“No impact on other shareholders”

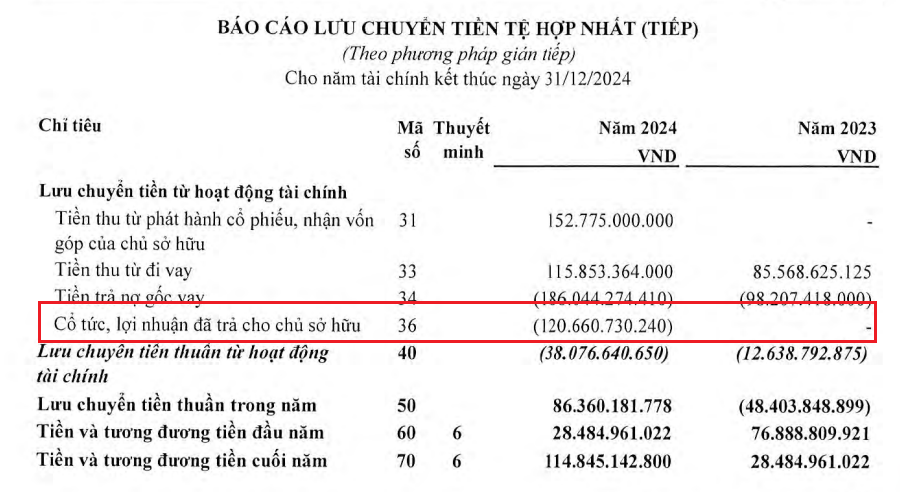

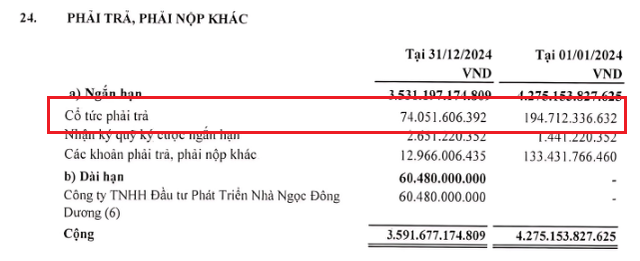

In the cash flow statement, dividend payments of over VND 120 billion were recorded, while the “Dividends payable” item in Note 24 decreased correspondingly, from nearly VND 195 billion to over VND 74 billion. This item originated from the 2017 dividend plan, when QCG approved a ratio of 25% of charter capital, including 15% in cash (VND 413 billion) and 10% in shares.

Addressing shareholders’ concerns, QCG representatives affirmed that this was not a new or unusual payment. “This is the dividend from the 2017-2018 distribution. Many shareholders have received their dividends through the Securities Depository Center (for registered accounts). However, there are still some unregistered shares, and the dividends for these shareholders are paid in cash. The unpaid dividends continue to be reflected in the financial statements until completion,” the company said.

Source: QCG’s 2024 Audited Financial Statements

|

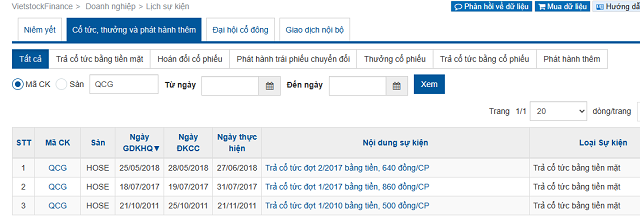

From 2019 to present, QCG has not made any other dividend payments to shareholders. Source: VietstockFinance |

According to QCG, the additional disbursement of VND 120 billion in 2024 was for the cash dividends of shareholders who had not previously registered their securities. After this payment, the remaining dividends payable amount to over VND 74 billion.

“The dividend payment is in full compliance with the resolutions of the General Meeting of Shareholders and the Board of Directors for the 2017-2018 term, and does not affect the rights of other shareholders, especially those who have already received their dividends,” QCG representatives emphasized.

According to our understanding, QCG has made cash dividend payments twice in 2017 and 2018, amounting to nearly VND 119 billion and VND 89 billion, respectively, equivalent to about 50% each time. The remaining amount of over VND 205 billion was “hanging” until 2020, after which it decreased to nearly VND 195 billion and remained unchanged until the end of Q3/2024.

Who will receive the money?

QCG’s 2024 audited financial statements do not specifically mention which shareholders received the recently paid dividends of over VND 120 billion. However, what caught investors’ attention was the large sum of money that had been “hanging” for many years.

In reality, it is difficult to imagine shareholders agreeing to leave a cash dividend with the company for 6-7 years, partly indicating that the suspended amount is likely to belong to shareholders with a special connection to QCG, and may even be an internal group.

At the time of the 2017 dividend entitlement, Mrs. Nguyen Thi Nhu Loan‘s family – the founder of QCG – held 55.1% of the shares. Specifically, Mrs. Loan owned 37.05%, her daughter Nguyen Ngoc Huyen My held 14.3%, her son Nguyen Quoc Cuong held 0.195%, and her sister held 3.5%. With this ratio, Mrs. Loan’s family was entitled to receive cash dividends of over VND 227 billion in the distribution 8 years ago.

Q3/2025: Will there be dividends for 2021?

