The VN-Index closed at 1,680 points on August 28, a gain of 8 points (0.48%).

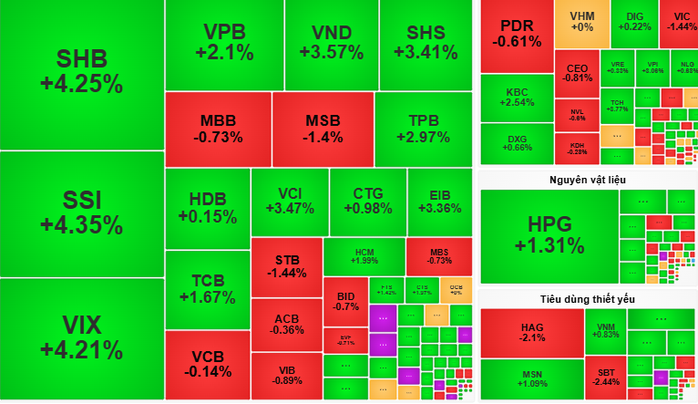

The trading session on August 28 started on a positive note, with the VN-Index climbing 7 points. However, the index soon faced corrective pressure as real estate stocks and large-cap stocks like Vingroup (VIC, VHM, VRE) encountered strong selling pressure. Meanwhile, securities stocks (SSI, VND, ORS) and steel stocks (HPG, NKG, HSG) remained the center of attention, attracting capital flows and helping the market maintain its balance.

In the afternoon session, the market gradually recovered thanks to increased buying interest in bank stocks. SHB (+4.25%), VPB (+2.10%), and TCB (+1.67%) led the rebound, while the Vingroup stocks narrowed their losses. The real estate sector’s improvement (DXG, KBC, TCH) and the continued strength of securities stocks from the morning session bolstered the upward trend.

At the close, the VN-Index ended at 1,680 points, marking an increase of 8 points (0.48%).

HoSE recorded 11 ceiling prices, 177 advancing stocks, and 137 declining stocks, indicating a buying bias. However, foreign investors continued to heavily offload Vietnamese stocks, with a net sell value of VND 2,574 billion, focusing on stocks like HPG, MSB, and MBB, which put significant pressure on the market.

According to VCBS, the VN-Index closing above 1,680 points is a positive signal, reflecting the market’s sustained recovery efforts. Active capital rotation among industries has supported the index in reinforcing crucial support levels. Nevertheless, stock divergence remains pronounced, necessitating cautious trading decisions.

VCBS advises investors to refrain from chasing after overheating stocks on August 29, as short-term corrective risks persist. Maintain a safe margin loan ratio and avoid excessive financial leverage in this volatile market environment. Consider gradual investment into sectors displaying positive signals, such as securities (SSI, VND, HCM) and retail (MWG, FRT), which are currently attracting strong capital inflows.

Other brokerage firms also caution investors to closely monitor foreign investors’ activities, as their continuous net selling in recent sessions could impact market sentiment, particularly for large-cap stocks.

Stock Market Update for Week of August 25-29, 2025: Foreign Investors Apply Pressure at Peak Levels

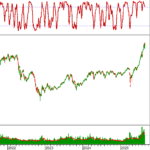

The VN-Index concluded its fourth consecutive week of gains despite facing substantial pressure at the peak. However, the recent strong selling trend among foreign investors is a notable concern. August 2025 witnessed the largest foreign net-selling since the beginning of the year, which could hinder the market’s upward trajectory in the short term if the situation doesn’t improve promptly.

“Technical Analysis for the Session Ahead: On the Cusp of History”

The VN-Index has been on a remarkable growth trajectory, inching closer to its historical peak. With a high probability of breaching the old peak zone of 1,680-1,693 points, the index is poised for a potential breakthrough. Meanwhile, the HNX-Index has also been on an upward trend, forming a Big White Candle pattern, indicating strong buying pressure and potential for further gains.

Market Beat: Lackluster Liquidity Ahead of Holidays, VN-Index Stuck in a Tug-of-War

The trading session concluded with a modest gain in the VN-Index, which rose by 1.35 points (+0.08%), closing at 1,682.21. The HNX-Index also witnessed a positive movement, climbing 3.35 points (+1.21%) to finish at 279.98. The market breadth tilted towards the bulls, as evidenced by 436 advancing stocks against 315 declining ones. However, the large-cap sector told a different story, with the VN30 basket showing a slight dominance of red, as 15 stocks fell, 13 advanced, and 2 remained unchanged.

Technical Analysis for August 28: Shaking Up the Old Highs

The VN-Index experienced significant volatility as it retested the old peak zone of 1,680-1,693 points, while the HNX-Index oscillated around the reference level. Both indices witnessed relatively low trading volumes, indicating a cautious market sentiment.