At the 2025 Personal Financial Planning Forum, organized by the Vietnam Financial Advisory Association (VFCA) and Van Lang University (VLU), Mr. Ngo Thanh Huan, Executive Director of FIDT Investment and Asset Management Consulting Joint Stock Company, pointed out the significant challenges facing the financial advisory industry in Vietnam.

Mr. Huan, a former licensed financial advisor in Australia, shared that upon his return to Vietnam in 2013, he noticed a severe lack of awareness and respect for the profession. “It wasn’t until the incidents involving life insurance and corporate bonds in 2022 that the market realized the importance of professional financial advisors,” he said.

According to Mr. Huan, in developed countries like Australia, financial advisory is tightly regulated with a comprehensive licensing and training system. The Australian Securities and Investments Commission (ASIC) oversees personal financial advisory activities, ensuring advisors meet professional standards. Meanwhile, the Australian Prudential Regulation Authority (APRA) supervises financial institutions such as banks and insurance companies. “Financial advisors should not just sell products but focus on helping clients achieve their long-term financial goals,” emphasized the FIDT expert.

In contrast, in Vietnam, many insurance agents and bank employees are pushed into providing advice beyond their expertise, especially regarding investment-linked insurance products. Mr. Huan asks, “When bank employees themselves do not trust insurance products, how can they advise their customers?”

