Before 7 a.m., a crowd had already gathered outside the Saigon Jewelry Company – SJC (on Nguyen Thi Minh Khai Street, Ho Chi Minh City), awaiting the opening of the store to transact. Many customers shared that they were used to buying gold for monthly savings, but had never witnessed such a crowded scene.

Customers queue to buy gold in front of SJC even before the store opens.

Ms. Dong Ha, a resident of Binh Tien Ward, shared: “I usually set aside a portion of my income to buy 1-2 taels of gold every month. Today, seeing over a hundred people lining up early in the morning made me worry that I wouldn’t get my turn.”

Sharing the same sentiment, Ms. Hien from Saigon Ward stated that despite the high price, she was determined to buy: “I’m buying for long-term savings, so I’m not too concerned about the price.”

Past 8 a.m., customers lined up neatly to transact. The buying and selling counters were packed with people, all eager to own a few taels of gold before the price fluctuated further.

Despite the high price, those with a need for gold remained vibrant.

At Mi Hong Jewelry Store, each customer was only allowed to purchase one tael of gold rings. The store ran out of gold bars. The selling price of plain gold rings here was listed at VND 122.4 million/tael, and the buying price was VND 121 million/tael. However, by 10 a.m., the store had sold out of gold rings.

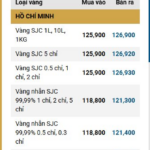

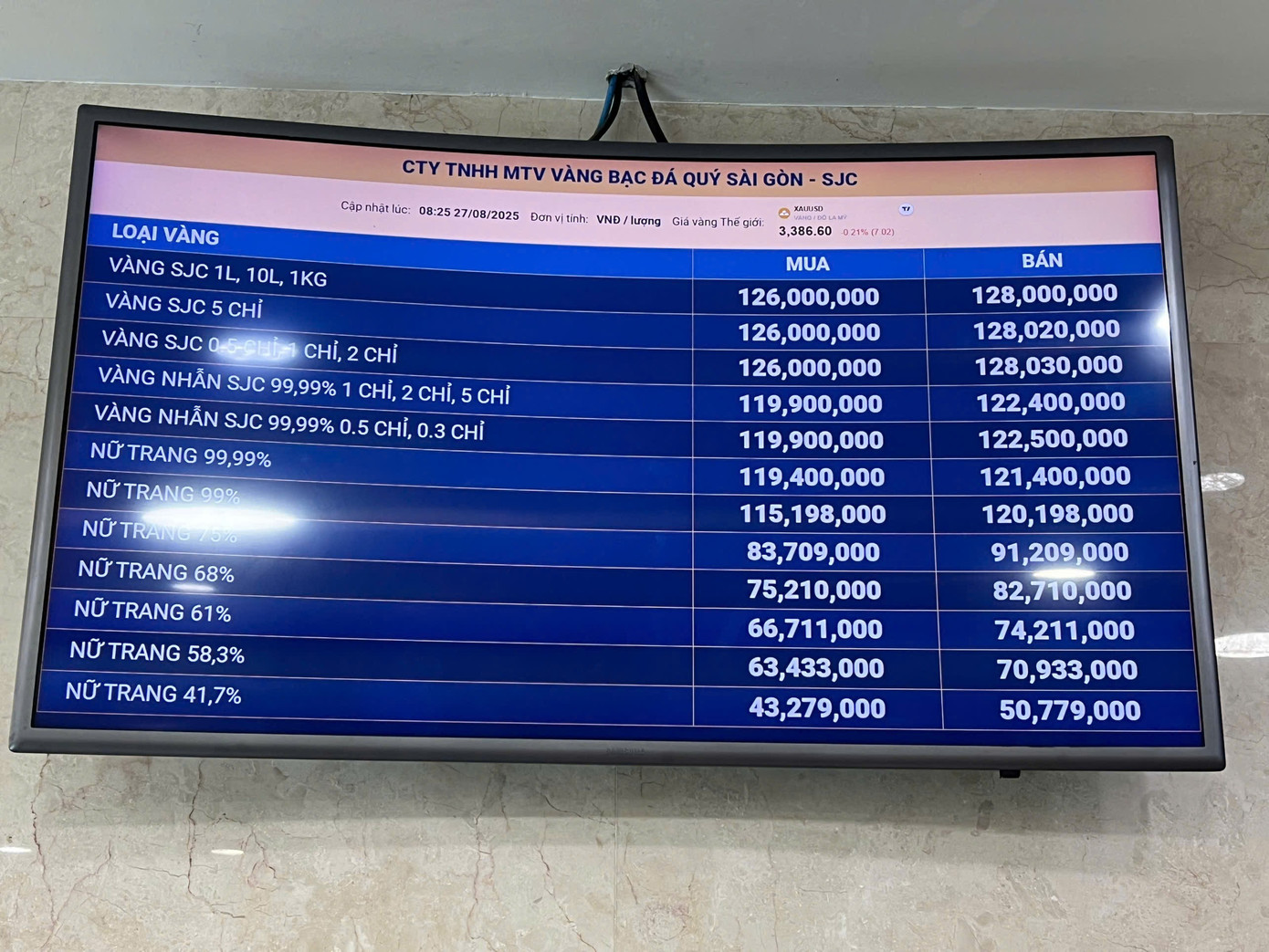

According to the listing on the morning of August 27, the buying price of gold bars at SJC was VND 126 million/tael, and the selling price was VND 128 million/tael, an increase of VND 300,000 compared to the previous day’s close. The price of 4-digit gold rings at SJC also increased by VND 200,000 – 300,000, reaching VND 119.9 – 122.4 million/tael.

SJC’s gold bar price hit a record high at VND 128 million/tael (selling price).

Other enterprises such as PNJ, DOJI, and Phu Quy also adjusted their prices upward, with gold ring prices fluctuating around VND 119.5 – 122.6 million/tael. The spread between buying and selling prices widened to VND 2-3 million/tael, compared to only VND 1 million previously.

Notably, domestic gold prices continued to rise despite the government’s recent issuance of Decree 232/2025, officially abolishing the state monopoly on gold bar production and trading and allowing the import and export of gold materials.

At Mi Hong Jewelry Store, a long line of people could be seen. The store had just opened, but it had already run out of gold bars, and by 10 a.m., it had also sold out of plain gold rings.

At 10:30 a.m., a steady stream of people continued to flock to SJC to buy and sell gold.

According to financial and banking expert Nguyen Tri Hieu, the amendment of Decree 24/2012 is necessary and appropriate in the current context. In the past, the shortage of domestic supply has caused domestic gold prices to exceed international prices by a large margin, sometimes up to VND 20 million/tael.

“To narrow the gap between domestic and international gold prices, we need to ensure a stable and abundant supply. When the domestic market is interconnected with the world, fluctuations will be less extreme, and people will be less affected,” said Mr. Hieu.

The Golden Opportunity: Unveiling the Latest Proposition on Gold Bullion

“We propose the integration of QR code technology into the packaging and sealing of gold bars. This innovative approach will revolutionize the management and tracking of these valuable assets, offering unparalleled convenience and security. With a simple scan, authorized personnel will have instant access to crucial information, enhancing efficiency and transparency in the industry.”

The Underground Gold Rush: How Small Jewelry Shops are Driving Record-High Gold Prices with Quiet SJC Gold Bar Trades

“According to regulations, businesses trading in artistic gold jewelry are not permitted to buy and sell SJC gold bars. This restriction is in place to maintain a clear distinction between the artistic gold jewelry market and the SJC gold bar market, ensuring that each operates within its own distinct parameters.”