Money Laundering: Uncovering a Complex Web of Illicit Financial Activity

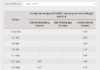

A recent report from the Payment Department of the State Bank of Vietnam reveals a concerning issue: out of over 200 million bank accounts, only approximately 113 million personal accounts and 711,000 organizational accounts have been biometrically verified as of June.

These verified accounts have undergone a stringent process, cross-referencing biometric data with the national population database. However, the remaining unverified accounts may pose a significant risk, potentially serving as “ghost” or dormant accounts, or even being utilized for fraudulent activities.

Ghost accounts are often used for money laundering and fraud.

The creation, sale, or rental of these “ghost” accounts is not only illegal but also carries serious risks for both the sellers and society at large. It facilitates money laundering and sophisticated cyber fraud. Account holders may even face criminal prosecution if their accounts are implicated in criminal activities.

A recent case in Da Nang illustrates this point: law enforcement authorities uncovered a syndicate involving bank employees and external parties who colluded to open accounts illegally, facilitating transactions totaling VND 30,000 billion. This involved the issuance of thousands of corporate and personal accounts, with some suspects even using forged documents to open accounts without physically visiting the bank.

In another instance, authorities in the former Thai Binh province encountered a syndicate employing AI technology to bypass biometric security measures. They facilitated money laundering for an online gambling website, amounting to over VND 1,000 billion. The group hired individuals to open bank accounts in Vietnam, enabling gamblers to deposit funds. Subsequently, foreign accomplices used computers and phones with internet banking apps to transfer funds across multiple accounts, obscuring the money trail.

To address transactions of VND 10 million and above, which require biometric verification, the syndicate created AI clips of account holders’ faces to deceive the bank’s security systems, eliminating the need for physical presence during transactions.

Strategies to Combat Money Laundering

Mr. Nguyen Quoc Hung, Secretary-General of the Vietnam Banks Association, acknowledged the stringent account opening procedures implemented by banks for individuals and enterprises. These procedures utilize electronic Know Your Customer (eKYC) technologies, incorporating AI and biometrics.

However, with the evolution of technology, money launderers have also adapted, employing increasingly sophisticated methods. While eKYC is a robust measure, it is not infallible, and determined criminals may find ways to circumvent it. Mr. Hung emphasized that while banks have anti-money laundering protocols in place, individual employees who deliberately flout these rules to aid criminals are responsible for their actions. No bank condones or encourages the creation of ghost accounts.

Mr. Pham Anh Tuan, Director of the Payment Department, emphasized the risks associated with unverified accounts. These accounts, lacking biometric verification, could be dormant, fraudulent, or even linked to illegal activities. The banking sector is committed to eradicating such accounts to enhance the security and transparency of digital transactions. A planned initiative for September involves the closure of all accounts lacking biometric verification, representing a significant step towards mitigating financial risks and safeguarding legitimate users.

“Da Nang Expands Money Laundering Investigation: Uncovering the Role of Bank Employees in the 30,000 Billion VND Scheme”

In the latest development of the money laundering and counterfeit document scheme, the Da Nang Police have made significant progress by initiating legal proceedings against 20 suspects, including three bank employees, as part of Phase 2 of the operation. The accused bank staff are alleged to have colluded with fake businesses to open accounts, facilitating a massive VND 30,000 billion fraud and money laundering operation.

Opening a Bank Account Online in 5 Minutes: A Step-by-Step Guide

Opening an online bank account has never been easier. With just a few simple steps, you can set up your very own digital banking profile and enjoy the convenience and security of managing your finances from the comfort of your home. It’s a seamless and straightforward process that puts the power of banking at your fingertips.

“Life Imprisonment Sought for Former Chairman of Company Linked to the Hiệp Bình Chánh Residential Area”

Over 200 billion VND was embezzled through mortgage and transfer contracts of overlapping land plots in the Hiep Binh Chanh Residential Area. This sophisticated scam has left a trail of destruction, with victims suffering financial loss and a sense of betrayal. The intricate web of fraudulent activity has shaken the very foundation of trust in the real estate industry, demanding immediate attention and justice.