Market liquidity increased from the previous trading session, with the matched trading volume of the VN-Index reaching more than 1.46 billion shares, equivalent to a value of over 43.1 trillion dong; The HNX-Index reached more than 144 million shares, equivalent to a value of more than 3.1 trillion dong.

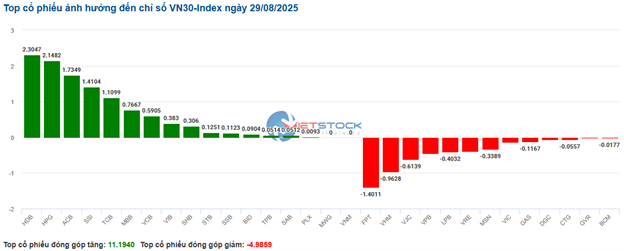

VN-Index opened the afternoon session with unexpected strong selling pressure, causing the index to plunge towards the reference level and switch to a prolonged tug-of-war until the end of the session. In terms of impact, VPB, HDB, MBB, and HPG were the codes with the most positive impact on the VN-Index, with an increase of more than 4.2 points. On the contrary, VIC, FPT, VCB, and GAS were the codes still under selling pressure, taking away more than 4 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index session on 08/29/2025 |

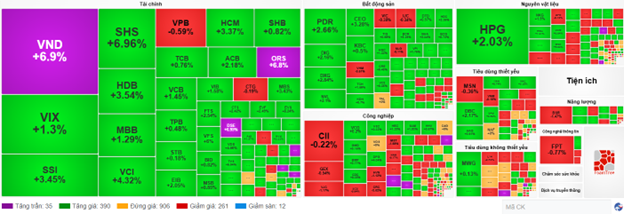

Similarly, the HNX-Index also had a fairly optimistic movement as the index was positively impacted by codes such as SHS (+6.96%), MBS (+2.21%), NVB (+1.29%), and THD (+1.57%)…

|

Source: VietstockFinance

|

The financial sector was the group with the best growth in the market, with a 0.87% increase mainly from codes BID (+0.82%), VPB (+2.94%), MBB (+2.02%), and ACB (+0.91%). Following the recovery was the healthcare and materials sectors, with increases of 0.6% and 0.51%, respectively. On the contrary, the information technology industry was the group that recorded a sharp decline in the market, with a decrease of 2.68%, mainly due to the code FPT (-2.78%), CMG (-1.47%), and ELC (-1.59%).

In terms of foreign transactions, they continued to sell a net of more than 3,623 billion dong on the HOSE floor, focusing on codes MBB (434.68 billion), HPG (373.81 billion), FPT (355.78 billion), and SSI (338.06 billion). On the HNX floor, foreigners bought a net of more than 61 billion dong, focusing on the SHS (77.98 billion) code, IDC (16.62 billion), VFS (6.71 billion), and EVS (2.64 billion).

| Foreign buying and selling movements |

Morning session: Financial stocks soar, VN-Index surpasses 1,690 points

The green still held the upper hand until the end of the morning session. At the midday break, the VN-Index gained nearly 10 points (+0.59%), to 1,690.76 points; The HNX-Index also rose sharply by 1.71%, reaching 281.36 points. The market breadth tilted towards buying pressure with 451 advancers and 297 decliners.

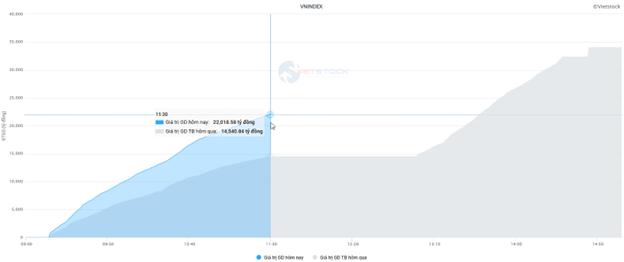

Market liquidity is improving quite well compared to the low of the previous session. The trading value of HOSE this morning reached 22 trillion dong, up 51%, close to the 1-month average. HNX also recorded a volume of 85 million units, equivalent to more than 1.8 trillion dong.

Source: VietstockFinance

|

In terms of impact, VPB was the code with the most positive impact when it brought in 2 points for the VN-Index. In addition, VCB and MBB also contributed a total of more than 2 points to the overall index. On the contrary, VHM was the code with the most negative impact this morning when it took away nearly 1 point from the index.

