In the latest announcement, Vietnam Asset Management Group, JSC (code: TVC) registered to increase its ownership ratio in its subsidiary T-Cap Securities JSC (code: TVB).

Accordingly, TVC registered to buy an additional 1.5 million TVB shares from August 29 to September 26 by matched orders and/or put-through transactions.

If the transaction is successful, TVC will raise its total holding of TVB shares to nearly 79 million units, equivalent to 70.15% of TVB’s charter capital.

The move to continuously increase ownership in TVB by Vietnam Asset Management Group has been ongoing recently. Most recently, from July 24 to August 22, TVC bought nearly 462,000 shares by put-through transactions, lower than the registered plan of 750,000 shares due to unfavorable market conditions. Meanwhile, since the beginning of the year, the parent company TVC has accumulated an additional 7.9 million TVB shares, increasing its ownership from 64% to over 70% as of now.

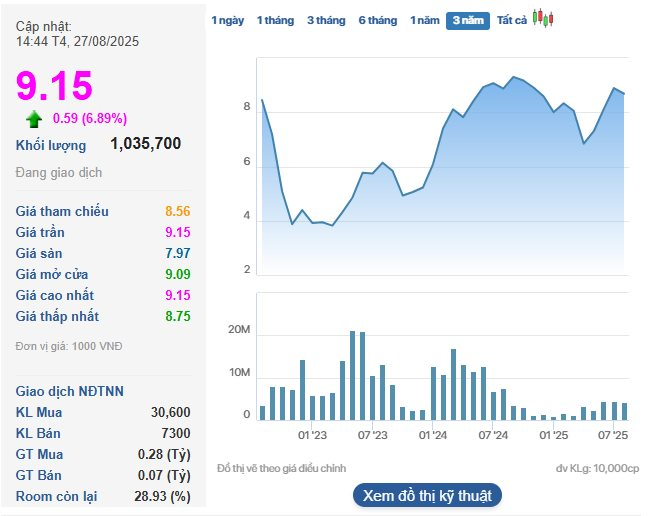

On the stock exchange, both TVC and TVB stocks surged to the maximum daily limit on August 27, thereby reaching price levels of VND 10,700/share and VND 9,150/share, respectively. These are also the highest price ranges since the beginning of the year.

Referring to TVB’s closing market price on August 27, which was VND 9,150/share, it is estimated that TVC will need to spend approximately VND 13.7 billion for this deal.

TVC shares closed at the maximum daily limit on August 27

TVB shares closed at the maximum daily limit on August 27

T-Cap Securities, formerly known as Tri Viet Securities JSC, has recently changed its name according to the resolution of the 2025 Annual General Meeting of Shareholders held on June 7, 2025.

Regarding the business results in the first half of 2025, TVB recorded revenue of VND 45 billion, only one-third of the same period last year. Despite a 15% reduction in expenses to VND 40 billion, post-tax profit still plummeted by 92%, reaching VND 6.2 billion.

Notably, both TVC and TVB stocks were once related to the market manipulation case involving former Chairman Pham Thanh Tung.

Previously, on May 12, 2023, Mr. Pham Thanh Tung, former Chairman and legal representative of Vietnam Asset Management Group JSC and T-Cap Securities JSC, was sentenced by the Hanoi People’s Court to three years of imprisonment but allowed to serve the sentence on probation with a five-year probation period for the same crime of “Manipulating the securities market”.

According to the indictment, in April 2023, the Hanoi Police Investigation Agency received a crime report from the State Securities Commission of Vietnam regarding a case with signs of securities market manipulation involving TVB shares of Tri Viet Securities JSC and TVC shares of Vietnam Asset Management Group JSC.

The investigation determined that: During the period from January 2, 2020, to October 19, 2020, Pham Thanh Tung directed Nguyen Manh Thin and Do Thi Hong Hanh, his accomplices, to manipulate the securities market by using 109 internal group accounts of Tri Viet belonging to 58 account holders to cross-trade TVB and TVC shares, creating fake supply and demand, causing damage/losses amounting to over VND 3.3 billion to 31 investors.

The Hanoi People’s Court opened a first-instance trial of the case related to the defendant Pham Thanh Tung and his two accomplices in August of last year.

After considering the case file and the defendants’ confessions in court, the Trial Panel decided not to impose a prison sentence on the defendants Pham Thanh Tung, Do Thi Hong Hanh, and Nguyen Manh Thin. Instead, Mr. Pham Thanh Tung was fined VND 2 billion, and Ms. Do Thi Hong Hanh and Mr. Nguyen Manh Thin were each fined VND 500 million.

The Art of Market Manipulation: A Legislative Guide to Curbing Illicit Stock Market Practices

Under the new law passed by the National Assembly, detailed provisions have been made regarding acts that are considered to be market manipulation in the securities sector.