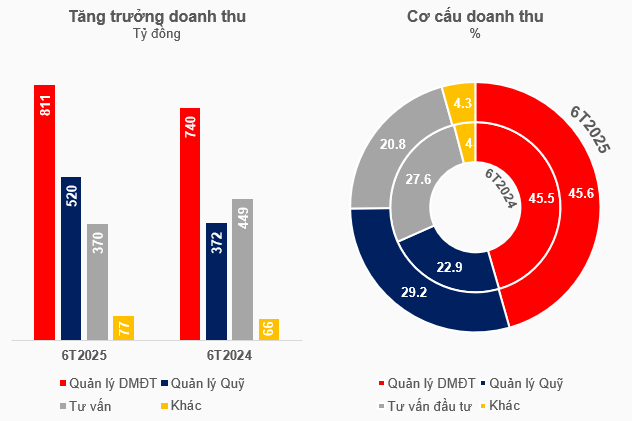

Trust and fund management remain the main sources of revenue

In the first half of 2025, the total revenue of the fund management industry reached nearly VND 1.8 trillion, up 9% over the same period last year. Of this, revenue from investment portfolio management (trust) still accounted for the highest proportion, at 46%.

The two other large segments showed contrasting trends, with securities investment fund management and securities investment companies increasing from 23% to 29%, while securities investment consulting activities decreased from 28% to 21%. The remaining activities (bonus activities, fund certificate repurchase fees, etc.) contributed a proportion of 4%, almost unchanged from the previous year.

In terms of growth scale, trust and fund management are the two segments that contribute the most to the overall results. Specifically, total trust revenue increased by 10% over the same period to VND 811 billion, which is understandable in the context of the continued expansion trend of the investment portfolio management scale.

The growth results came from a total trust scale of more than VND 614 trillion, 61 times the total assets (as of June 30, 2025). This scale increased by 2% compared to the end of Q1 and by 5% compared to the beginning of the year.

Meanwhile, the fund management segment brought in VND 520 billion in revenue, up 40%. Other activities also supported to some extent with a revenue growth of 17%, to more than VND 77 billion.

On the contrary, consulting activities decreased by 18% over the same period, corresponding to only more than VND 370 billion.

Source: Author’s synthesis

|

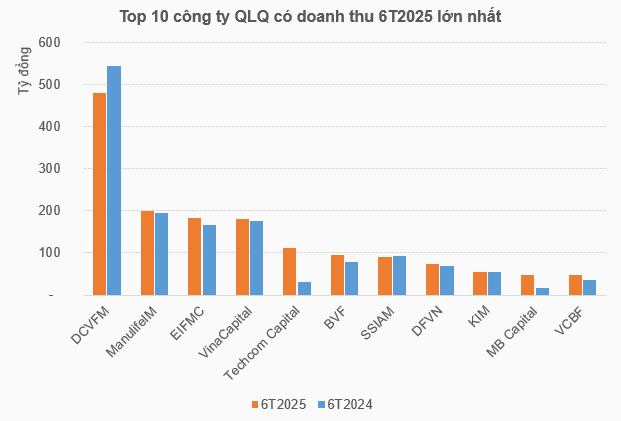

Dragon Capital Vietnam (DCVFM) leads in terms of revenue scale with more than VND 480 billion, despite a 12% decrease over the same period. The next two positions are held by insurance-based companies, including Manulife Investment Vietnam (ManulifeIM) with nearly VND 199 billion, up 2%, and Eastspring Investments (EIFMC) with nearly VND 184 billion, up 10%.

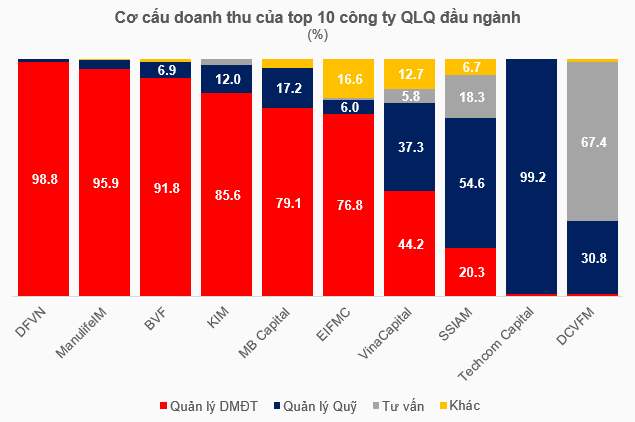

In terms of structure, 21 companies focus on the trust segment, 16 companies focus on fund management, 5 companies depend on consulting, and the different case is FPT Investment (FPT Capital) where other activities contribute more than half of the revenue proportion.

