According to data from VietstockFinance, 1,017 companies listed on HOSE, HNX, and UPCoM exchanges achieved a combined revenue of nearly VND 1.1 quadrillion, a 6% increase compared to the same period last year. The net profit reached nearly VND 83,388 billion, a significant 27% surge. Notably, 872 companies reported profits, far exceeding the 145 companies that incurred losses.

Among the profitable companies, 469 businesses experienced growth, 309 witnessed a decline in profits, and 83 turned their fortunes around by transitioning from losses to profits. Nine companies maintained their performance from the previous year, while two newly listed companies in 2024, Coal Deo Nai – Coc Sau – TKV Joint Stock Company (HNX: TD6) (May 2024) and Railway Transport Joint Stock Company (UPCoM: TRV) (March 2025), did not have comparable data.

On the flip side, the group of 145 loss-making enterprises consisted of one company that maintained its loss from the previous period, 56 companies that reduced their losses, 38 that experienced heavier losses, and 50 that shifted from profits to losses.

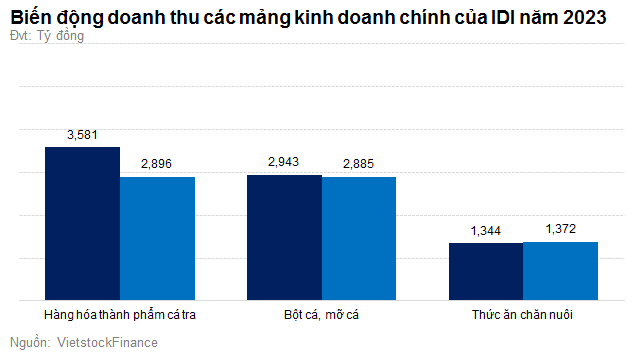

18 companies boasted impressive net profits of over a thousand billion VND in Q2

Source: VietstockFinance

|

Leading the pack in terms of net profit for Q2 2025 was Vinhomes Joint Stock Company (HOSE: VHM), with over VND 7,500 billion. This figure represented a decrease compared to the previous year’s performance due to a 33% drop in revenue, which stood at VND 19,022 billion.

Ranking second was the flagship enterprise in the gas industry, Vietnam National Gas Corporation (PV Gas, HOSE: GAS), with a profit of more than VND 4,700 billion, marking a 43% increase. This impressive performance was mainly attributed to the reversal of VND 1,814 billion in provisions for doubtful accounts.

Additionally, the ranking of profitable companies with net profits in the thousands of billions continued to include prominent names in the steel, aviation, food, and beverage industries, such as Hoa Phat (HOSE: HPG), Vietnam Airlines (HOSE: HVN), Vinamilk (HOSE: VNM), and Masan (HOSE: MSN).

