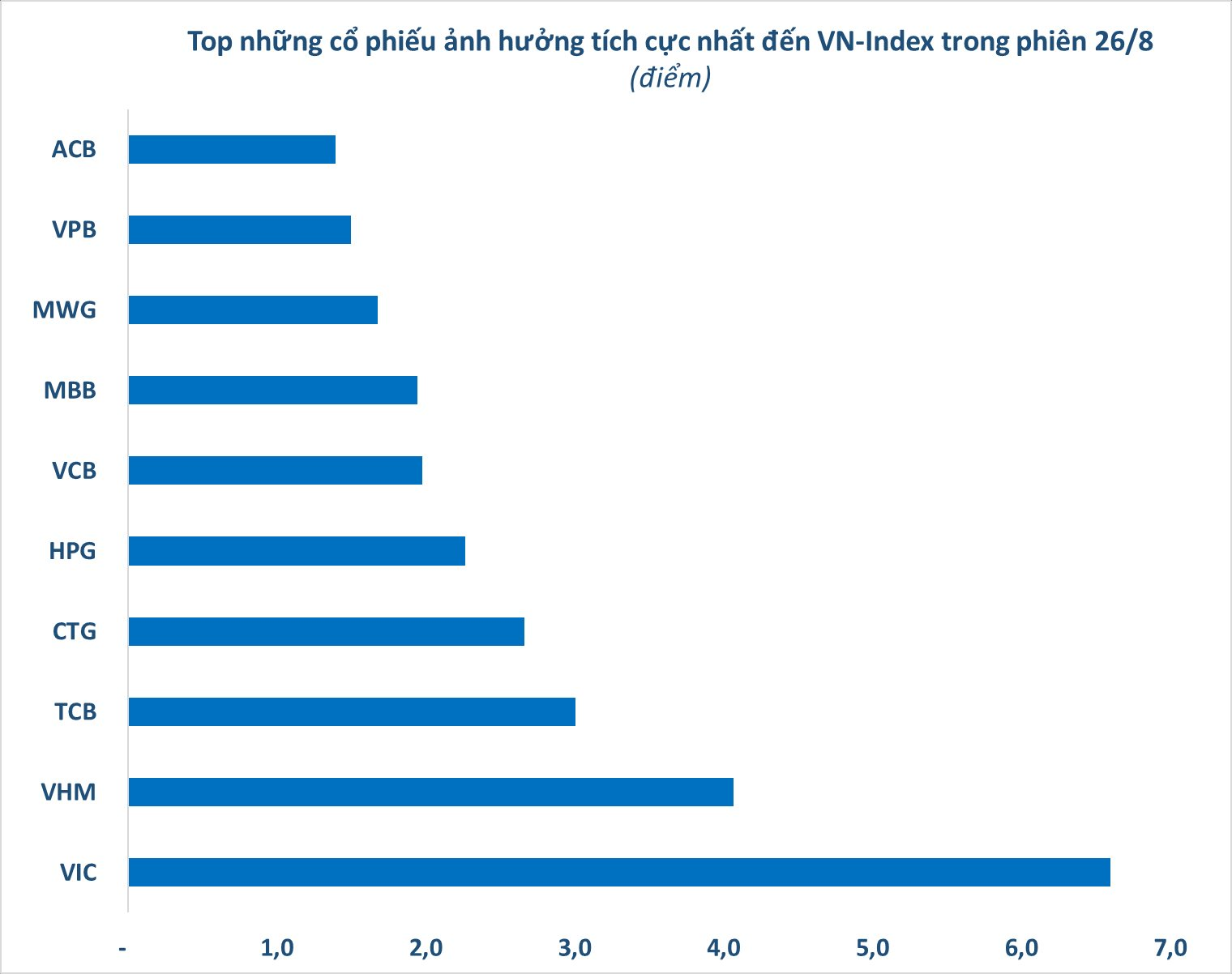

A closer look at the contributors reveals that all 30 constituents of the VN30 basket closed higher, with MWG, SSI, VHM, and SHB surging to the daily limit-up, providing solid support for the benchmark’s gains. Sector-wise, the rebound was led by securities, banking, steel, and real estate stocks, which helped the index recoup all the losses incurred in the previous session.