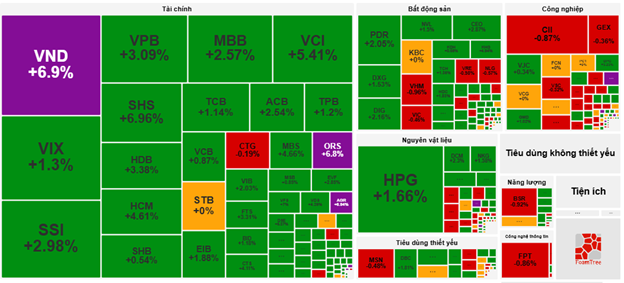

In terms of sector performance, the green dominated most stock groups. The financial group temporarily led the market in the morning session as the green spread across a wide range, especially in banking and securities stocks such as BID (+1.18%), TCB (+1.14%), MBB (+2.57%), ACB (+2.54%), HDB (+3.38%), SSI (+2.98%), and VND, ORS, and AGR hitting the daily limit-up band.

Source: VietstockFinance

|

In addition, the essential consumer goods and materials groups also traded actively with bright spots such as MCH (+3.8%), HAG (+2.14%), MML (+1.04%), DBC (+1.81%), HNG (+3.17%); HPG (+1.66%), DCM (+2.3%), HSG (+1.09%), NKG (+1.58%), and MSR (+6.15%). However, many codes are still in the red, such as MSN (-0.48%), VSF (-0.79%), ANV (-1.43%); KSV (-0.83%), HT1 (-1.72%), NTP (-0.16%), and ACG (-0.54%).

On the opposite side, the information technology group temporarily “bottomed out” with a decrease of 0.85%, affected by the adjustment of FPT (-0.86%), CMG (-0.61%), ELC (-1.36%), VEC (-6.09%), and HPT (-2.68%).

The downside was that foreigners continued to sell a net of 2.2 trillion dong on the three exchanges. The selling pressure was concentrated in the two codes MBB and SSI with values of 263.86 billion and 250.8 billion, respectively. Meanwhile, VCI led the net buying list with a value of 78.96 billion dong.

| Top 10 stocks with the strongest net buying and selling in the morning session of 08/29/2025 |

10:30 am: Tilting towards the upside

VN-Index rose 7.12 points, trading around 1,687.98 points. HNX-Index rose 4.88 points, trading around 281.51 points.

Most of the stocks in the VN30 basket rebounded strongly. Notably, four banking codes, HDB, ACB, TCB, and MBB, contributed 2.3 points, 1.73 points, 1.1 points, and 0.76 points to the VN30 index, respectively. On the contrary, FPT, VHM, VJC, and VPB were the stocks still under selling pressure, taking away more than 3.4 points from the index.

Source: VietstockFinance

|

The breadth of sectors was fairly balanced, with green and red hues interspersed. Among them, on the upside, supporting the market’s upward momentum, was the financial stock group, which turned green from the start of the session. Specifically, VCB rose by 1.45%, TCB by 0.88%, BID by 0.82%, and MBB by 1.1%… Only a few codes remained flat or were under mild selling pressure, such as CTG, VPB, LPB, and BVH, but their impact was not significant.

Following this was the essential consumer goods sector, which also contributed to the market’s upward momentum despite the ongoing strong divergence, with green appearing in stocks such as MCH (+3.48%), SAB (+0.64%), QNS (+0.21%), and HAG (+0.31%)… Meanwhile, some other large-cap codes like VNM (-0.16%), MSN (-0.24%), and SBT (-0.21%)… remained under selling pressure, but the decline was not significant.

In contrast, the information technology sector was experiencing contrasting fortunes, with most codes in the red, such as FPT (-0.77%), CMG (-1.22%), ELC (-0.91%), VEC (-5.22%)…

On the buying and selling front, buyers continued to hold the upper hand. There were more than 390 gainers and over 260 decliners.

Source: VietstockFinance

|

Opening: Green prevails at the start of the session

At the start of the session on August 29, as of 9:30 am, the VN-Index rose more than 3 points to 1,684 points. The HNX-Index also posted solid gains, climbing over 3 points to 279 points.

The green dominated the morning session, with several securities stocks rising sharply from the opening bell, including VIX (+0.26%), ORS (+5.5%), VND (+6.29%), and SHS (+3.66%).

Large-cap stocks such as VIC, VCB, TCB, and BID led the market higher, contributing more than 4 points to the main index. Conversely, VPB, BCM, GAS, and CII weighed on the market, dragging the index down by nearly 0.7 points.

Energy stocks continued their steady upward trajectory, with most codes remaining in positive territory. Notable gainers included BSR (+0.18%), OIL (+5.08%), PVC (+1.72%), and PVS (+0.59%)…

– 15:20 08/29/2025

“Foreign Investors Sell Nearly VND 2.7 Trillion as VN-Index Surges Past 1,680 Points: Which Stocks Were in the Firing Line?”

“Foreign investors showed strong buying interest in GMD stock during the afternoon trading session, making it the most actively bought stock across the market. The net buying value stood at an impressive 135 billion VND.”

The Hottest Bank Stock Before Closing Bell

Today (August 27th), while the market returned to a state of tug-of-war, VCB stock stood out by closing at the ceiling, setting a new peak of VND 69,100 per share.