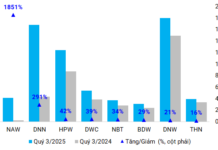

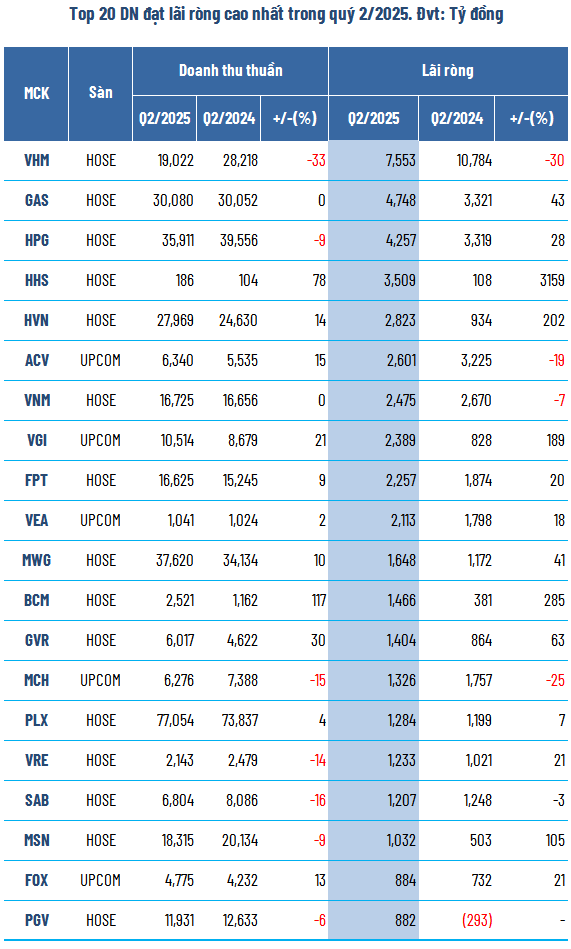

Phenomenal Growth in Profitability

Source: VietstockFinance

|

The record for the highest growth rate in net profit for Q2 2025 went to Petrolimex Petrochemical Corporation (HNX: PLC). With a net profit of just under VND 1 billion in Q2 2024, the company achieved an impressive turnaround, reaching over VND 35 billion in the same quarter this year, representing a nearly 36-fold increase. This remarkable improvement was driven by increased sales volume, which boosted revenue. However, it is important to note that the Q2 2024 profit was the lowest in the company’s history, excluding the loss incurred in Q4 2008.

Following the consolidation of financial statements with HHS Capital Joint Stock Company and CRV Real Estate Group Joint Stock Company, Hoang Huy Investment Services Joint Stock Company (HOSE: HHS) expanded its profit margins. The company’s net profit soared by 32.5 times, skyrocketing from a few hundred billion to over VND 3,500 billion. This remarkable achievement propelled Hoang Huy Investment Services Joint Stock Company into the exclusive “thousand billion club,” surpassing numerous industry giants in the stock market.

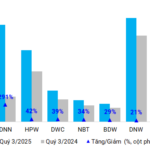

The Fantastic Four: Turning Losses into Profits and Joining the Billion-Dollar Profit Club

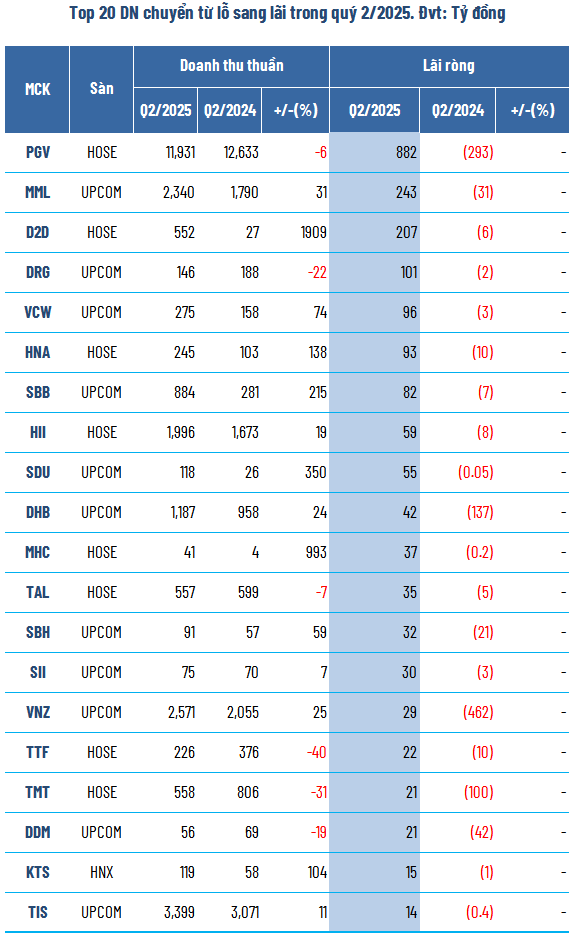

In Q2 2025, four enterprises successfully transformed their fortunes, transitioning from losses to impressive profits of over a hundred billion VND each. Each of these companies has a unique story to tell.

Source: VietstockFinance

|

Despite a 6% decline in revenue from its core business, which stood at VND 11,931 billion due to a decrease in electricity sales, Power Generation Corporation 3 (HOSE: PGV) managed to reduce its cost of goods sold at a faster rate. Additionally, a reduction in interest expenses and a significant contribution of VND 169 billion (nearly four times the previous year) from associated companies resulted in a remarkable turnaround for PGV, with a net profit of VND 882 billion, compared to a loss of VND 293 billion in Q2 2024.