The long delay in dividend payments is just one part of the long story about shareholder interests at QCG. In fact, the issue of dividends has been discussed several times at the company’s general meetings.

Since its listing in 2010, QCG has only paid cash dividends twice, in 2011 (over VND 60 billion) and in 2017 (VND 413 billion), but as of now, there is still over VND 74 billion unpaid. 2017 was a rare year when QCG made an exceptional net profit of VND 396 billion thanks to the divestment from Sparkle Values Limited Company and Hiep Phu Real Estate Joint Stock Company. Since then, profits have fluctuated at only a few dozen billion VND per year, limiting cash flow and making it difficult to implement dividend payments.

| The exceptional profit in 2017 allowed QCG shareholders to receive cash dividends for the second time since listing. |

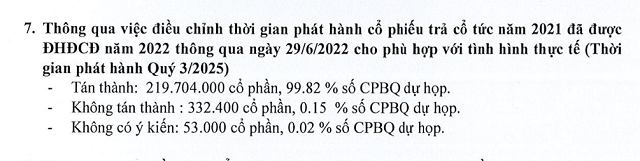

The 10% stock dividend in 2017 was also canceled, and the plan to pay dividends in shares in 2021, which the company had promised to implement in Q3/2025, was not mentioned by the Management Board at this year’s general meeting.

Previously, when asked about dividends, Mrs. Loan explained that due to the nature of the real estate industry, which “does not have quick cash flow,” the temporary suspension of dividends should be “understood.” In 2023, she also affirmed that the company would not distribute dividends to facilitate negotiations with partners.

QCG shareholders are still waiting for the 2021 stock dividend to be paid in Q3/2025. Source: QCG’s 2023 Annual General Meeting Resolution

|

100 billion VND and the founder is released

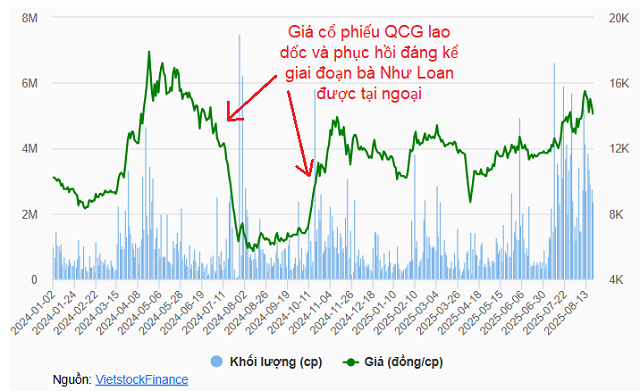

In the market, QCG shares fluctuated significantly during the period when Mrs. Loan was involved in legal issues. In July 2024, she was temporarily detained by the Police Investigation Agency for Corruption, Economy, and Smuggling (C03, Ministry of Public Security) for the offense of “Violation of regulations on the management and use of state assets, causing waste and loss” under Clause 3, Article 219 of the Penal Code.

This move by C03 was made in the process of expanding the investigation of the case “Violation of regulations on the management and use of state assets, causing waste and loss” occurring at the Vietnam Rubber Industry Group, Dong Nai Rubber Company, Ba Ria Rubber Company, and some related units in the project of land lot 39-39B Ben Van Don, District 4 (old) Ho Chi Minh City. As a result, QCG share price plummeted by nearly 70%, falling below VND 6,000/share.

After being released at the end of November, the share price of QCG surged to over VND 14,000/share, and is currently trading around this level, equivalent to a recovery of about 150%.

Notably, in 2024, QCG made a temporary payment of VND 100 billion to the competent authorities related to Mrs. Loan’s case. This amount most likely arose in Q3/2024 when “Accounts Receivable from Third Parties” increased sharply without specific explanations.

At the 2025 Annual General Meeting of Shareholders, Mrs. Loan reappeared. General Director Nguyen Quoc Cuong took the time to recount her contributions, using many beautiful words to describe his mother as a “captain” and a “great founder,” and invited all employees to stand up and express their gratitude before the entire assembly.

Mrs. Nhu Loan returned to the 2025 Annual General Meeting of QCG

|

– 10:13 28/08/2025

Why Are Exchange Rates Constantly Rising?

The State Bank of Vietnam (SBV) announced the reference exchange rate for August 28 at 25,268 VND per USD. Bank USD selling prices remained at the ceiling level of 26,531 VND/USD. The free market saw record highs for USD at 26,720 VND. Since the beginning of 2025, the Vietnamese dong has depreciated by 3.8% against the US dollar in the banking system and 3.4% in the free market.

The Veiled Female Shareholder Splashes Cash on Vietravel Stocks

“In a recent display of confidence in Vietravel, Ms. Thuy Tien has bolstered her stake in the company. She acquired an additional 6 million VTR shares, investing a substantial 144 billion VND during the company’s recent rights issue. This strategic move follows her earlier investment of 168 billion VND in March, where she acquired a significant 20.94% stake, previously held by Hung Thinh Group.”

“MB Capital Pays 12% Dividend, MB to Receive Nearly VND 40 Billion”

MB Capital plans to distribute nearly VND 43 billion in dividends over the period of September-October 2025. The main beneficiary is the Military Bank (MB), which directly owns 90.77% of MB Capital’s capital.