Notably, VIC and VHM, the heavyweight duo, simultaneously hit new all-time highs, contributing 6.6 and 4.1 points, respectively, to the VN-Index’s advance. VHM, a securities stock, soared by the maximum allowed limit of 6.7% to VND 105,200 per share, while VIC, defying the previous session’s peak, climbed 3.4% to VND 135,500 per share.

Two banking stocks, TCB and CTG, rose over 4%, adding nearly 5.7 points to the main index. Other prominent banks, including VCB, MBB, VPB, and ACB, also ended in positive territory, serving as robust pillars for the VN-Index’s ascent.

Moreover, HPG, another heavyweight, witnessed a robust rally, climbing 4.8% to VND 27,200 per share and contributing almost 2.3 points to the HoSE benchmark.

On the flip side, stocks like VPL, VCF, CHP, and SVC exerted some drag on the VN-Index, but their impact was relatively muted.

The rebound eased market concerns following two consecutive sessions of sharp losses, where the VN-Index shed more than 70 points. Analysts share the view that a technical correction after a strong rally of nearly 600 points is understandable. As per Mr. Dang Van Cuong, Head of Investment Consulting at Mirae Asset Vietnam Securities, short-term corrections are an inevitable part of every bull market, occurring as expectations shift among different investor groups, but their precise timing is challenging to predict.

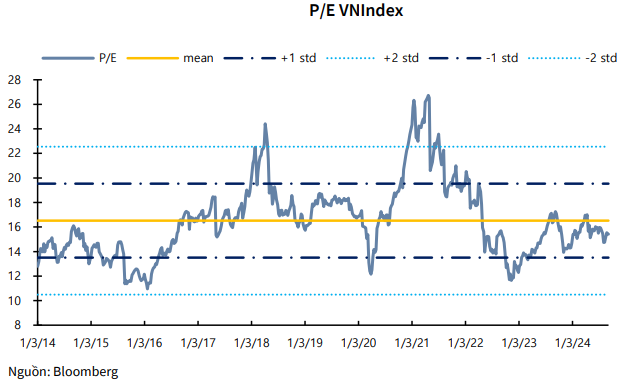

However, he emphasizes that corrections present opportunities to increase allocations and provide a window for investors who missed the previous rally, as the market remains relatively attractive in terms of valuations, listed companies’ earnings growth, and the impending upgrade story.

Echoing this sentiment, Mr. La Giang Trung, CEO of Passion Investment, recently shared on his Facebook page that with the Fed and numerous central banks worldwide injecting liquidity and the State Bank of Vietnam maintaining an accommodative stance for at least another year, ample capital will continue flowing into various assets, including equities.

Mr. Trung stresses the importance of focusing on the bigger picture and long-term trends. As long as liquidity remains robust, the market has room to climb higher. Short-term fluctuations of a few dozen points or stock-specific narratives will not alter the overarching trajectory. Liquidity has doubled or tripled compared to the previous cycle of 2020-2021, and valuations are only halfway through that cycle.

Regarding the market’s upside potential, Mr. Trung boldly asserts that the “VN-Index will surpass all scenarios in the most imaginative investor’s mind.”

Breaking the Losing Streak: Foreign Block Snaps 13 Consecutive Selling Sessions with Near 1,000 Billion Dong Purchase on HoSE

Foreign investors surprised the market with a net buy-in of nearly VND 742 billion, ending a 13-session long selling streak.

Has the Stock Market Moved Past the ‘Speculative Peak’?

The sharp dip over the weekend caused the VN-Index to lose most of its previous gains, raising questions about whether the market has moved past the “speculative peak”. Analysts believe that after a heated rally and a spread of speculative money, the market may return to reflecting fundamental valuation factors and expectations for Q3 earnings. The pressure to adjust remains in the week ahead.

“Attractive Market Valuations Persist: VPBank’s Experts Uncover 6 Lucrative Investment Opportunities for the Remaining Year”

The technical and fundamental analysis suggests that the market has yet to peak according to both Elliott Wave theory and market valuation metrics.