Dak Lak Rubber Joint Stock Company (UPCoM: DRG) experienced a 22% decline in revenue, which amounted to VND 146 billion. However, the company surprised the market by turning a loss into a profit, primarily due to a gain of VND 87 billion from the divestment of its subsidiary, while no such gain was recorded in the previous year. Moreover, other financial expenses decreased significantly from over VND 39 billion to just VND 178 million.

Masan MeatLife Joint Stock Company (UPCoM: MML) made a remarkable recovery, propelled by strong growth in its core business segments. The company witnessed a remarkable increase of VND 550 billion in revenue compared to the same period last year, with impressive performance across its chilled meat, processed meat, and farm segments. This outstanding performance resulted in a net profit of VND 243 billion for MML.

Lastly, Industrial Urban Development No. 2 Joint Stock Company (HOSE: D2D) garnered attention by achieving a net profit of VND 207 billion in Q2, the highest since its listing in 2009. This remarkable feat was primarily driven by land transfer revenue generated from the Chau Duc Industrial Park project.

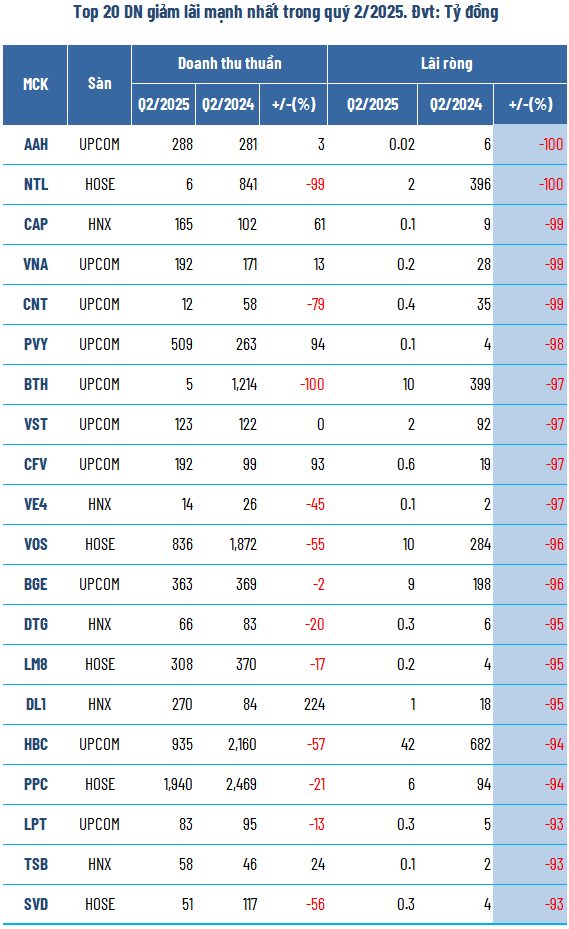

Net Profit Compression amid Cost Pressures

Source: VietstockFinance

|

Engaged in the exploitation and collection of hard coal, Consolidated Joint Stock Company (UPCoM: AAH) faced significant pressure from cost of goods sold, amounting to nearly VND 282 billion. This expense accounted for 98% of the company’s revenue, resulting in a slim gross profit margin of just 2.3%. With additional interest expenses of nearly VND 3 billion and operating expenses of over VND 3.6 billion, AAH managed to scrape by with a meager net profit of just over VND 21 million in Q2 2025, a mere fraction of the previous year’s performance.

As real estate projects are still in the process of completing legal procedures, Tu Liem Urban Development Joint Stock Company (HOSE: NTL) experienced a near-total loss in revenue from its core business. However, the company managed to stay afloat by generating financial income of nearly VND 21 billion (2.6 times higher than the previous year) from interest on deposits and investments in securities. With reduced financial and operating expenses, the company maintained a net profit of nearly VND 2 billion, albeit a significant 99.7% decline from Q2 2024.

