After two adjustments, the stock market reversed and regained nearly 54 points, raising hopes for a new upward trend. With just a 20-point gap, it won’t be a surprise if the VN-Index peaks soon, especially given the market’s favorable conditions.

At the Jackson Hole conference on August 22, Fed Chairman Jerome Powell made remarks that investors interpreted as paving the way for a potential interest rate cut as soon as September 2025. This move is expected to provide the State Bank of Vietnam (SBV) with more flexibility to maintain its loose monetary policy.

Despite significant exchange rate pressure, the SBV has maintained low-interest rates to support economic growth. Meanwhile, the government is ramping up public investment and infrastructure projects to achieve its goal of over 8% GDP growth this year, setting the stage for a double-digit target in the next phase.

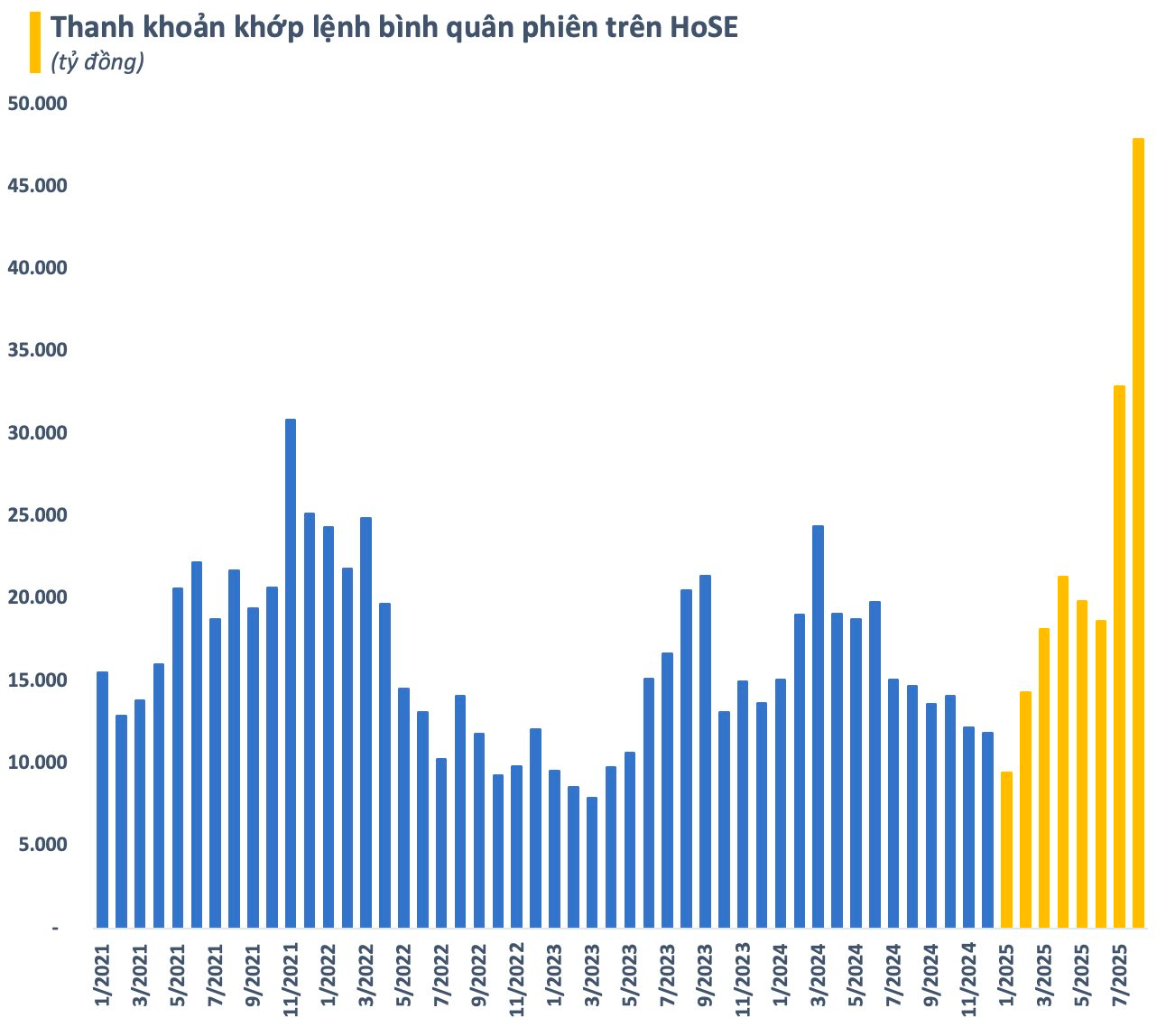

In this low-interest-rate environment, other investment channels like gold and real estate have already seen substantial price increases and are showing signs of cooling down, making the stock market the focal point for attracting capital inflows. This is evident from the market’s booming liquidity, with transaction values regularly reaching approximately $2 billion.