Looking at the top 10 companies in terms of revenue in the first 6 months of 2025, the total scale reached more than VND 1.5 trillion, accounting for 85% of the whole industry, it is clear that there are up to 7 companies whose main source of revenue comes from the trust segment, including 4 insurance-based companies. This clearly reflects the business picture of the industry, where trust activities play an important role. In addition to ManulifeIM and EIFMC, Bao Viet (BVF) and Dai-ichi Life Vietnam (DFVN) also have advantages from the insurance ecosystem. The extremely abundant and stable amount of trust money from insurance units has brought large revenue to these member companies.

Source: Author’s synthesis

|

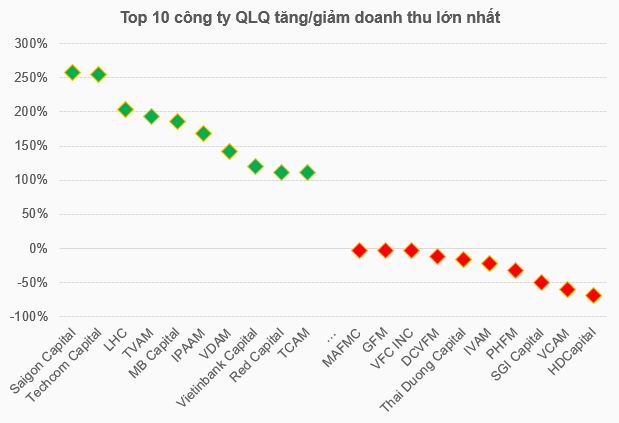

Compared to the same period last year, the industry recorded 30 companies with revenue growth. Saigon Capital Management led with revenue 3.6 times higher than the same period, however, the scale is still quite small, less than VND 5 billion.

Not many companies have a growth rate of several times on a large revenue base. A few that can be mentioned are Techcom Capital with more than VND 111 billion, 3.5 times higher than the same period; Thien Viet (TVAM) with more than VND 34 billion, 2.9 times higher; MB Investment (MB Capital) with nearly VND 48 billion, 2.9 times higher than the same period.

On the contrary, 13 companies saw revenue decline, led by HD Capital Management, down 69%, to more than VND 1 billion, followed by VCAM down 60% to nearly VND 2 billion.

Large-scale revenue companies that fell into the decline list include DCVFM down 12% to more than VND 480 billion, alongside Mirae Asset Vietnam (MAFMC), KIM Vietnam (KIM), SSI (SSIAM), and Vietnam Joint Stock Commercial Bank (PVCB Capital) slightly down.

Source: Author’s synthesis

|

The profit picture has many “dark spots”

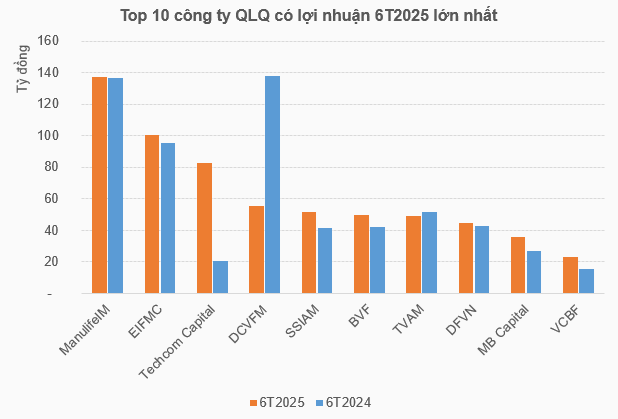

In the context of the industry’s revenue growth, the profit picture is not as bright. After deducting expenses, the industry’s net profit was nearly VND 683 billion, down 3%, corresponding to a decrease in profit margin from 43.3% to 38.4%.

Not counting the 11 companies that made losses and 1 company that turned losses into profits in the first half of 2025, the fund management industry recorded 18 companies with declining profit margins, while only 13 companies increased their profit margins.

In terms of profit scale changes over the same period, 8 companies declined, especially many companies with sharp declines from billions or tens of billions of dong.

Of this, VinaCapital reached VND 317 million in net profit in the first half of the year. The main reasons for this result are the sharp increase in agency and advertising expenses, along with the pressure to reduce profits from the sale of fund certificates.

