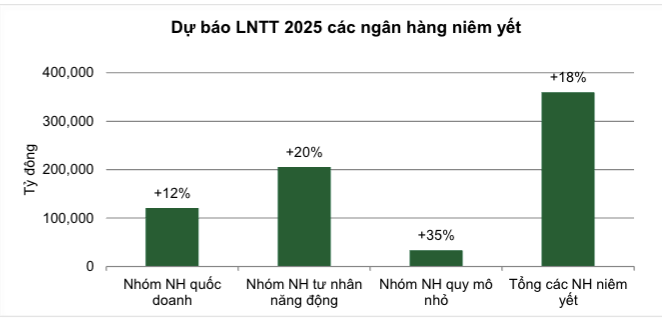

In VCBS’s recently published Outlook Report for the last months of 2025, Vietcombank Securities JSC (VCBS) forecasts an 18% growth in pre-tax profits for the entire banking sector in 2025.

This includes a 35% increase in profits for small-scale banks, attributed to high credit growth rates and aggressive bad debt handling.

Dynamic private banks are expected to witness a 20% growth, benefiting from policies encouraging private economic sectors and improved asset quality. This group also saw notable developments, including IPOs, restructurings, and debt recoveries.

Despite slower credit growth, state-owned banks are projected to break through with a 12% profit growth forecast, having already addressed bad debts.

(Source: VCBS)

VietinBank: VCBS anticipates VietinBank’s credit growth to match the industry average of 16.9% in 2025, with NIM improvements in the second half driven by both deposit and lending factors. Additionally, asset quality is well-managed, and some restructured clients will be moved to lower debt groups, resulting in provisioning write-backs in Q2.

Based on these assessments, VCBS projects VietinBank’s pre-tax profit to reach VND 36,966 billion, a 26% increase.

BIDV: Analysts forecast a 16% credit growth rate for BIDV in 2025, with a slight NIM decrease to 2.3%. The bank boasts the industry’s best asset quality and low provisioning pressure. Operating income is projected to increase by 17% (reaching VND 94,453 billion), and pre-tax profits are expected to rise by 14% (reaching VND 35,698 billion) compared to 2024.

BIDV plans to increase its charter capital by VND 21,656 billion to nearly VND 91,870 billion by utilizing the supplementary capital reserve fund (7.1%), paying dividends at a rate of 19.9%, and conducting a private placement at a rate of 3.84%.

Military Bank (MB): VCBS projects MB to be among the top performers in credit growth, estimating a 28% expansion in 2025, driven by both wholesale and retail lending. NIM is expected to recover in the second half due to an increase in CASA ratio (currently the highest in the industry) and a growing proportion of retail lending. Improved asset quality and robust fee income are also anticipated.

VCBS estimates operating income (TOI) to reach VND 70,448 billion, with pre-tax profits forecasted at VND 35,496 billion, representing increases of 27% and 23%, respectively.

Techcombank: VCBS recognizes Techcombank’s strong credit growth, supported by a recovering real estate and construction market. The bank’s high CASA ratio continues to offer a competitive advantage in terms of funding costs, mitigating NIM compression pressures. Diversified non-interest income contributes to profit growth.

In 2025, Techcombank’s operating income is estimated to reach VND 55,251 billion, an 18% increase year-over-year, with pre-tax profits expected to reach VND 33,123 billion, a 20% increase.

VCBS also notes that the anticipated IPO of TCBS, a subsidiary, will enhance Techcombank’s capital position, allowing for a revaluation of its investment and strengthening its presence in the financial market.

ACB: ACB’s credit growth remains positive in 2025, driven by a noticeable recovery in individual customers and sustained growth in corporate lending due to expected economic improvements. High profitability is maintained through effective cost management and asset quality. NIM is projected to recover slightly from the second half of 2025 due to improved funding costs and a slower decline in lending rates.

VCBS estimates ACB’s operating income to reach VND 35,805 billion in 2025, a 7% increase, with profits expected to reach VND 22,940 billion, a 9% increase for the year.

MSB: VCBS anticipates MSB’s credit demand to remain robust, with a projected credit growth rate of 21.2% for 2025. NIM is expected to improve starting in the second half of 2025. Asset quality is expected to enhance further, with the non-performing loan ratio declining to 2% due to robust credit growth and increased debt recovery.

MSB is working to perfect its ecosystem, with plans to divest, contribute capital to subsidiaries, and transfer a portion or all of its capital contribution in TNEX Finance. It also intends to invest in a securities company and a fund management company.

VCBS projects MSB’s operating income (TOI) to reach VND 16,337 billion, with pre-tax profits estimated at VND 8,198 billion, representing increases of 15% and 19%, respectively, compared to the end of 2024.

VIB: VCBS expects VIB to continue its positive credit growth trajectory in 2025, driven by the recovery of most business segments, particularly the home lending sector. A slight improvement in NIM is anticipated from the second half of 2025. Additionally, income from bad debt handling will contribute to non-interest income growth.

Based on these assumptions, VCBS forecasts VIB’s operating income to reach VND 16,361 billion in 2025, with pre-tax profits of VND 10,726 billion, reflecting a 19% increase compared to 2024.

The Vietnamese Stock Market: On the Verge of a Golden Growth Cycle

The VN-Index is surging towards the 1,700-point mark, accompanied by record-high market liquidity, with many sessions reaching 70,000 to 80,000 billion VND. This remarkable performance reflects investors’ strong confidence and the allure of the stock market, especially in the context of low-interest rates and tightened speculative real estate investments.

“Eximbank Maintains B+ Rating with Stable Outlook from S&P Global Ratings”

The renowned international credit rating agency, S&P Global Ratings (S&P), has assigned a ‘B+’ long-term issuer credit rating with a stable outlook to the Vietnam Export Import Commercial Joint Stock Bank (Eximbank). This endorsement underscores Eximbank’s strengthened financial foundation, clear business strategy, and notable enhancements in asset quality, even amidst a volatile macroeconomic landscape.

HDBank: Among the Top 50 Listed Companies of 2025

As of August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies for 2025, featuring leading enterprises across vital sectors. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”