Vietnamese Stock Market Update: August 28, 2025

The Vietnamese stock market experienced a slow trading day on August 28, with a significant decline in liquidity. The VN-Index, after facing selling pressure at the peak, managed to rebound, ending the session up 8.08 points (+0.48%) at 1,680.86. Despite the positive performance, foreign investors remained net sellers, offloading a substantial 2.697 trillion VND.

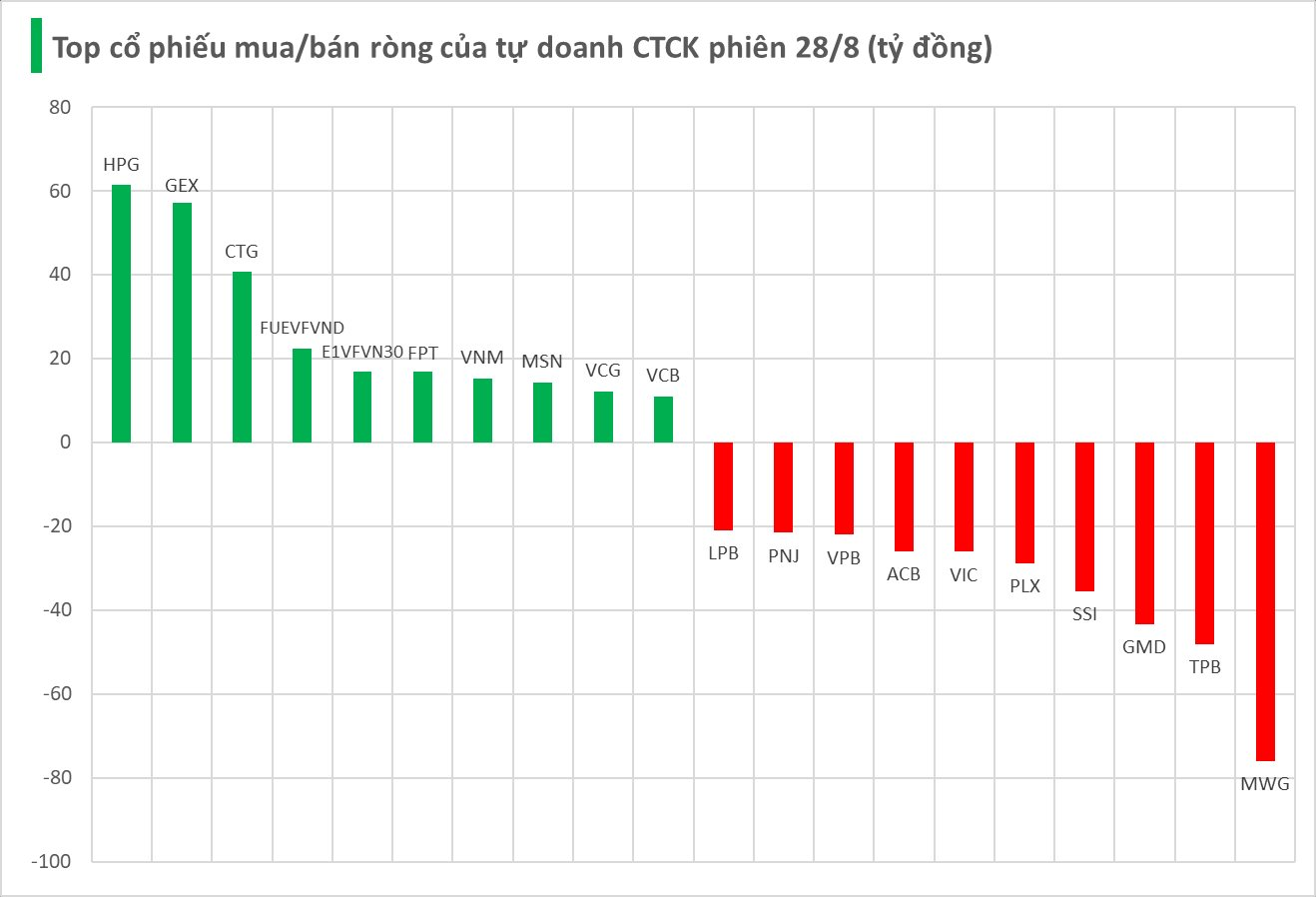

Securities firms continued their net selling streak, offloading 261 billion VND on the HoSE.

In terms of securities firms’ net selling activities, MWG topped the list with a net sell value of -76 billion VND, followed by TPB (-48 billion), GMD (-43 billion), SSI (-35 billion), and PLX (-29 billion VND). Other notable stocks that witnessed significant net selling pressure included VIC (-26 billion), ACB (-26 billion), VPB (-22 billion), PNJ (-21 billion), and LPB (-21 billion VND).

On the flip side, HPG emerged as the most notable net bought stock, with a net buy value of 61 billion VND. GEX ranked second in the list of net bought stocks by securities firms, with 57 billion VND, followed by CTG (41 billion), FUEVFVND (22 billion), E1VFVN30 (17 billion), FPT (17 billion), VNM (15 billion), MSN (14 billion), VCG (12 billion), and VCB (11 billion VND).

The Stock Market Shudder Before the Holiday Lull

Today’s trading session (August 28th) witnessed domestic stocks continue their volatile trend. Despite the VN-Index posting gains, investor sentiment turned cautious, resulting in a sudden drop in market participation.

Market Beat: Green Returns in Afternoon Trade, VN-Index Climbs to 1,680 Points.

The market staged a remarkable comeback in the afternoon session, reversing the negative trend witnessed in the morning. The afternoon session saw a surge of buying interest, pushing the market into positive territory and closing the day in the green.

Reviewing the VN-Index 2025 Forecast: VCBS Stands Out With Its Realistic Scenario

VCBS, or Vietnam Joint Stock Commercial Bank for Foreign Trade Securities Corporation, stands out as the sole entity, since late 2024, to forecast the VN-Index reaching 1,555 points in a base scenario and 1,663 points in an optimistic one. This prediction has proven remarkably accurate, closely mirroring the index’s actual performance.