HoSE-listed SSI Securities Corporation (code: SSI) has just released the documents for its upcoming Extraordinary General Meeting (EGM), scheduled for the afternoon of September 25, 2025, at the Reunification Hall, 135 Nam Ky Khoi Nghia, Ben Thanh Ward, Ho Chi Minh City.

The main agenda item for this assembly is to discuss the proposal to offer a maximum of 415.58 million shares to existing shareholders through a rights issue.

Shareholders will be granted subscription rights at a ratio of 5:1, meaning for every five shares held, one new share can be purchased. These newly issued shares will not be subject to transfer restrictions. Shareholders holding restricted shares will still be entitled to receive subscription rights. The offering is planned to be executed in 2025-2026.

The proposed offering price is VND 15,000 per share. If the entire offering is subscribed, SSI expects to raise up to VND 6,234 billion to supplement its capital for investment and margin lending activities. Consequently, SSI’s chartered capital is expected to increase from VND 20,778 billion to VND 24,935 billion.

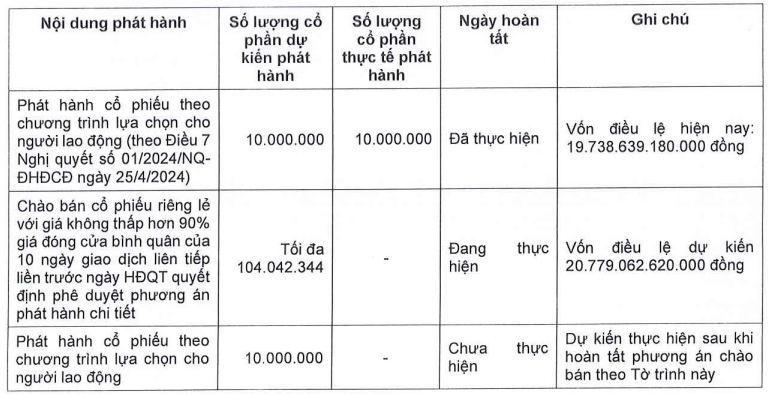

Additionally, SSI’s board of directors will present a report on the progress of the capital increase plan approved at the 2025 Annual General Meeting, as outlined below:

Among the above options, SSI Securities Corporation recently announced its resolution to proceed with the private placement of over 104 million shares to professional securities investors. These shares will be restricted from transfer for one year.

According to the published list, 18 investors participated in SSI’s private placement, including Vietnam Enterprise Investments Limited, a fund member of Dragon Capital, which was offered the highest number of shares at 16.8 million. Following closely is Daiwa Securities Group Inc., a board member of SSI, Mr. Kosuke Mizuno, serving as its senior executive officer, was offered nearly 15.9 million shares.

Additionally, Mr. Nguyen Duc Thong, SSI’s CEO, was offered 1 million shares, while Mr. Nguyen Hong Nam, a board member, was offered 5 million shares.

With a offering price of VND 31,300 per share, SSI expects to raise over VND 3,256.5 billion from this private placement.

The company intends to utilize 50% of the proceeds to supplement capital for investing in certificates of deposit and the remaining 50% for margin lending activities.

The offering is planned for the third and fourth quarters of 2025, pending written approval from the State Securities Commission of Vietnam (SSC).

If successful, SSI’s outstanding shares will increase from over 1.97 billion to nearly 2.08 billion.

The Crypto Asset Exchange: VIX Securities Leads the Way

On August 26th, the Digital Asset Exchange Floor Joint Stock Company, or VIXEX, was established with a charter capital of 1 trillion VND. This marks a significant move by VIX as Vietnam navigates the path towards piloting licenses for digital asset exchanges.

The Largest Shareholder of SSI Securities Wants to Accumulate an Additional 16 Million Shares

Daiwa Securities Group Inc. is seeking to acquire nearly 16 million SSI shares directly from the issuer in a private placement. This move underscores Daiwa’s confidence in the potential of SSI and its commitment to strengthening its presence in the market. With this significant investment, Daiwa positions itself as a key player in SSI’s growth story, signaling a promising future for both companies.

“Taseco Land Seeks Shareholder Approval for Plans to Offer Over 48 Million Private Placement Shares”

Taseco Land seeks shareholder approval to offer 48.15 million private placement shares at VND 31,000 per share, aiming to boost its charter capital to VND 3,600 billion.