A Vision for Vietnam’s Financial Advisory Industry

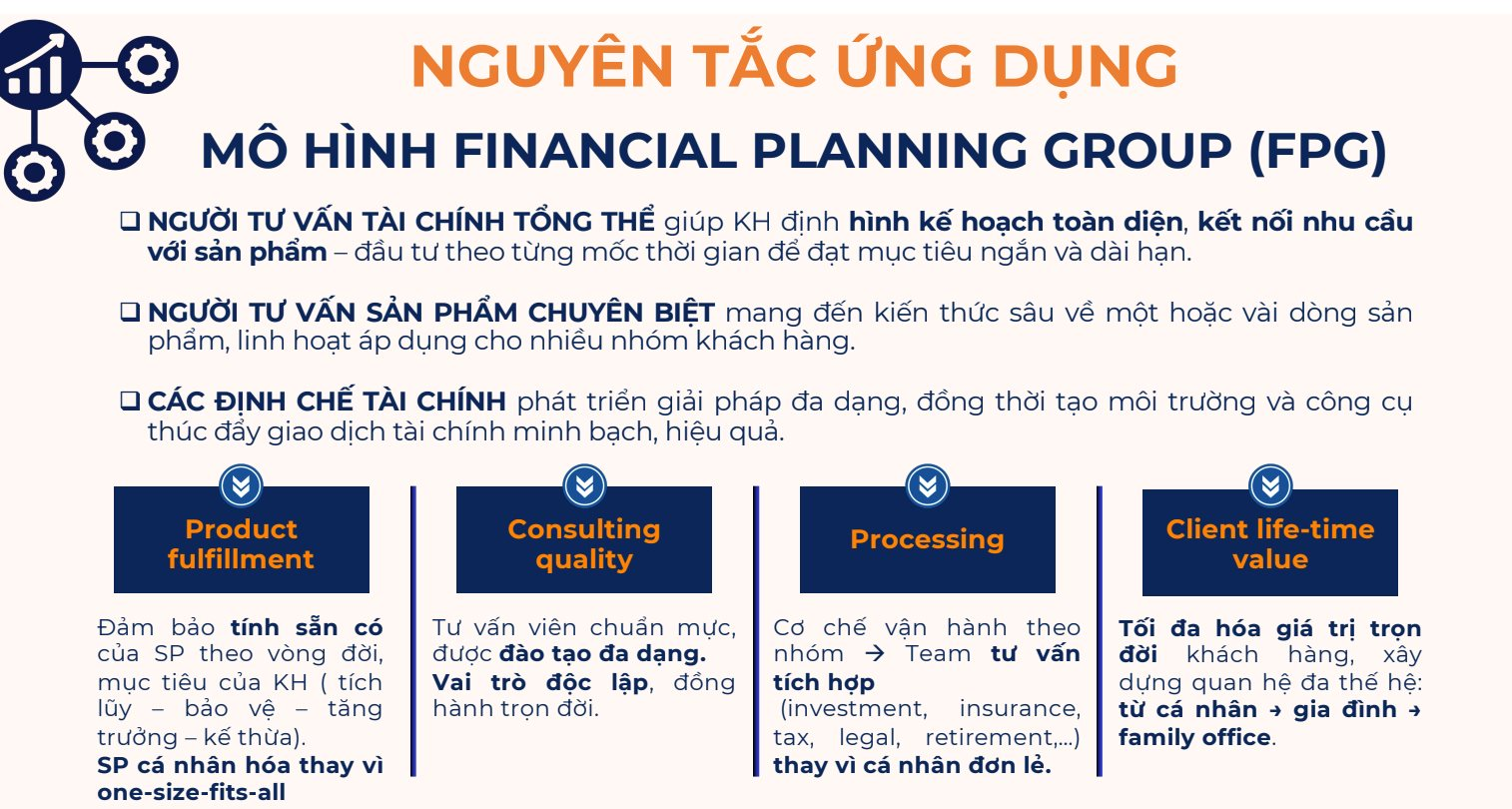

Mr. Huan stated that the demand for financial advisory services in Vietnam is surging, especially among the middle class and intellectual middle class. However, 51% of surveyed individuals make financial decisions based on emotions, while 48% admit to lacking the necessary knowledge. This leads to issues such as customers not thoroughly reading complex insurance contracts, resulting in disputes when problems arise. “32% of customers want a comprehensive financial plan instead of purchasing individual products. This indicates a growing demand for holistic advisory services and trust in financial advisors,” Mr. Huan analyzed.