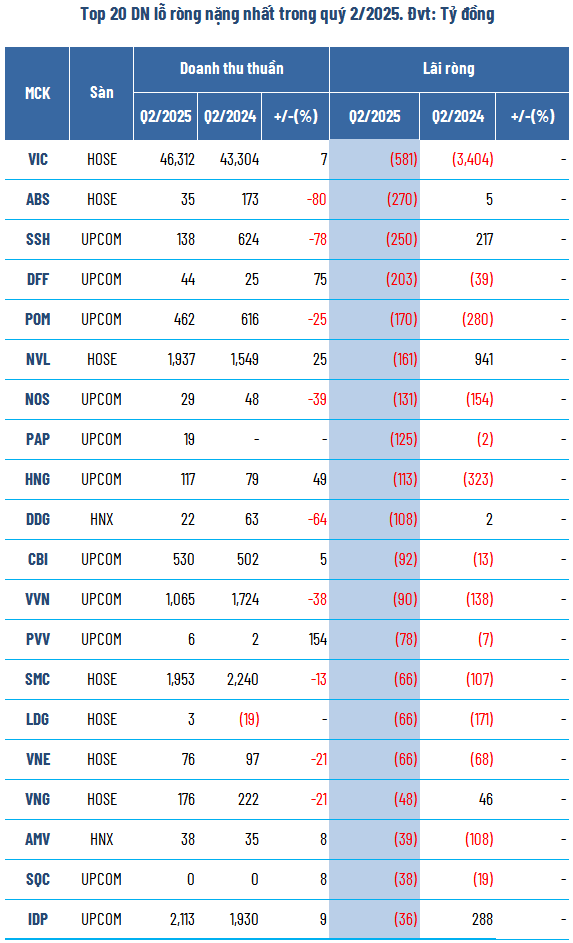

145 Companies Incur Losses of Nearly VND 3,500 Billion

Source: VietstockFinance

|

Despite the overall improvement in the business landscape, there were still some dark spots, with 145 companies reporting net losses totaling nearly VND 3,493 billion. Among them, 10 companies recorded losses of over a hundred billion VND.

Source: VietstockFinance

|

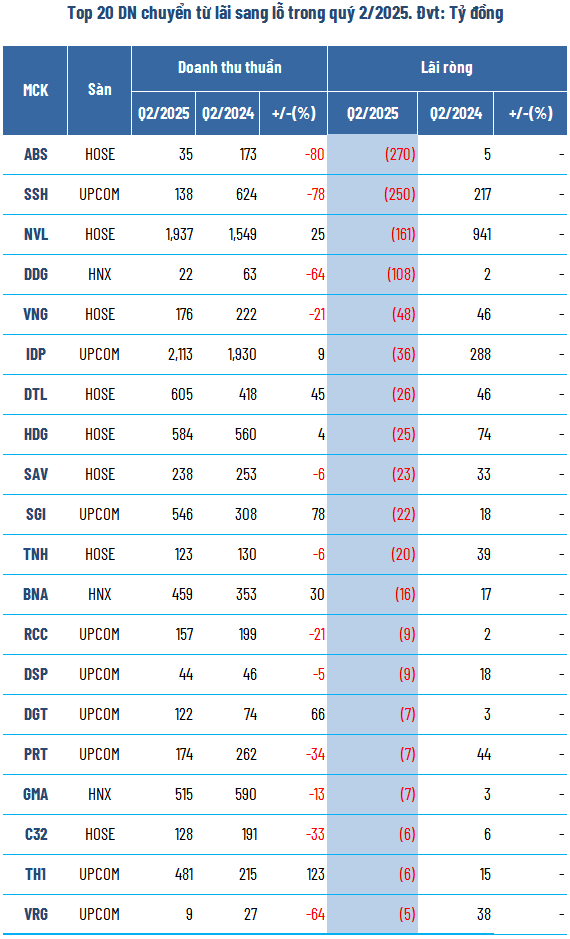

Notably, some companies, such as Binh Thuan Agricultural Services Joint Stock Company (HOSE: ABS) and Sunshine Homes Development Joint Stock Company (UPCoM: SSH), shifted from profits to substantial losses in this quarter, amounting to VND 270 billion and VND 250 billion, respectively.