Another positive sign is that foreign investors recently net bought over VND 500 billion, ending a 13-session selling streak. It’s too early to confirm if foreign capital has reversed its outflow trend. However, if this trend continues, it will be one of the market’s driving forces, further reinforcing the belief that Vietnam will be upgraded by FTSE this year.

Overall, while short-term fluctuations are inevitable, many analysts believe that the stock market is in a significant uptrend, potentially pushing the VN-Index to unimaginable levels.

In his latest post on his personal Facebook page, Lã Giang Trung, CEO of Passion Investment, argued that compared to the 2020–2021 period, the current market is witnessing even stronger capital inflows, while valuations remain lower. “If we make a relative comparison in terms of time, August 2025 is quite similar to December 2020 in terms of market cycle, valuation, market volatility, and the performance of different stock categories,” Mr. Trung analyzed.

The expert emphasized that the critical factor now is to focus on the bigger picture and the long-term trend. As long as liquidity remains robust, there is room for the market to move higher. Short-term fluctuations of a few dozen points or individual stock movements will not alter the long-term trend. Liquidity has doubled or tripled compared to the previous cycle of 2020-2021, and market valuations have only reached the halfway point compared to that cycle. “The VN-Index will surpass all scenarios in the most imaginative investor’s mind,” the expert emphasized.

Previously, in a letter to investors, Petri Deryng, head of the foreign fund Pyn Elite Fund, also assessed that the stock market is growing well, and the pace could even accelerate. According to the fund manager, based on current fundamentals, this could be a “Big Year” for the stock market’s performance, citing seven reasons:

(1) Government spending is boosting economic growth.

(2) Vietnam has ample liquidity, and the government is supporting bank lending.

(3) The uncertainty over Vietnam’s exports to the US due to tariffs has been resolved.

(4) FTSE is expected to upgrade Vietnam to emerging market status in October.

(5) Profit growth prospects are very positive, with an estimated 32% for 2025 and 19% for 2026.

(6) With such profit growth, Pyn Elite Fund calculates that the projected P/E for 2026 is 11.1.

(7) The market rally has been intense, and rotation will stimulate new stocks and sectors.