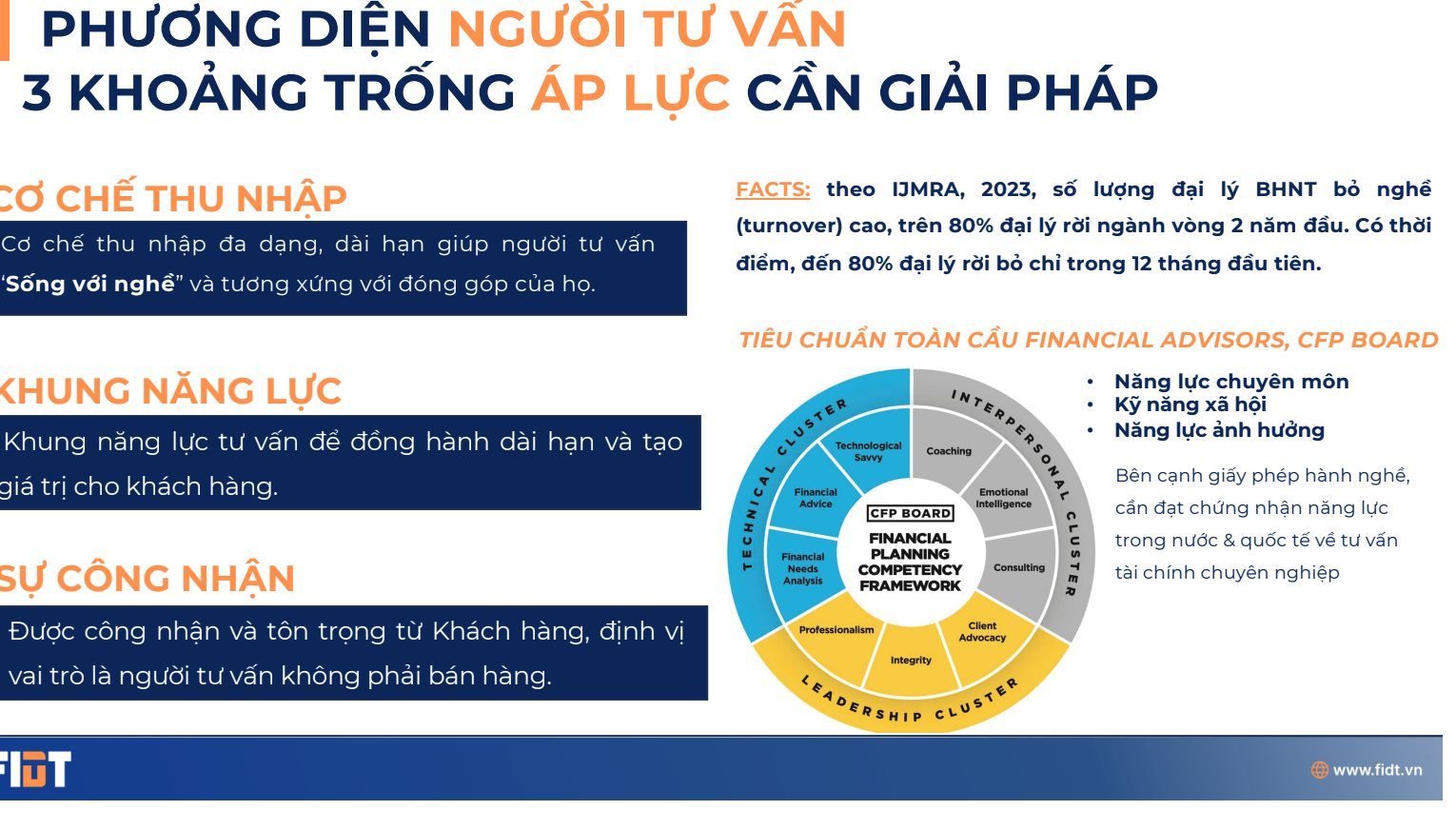

Nevertheless, Vietnam’s financial advisory industry still faces considerable challenges. A significant issue is that financial advisors’ income primarily relies on commissions from product sales rather than independent advisory fees. “When income is tied to product sales, can advisors truly put their clients’ interests first?” Mr. Huan questioned. Additionally, Vietnamese customers are not accustomed to paying for advisory services, partly due to the deep-rooted culture of self-reliance.

- Establishing a Professional Legal Framework: Creating a clear legal framework to standardize and professionalize the financial advisor workforce, similar to developed markets.

- Enhancing Financial Literacy: Promoting financial education to enable customers to make informed decisions and build trust in financial advisors.

- Differentiating Product Advisory and Financial Advisory: Clarifying the distinction between these two concepts to help customers understand the advisor’s role better and instill professional pride in advisors.

- Developing Connecting Technologies: Building technology platforms to enhance transparency, optimize customer experience, and foster long-lasting relationships between advisors and clients.

Mr. Huan emphasized that for the financial advisory profession to thrive sustainably, society needs to cultivate a culture of respecting intellectual labor and paying for advisory services. The life insurance industry, known for its superior customer care skills, can serve as a model in this regard. However, the reliance on product commissions remains a significant barrier. “Where the motivation lies, there the will aligns,” concluded the FIDT expert, suggesting that a diverse and sustainable income mechanism would enable financial advisors to devote themselves wholeheartedly to serving their clients’ best interests.

The Crypto Asset Giant: VIX Securities Forges Ahead

The investment in VIXEX marks a significant step for the VIX group, as it ventures into the newly legalized digital asset space in Vietnam. This move underscores the group’s forward-thinking approach and its recognition of the immense potential within this burgeoning industry.

“Surpassing Heat, Conquering Rain, Unfazed by Storms: Vingroup’s Resilience in Building One of the World’s Top 10 Largest Exhibition Centers”

This morning, the capital city of Hanoi witnessed a grand opening ceremony of the Exhibition of National Achievements titled “80 Years of Independence, Freedom and Happiness” to commemorate the 80th anniversary of the August Revolution (August 19, 1945 – August 19, 2025) and National Day (September 2).

The Evolution of Vietnam’s Economy: 80 Years of Resilience and Transformation

Over the past eight decades, Vietnam has risen from the ashes of war to achieve remarkable economic progress.