|

A notable highlight is the nearly 34% year-over-year surge in listed companies’ net profits for Q2 2025. Non-financial enterprises witnessed a remarkable surge, especially banks, which recorded combined profits exceeding VND 71,400 billion. Positive business results were observed across real estate, securities, banking, and port industries, catalyzing stock price hikes.

Despite potential profit-taking pressures that may cause market fluctuations in late August and early September, experts remain optimistic about the long-term outlook. Anticipated catalysts include the expected FTSE market upgrade in late September, a 20% public investment growth policy, projected 16% credit growth, and the possibility of Fed rate cuts.

Mirae Asset Securities identifies key sectors for investors’ focus in the new cycle: Securities, benefiting directly from enhanced liquidity and the expected upgrade; Banking; Construction & Building Materials; Ports & Logistics; and Retail.

Alongside the market’s positive momentum, the MASCham 2025 investment competition has captivated investors’ interest. With thousands of participants, the contest offers a platform for traders to experiment with strategies and showcases their spirit of seizing opportunities. Contestants also stand a chance to win an iPhone 16 Promax and numerous other attractive prizes.

The registration for the competition is open until September 5, 2025. Interested investors can learn more and sign up at: https://mascham.masvn.com

Services

– 12:30 28/08/2025

The Stock Market Embraces a New Growth Cycle

The Vietnamese stock market is at a pivotal crossroads, where macro policy drivers, upgrade expectations, and international capital converge to shape a new era of quantitative and qualitative growth. While short-term challenges persist, the long-term outlook is clearer than ever, promising a transformative phase in the country’s economic landscape.

“Eximbank Maintains B+ Rating with Stable Outlook from S&P Global Ratings”

The renowned international credit rating agency, S&P Global Ratings (S&P), has assigned a ‘B+’ long-term issuer credit rating with a stable outlook to the Vietnam Export Import Commercial Joint Stock Bank (Eximbank). This endorsement underscores Eximbank’s strengthened financial foundation, clear business strategy, and notable enhancements in asset quality, even amidst a volatile macroeconomic landscape.

HDBank: Among the Top 50 Listed Companies of 2025

As of August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies for 2025, featuring leading enterprises across vital sectors. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.

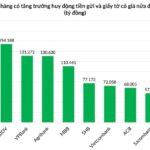

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

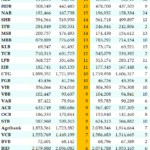

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”