Another notable name is VietinBank Capital Management, which also decreased by 76%, to nearly VND 807 million, due to the provision for re-evaluation of financial asset portfolios.

Another company that suffered a 60% decrease was DCVFM, with a net profit of more than VND 55 billion in the first half of the year. The business segment that brings in the most revenue is securities investment consulting (67% ratio) with a decrease of 17% to nearly VND 324 billion. Another factor is that financial investment revenue decreased by 90%, to only nearly VND 9 billion, mainly due to the absence of large profits from the redemption of fund certificates as in the same period.

Not stopping there, there are 11 companies that fell into a loss situation, the heaviest was Phu Hung (PHFM) with a net loss of more than VND 7 billion. In this list, 5 companies changed their status from profit in the same period last year to loss this period, including UOB Asset Management Vietnam (UOBAM Vietnam), Vietnam Securities Investment (VCAM), SGI Investment (SGI Capital), Rong Viet (VDAM) and Viet Tin (VTCC).

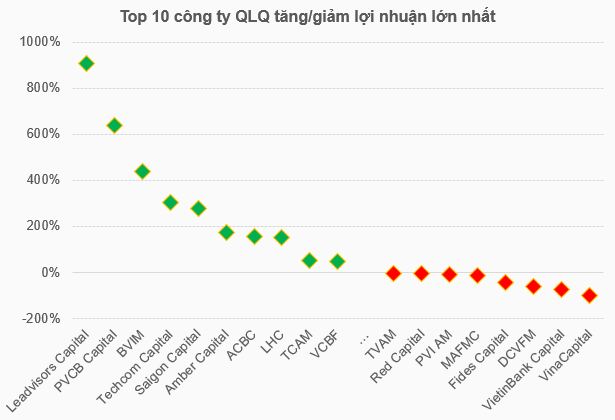

But not all aspects are negative, 23 companies recorded profit growth over the same period last year. Leading the market is Leadvisors Capital with more than VND 1.9 billion in the first half of 2025, 10 times higher than the same period. The growth of trust revenue has contributed to this result.

Many other companies with strong net profit growth can be mentioned as PVCB Capital up 7.4 times, BVIM up 5.4 times, Techcom Capital up 4 times, Saigon Capital up 3.8 times, Amber (Amber Capital) up 2.7 times, ACB (ACBC) up 2.6 times and Lighthouse Investment (LHC) up 2.5 times. A notable case is Vietnamese Intelligence (IVAM), which turned from a loss of nearly VND 600 million in the same period to a profit of nearly VND 1.4 billion in this period.

It is worth noting that the cases of growth by times all have small profit scales, except for Techcom Capital with a net profit of more than VND 82 billion.

The growth of fund management revenue – the segment that accounts for almost the entire revenue structure – is the main driver for Techcom Capital. Financial activities were also much more efficient, with bond yields increasing sharply and at the same time, provision for long-term investment depreciation was reversed.

Source: Author’s synthesis

|

Out of a total of 43 companies in the statistics, the revenue scale continues to increase, and the number of companies with profit growth is also slightly higher than the number of companies with declining and loss-making, but the final result is that the industry’s profit still decreased slightly due to many reasons, it may be due to the decline in financial investment activities, or accepting to increase expenses to expand activities.

Huy Khai

– 09:00 29/08/2025

“Rising from the Ashes: The First National Treasure of ‘Make in Vietnam’ Enterprises”

Introducing our state-of-the-art facility, dedicated to producing impeccable, European-standard goods. With meticulous attention to detail, our team ensures that every product that leaves our facility is of the utmost quality. We pride ourselves on our commitment to excellence, delivering nothing but the best to our valued customers. Experience the difference with our meticulously crafted offerings.

The Mobile World Spends $8.6 Million to Buy Out a Securities Firm’s Bond Issue

As one of the leading retail businesses, The Gioi Di Dong is renowned for its savvy financial dealings and has earned a reputation as a formidable player in the industry.

The Sugarcane Industry Under the Twin Pressures of Oversupply and Smuggled Goods

The Vietnamese sugar industry faced a challenging second quarter in 2025 due to a perfect storm of excess supply and illicit imports. This led to a significant drop in profits and rising inventories for many businesses. However, a handful of enterprises maintained their growth trajectory by strategically managing costs and consumption strategies. With a keen eye on expenses and a focused approach to sales, these resilient companies navigated the turbulent market conditions with relative stability.