Red Capital Investment Fund Management Joint Stock Company (Red Capital) has announced the sale of its entire holding of 18 million shares, equivalent to 14.4% of the charter capital of Vietnam Seafood Corporation (Seaprodex, ticker symbol: SEA). The transaction took place between August 14 and August 22, 2025, through a matched bargain deal.

It is known that Ms. Do Thi Phuong Lan is a member of the Board of Directors and General Director of Red Capital, as well as a member of the Board of Directors of Seaprodex.

Red Capital acquired 18 million SEA shares on August 6, 2024. At that time, SEA shares closed at VND 28,710 per share.

As of the closing price on August 22, 2025, SEA shares stood at VND 40,000 per share. Assuming this was the transaction price, Red Capital is estimated to have pocketed VND 720 billion and gained over VND 200 billion in profit after holding the shares for a year.

On the same day, August 22, SSG Group became a new major shareholder of Seaprodex after purchasing more than 14.9 million shares, equivalent to 11.92% of SEA’s charter capital. The group is estimated to have spent VND 596 billion on this acquisition.

SSG Group, established on October 24, 2003, is a diversified conglomerate with approximately 24 subsidiary companies spanning various industries, including real estate investment, education, and renewable energy. Real estate investment is the group’s core business, with prominent projects such as Saigon Pearl, Thao Dien Pearl, Pearl Plaza, Saigon Airport Plaza, My Dinh Pearl, and Thanh Da Pearl.

As of June 30, 2025, Seaprodex had two other major shareholders: State Capital Investment Corporation (SCIC), holding 63.38% of the charter capital, and Gelex Group Joint Stock Company (GEX on HoSE), holding 9.52%.

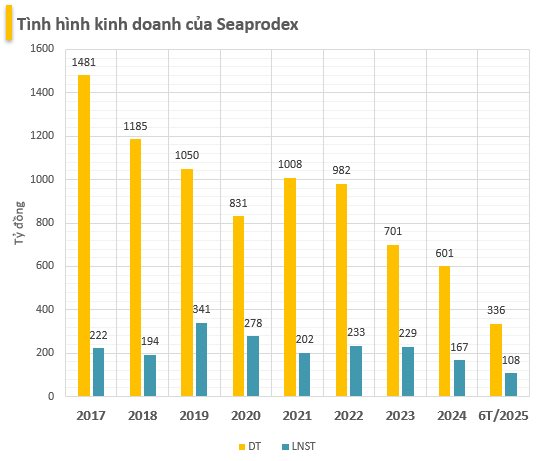

In terms of business performance, in the second quarter of 2025, Seaprodex recorded revenue of VND 195.6 billion, up 5% year-on-year, and a net profit of VND 62.6 billion, unchanged from the previous year. While gross profit increased, net profit remained flat due to cost pressures.

For the first half of 2025, Seaprodex reported revenue of VND 336 billion, an increase of 8% year-on-year, and a net profit of VND 108 billion, up 6% compared to the same period last year.

For the full year 2025, Seaprodex set a target of VND 155.58 billion in total revenue, up 8.4% year-on-year, and a pre-tax profit of VND 77 billion, representing a 1.2% increase compared to 2024. The company plans to pay dividends at a rate of 5%.

With a pre-tax profit of VND 112.3 billion in the first half of 2025, Seaprodex has already surpassed its full-year target, achieving 145.8% of its 2025 plan.

Why Did NEM Leave UPCoM Just 3 Years After Joining?

The Hanoi Stock Exchange (HNX) has announced the delisting of over 8.8 million shares of Northern Electric Equipment JSC (UPCoM: NEM) effective September 18, with the last trading date on the UPCoM system being September 17.

The Trade War’s Silver Lining: Opportunities for Vietnam Amid US-India Tensions

The unexpected 25% tariff imposed by the US on imports from India has sent shockwaves through the country’s prominent export sectors, including textiles, footwear, and jewelry, during what is usually their peak season. This move not only rattled India’s major production hubs but also presents a unique mix of opportunities and challenges for Vietnamese businesses vying for a larger share of the US market.