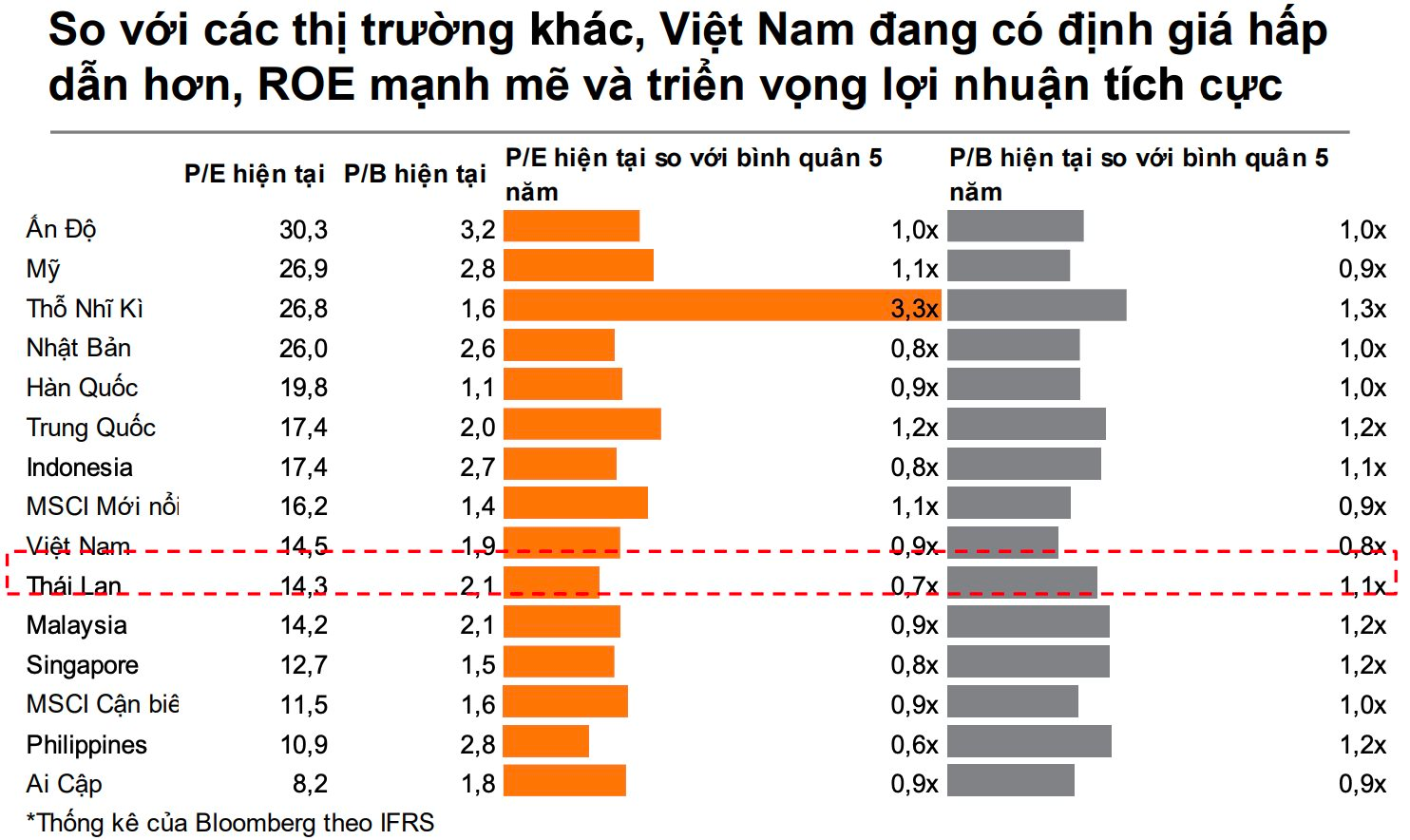

Sharing the same view, Maybank Investment Bank gave a positive assessment of the market outlook for the second half of the year, raising its VN-Index target for the end of the year to 1,800 points , based on a target P/E of 14.5x (equivalent to a 5-year average) and an expected earnings growth of 18.5% for 2025. The three priority sectors are those benefiting from infrastructure investment (steel, real estate), strong credit growth (banks), and structural demand (IT, aviation).

Similarly, SSI expects the VN-Index to reach the 1,750-1,800 range in 2026. The main drivers are a solid recovery in profit growth, supported by: (1) The rebound in the real estate market and public investment, (2) A favorable interest rate environment, (3) Easing concerns about tariff-related risks, and (4) Expectations of an upgrade in October.

Meanwhile, VNDirect expects listed companies’ EPS growth on HoSE to reach about 20-22% in 2025, corresponding to a projected P/E of around 13 times for the VN-Index in 2025. This attractive valuation will continue to make Vietnam a potential destination for investors.

For the longer term, specifically over the next 9-12 months, VNDirect maintains a positive outlook, with a base case scenario of the VN-Index reaching the 1,850-1,900 range. The main drivers include the potential market upgrade, the Fed’s monetary policy easing prospects, and robust corporate profit growth, thereby creating a foundation for improved valuations and strengthened investor confidence.

Unlocking Housing Opportunities: Hai Phong Seeks Investors for Two Social Housing Projects Valued at 2.5 Billion VND

The Hai Phong Department of Construction has just invited interested investors to register as investors for two social housing projects in An Duong Ward, with a total investment of approximately VND 2,500 billion.

The Alphanam Group’s Ambitious Plans: Proposing 5 Mega Projects Totalling Over 1,000 Ha in Can Tho

The bustling city of Can Tho has big plans for the future, and it is knocking on Alphanam’s door to make them a reality. With a vision to kickstart development, the city proposes that Alphanam take the driver’s seat and coordinate efforts to break ground on one or two pivotal projects by 2025. This ambitious timeline underscores the urgency and potential for transformative growth in the region.