Source: VietstockFinance

|

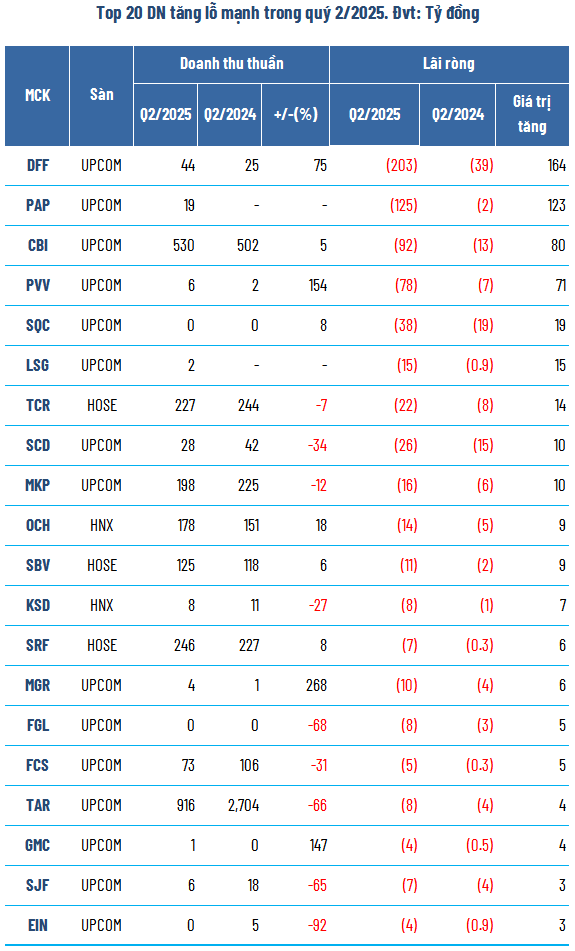

Numerous loss-making enterprises struggled to find a way out of their predicament. Typical examples include Fat Racing Group Joint Stock Company (UPCoM: DFF) and Phuoc An Port Petroleum Investment and Exploitation Joint Stock Company (UPCoM: PAP), which incurred losses of VND 203 billion and VND 125 billion, respectively. As a result, their accumulated losses reached VND 882 billion and VND 278 billion by the end of Q2 2025.

Overall, the primary reason for these losses can be attributed to income levels that were insufficient to offset the pressure from cost of goods sold and financial expenses. This situation highlights that while there are positive signals in the broader landscape, challenges remain for specific industries and individual companies.

– 08:00 29/08/2025

“Profits Choked by Expenses as Revenue Grows for Asset Management Firms”

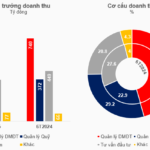

The Vietnamese stock market is a bustling arena, with 43 active fund management companies trading and driving the economy. Despite a promising 9% growth in revenue, primarily fueled by dynamic trust activities, the industry faced a challenging period with a decline in net interest margins, resulting in a 3% contraction due to various factors.

Q2: Oil Giants Soar, Upstream Group Shines Brightly

The oil and gas industry witnessed a notable divergence in the second quarter of 2025. The industry giants soared to new heights, while the remaining players experienced a boom in upstream ventures.

“Rising from the Ashes: The First National Treasure of ‘Make in Vietnam’ Enterprises”

Introducing our state-of-the-art facility, dedicated to producing impeccable, European-standard goods. With meticulous attention to detail, our team ensures that every product that leaves our facility is of the utmost quality. We pride ourselves on our commitment to excellence, delivering nothing but the best to our valued customers. Experience the difference with our meticulously crafted offerings.

“Private Equity Firm Partially Exits Investment in SAFI Transport Agency”

The Samarang UCITS – Samarang Asian Prosperity Fund has reported a reduction in its ownership stake in Transport Agent Joint Stock Company SAFI (HOSE: SFI) from 8.41% to 6.55%.