Mr. Le Nhi Nang, representative of the State Securities Commission, delivered a speech at the event

|

Speaking at the event, Mr. Le Nhi Nang, representing the State Securities Commission of Vietnam, stated that in recent years, Vietnam has demonstrated a strong commitment to the international community regarding green development, especially the net-zero emission goal by 2050 as stated in the COP26 Declaration. To realize this commitment, we cannot rely solely on government funding but need to effectively mobilize social resources, with the financial market playing a central role.

Currently, the two main green finance instruments legalized under the Law on Environmental Protection are green credit and green bonds. State agencies have made significant efforts to improve the legal framework. Notably, the issuance of the Green Classification List under Decision No. 21/2025 is an important institutional step forward, helping to direct capital towards priority areas.

The State Securities Commission is in the process of updating the Green Bond Handbook to address the challenges in accessing and implementing green finance instruments, which are still relatively new and complex for many businesses, especially the requirements for ESG disclosure and post-issuance monitoring.

However, according to Mr. Nang, for the green financial market to develop to its full potential, we must honestly acknowledge the existing challenges. The cost of issuing green bonds is not yet truly competitive compared to conventional bonds. The supporting ecosystem, including independent verification organizations, green finance databases, and digital technology applications in capital use supervision, is still in the process of formation.

Ms. Candice Low – Director of ESG Ratings at Sustainable Fitch

|

Commenting on global trends, Ms. Candice Low, Director of ESG Ratings at Sustainable Fitch, noted that the market has been relatively quiet this year, with the second-quarter issuance volume being the lowest since 2019. The proportion of labeled ESG debt in the global bond market has decreased to 10.2% from 11.7% last year. While green bonds still account for the largest proportion, sustainable bonds have shown the most resilience.

China’s overseas issuances are going against the trend; while many other markets have seen a decline in the issuance of ESG-related financial products, China has maintained growth momentum in its overseas issuances.

Another notable point is the strong trend of SSA (Supranational, Subnational, and Agency) organizations issuing bonds. These organizations often play a pioneering role and can finance a wider range of projects, including less common categories such as climate change adaptation.

Green Finance in Vietnam has a Promising Future

At the workshop, Mr. Nguyen Phi Long, Director of Research at S&I Ratings, provided a comprehensive overview of the ESG story in Vietnam.

Mr. Long emphasized that Vietnam is on the right track regarding the UN’s 17 Sustainable Development Goals. Vietnam also made significant commitments at COP26, including reducing global methane emissions, increasing forest efficiency and land productivity by 2030, along with a commitment to transition from coal-fired power to renewable energy and achieve the Net Zero target by 2050.

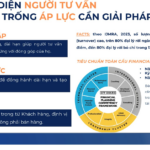

However, the ESG trend in Vietnam also faces challenges. Mr. Long pointed out some of the main obstacles to implementing ESG in Vietnam. Many businesses still consider ESG adoption as a “nice to have” rather than a “must-have.” This is because the green transition may require business model upgrades and additional efforts, while shareholders mainly focus on final profits rather than environmental or social benefits.

On the other hand, the legal framework is not yet fully developed, and more detailed regulations are needed. However, there is good news: Vietnam has taken positive steps in building its legal framework. Mr. Long highlighted the recently issued Decision 21 on green credit and green bonds for projects, which introduced green classification and enhanced the role of independent verification for the first time. This decision expands access to the green financial market and lays a solid foundation for future development, covering seven sectors and 45 reduced project categories.

Mr. Nguyen Phi Long, Director of Research at S&I Ratings, presented on ESG trends in Vietnam

|

Implementing ESG will incur costs for businesses, including initial costs (consulting fees, initial opinion fees) and periodic costs (audit fees, training fees, reporting fees). However, Mr. Long believes that, in the long run, the benefits will far outweigh the costs, including reduced expenses, enhanced reputation, a more diverse investor base, and improved governance structure.

Having a strong ESG performance or issuing green financial instruments (such as green bonds) can attract a large number of investors seeking sustainable profits and positively impacting the environment and society. These investors are looking beyond financial returns and want to see additional environmental and social impacts.

Moreover, focusing on ESG often goes hand in hand with improving a company’s internal governance structure and processes.

Mr. Long stated that as a credit rating and corporate analysis agency, S&I Ratings is committed to accompanying Vietnamese businesses on their ESG journey. S&I Ratings is in the process of becoming an independent verifier under Decision 21. Simultaneously, S&I Ratings will soon launch credit rating services and SPO (second-party opinion) services for green bonds this year.

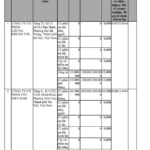

Concluding his presentation, Mr. Long shared impressive figures on the development of green finance in Vietnam. Green credit accounts for about 4.3% of the economy’s total outstanding credit. Nearly 60 financial institutions are applying ESG assessment in lending activities. The cumulative issuance of green bonds from 2016 to 2024 reached VND 33,500 billion, indicating a strong upward trend in green bond issuance by Vietnamese enterprises.

|

Green credit and green bond issuance growth in Vietnam

|

– 1:48 PM, August 29, 2025

The Festive Season’s Grand Finale: TCM Anticipates Peak Orders

The Ho Chi Minh City Textile, Garment, Investment, and Trade Company (HOSE: TCM) anticipates a vibrant fourth quarter as it enters the peak festive and holiday season.

The Crypto Asset Giant: VIX Securities Forges Ahead

The investment in VIXEX marks a significant step for the VIX group, as it ventures into the newly legalized digital asset space in Vietnam. This move underscores the group’s forward-thinking approach and its recognition of the immense potential within this burgeoning industry.

“Surpassing Heat, Conquering Rain, Unfazed by Storms: Vingroup’s Resilience in Building One of the World’s Top 10 Largest Exhibition Centers”

This morning, the capital city of Hanoi witnessed a grand opening ceremony of the Exhibition of National Achievements titled “80 Years of Independence, Freedom and Happiness” to commemorate the 80th anniversary of the August Revolution (August 19, 1945 – August 19, 2025) and National Day (September 2).