Nearly Half of the Banking System Reduced Staff

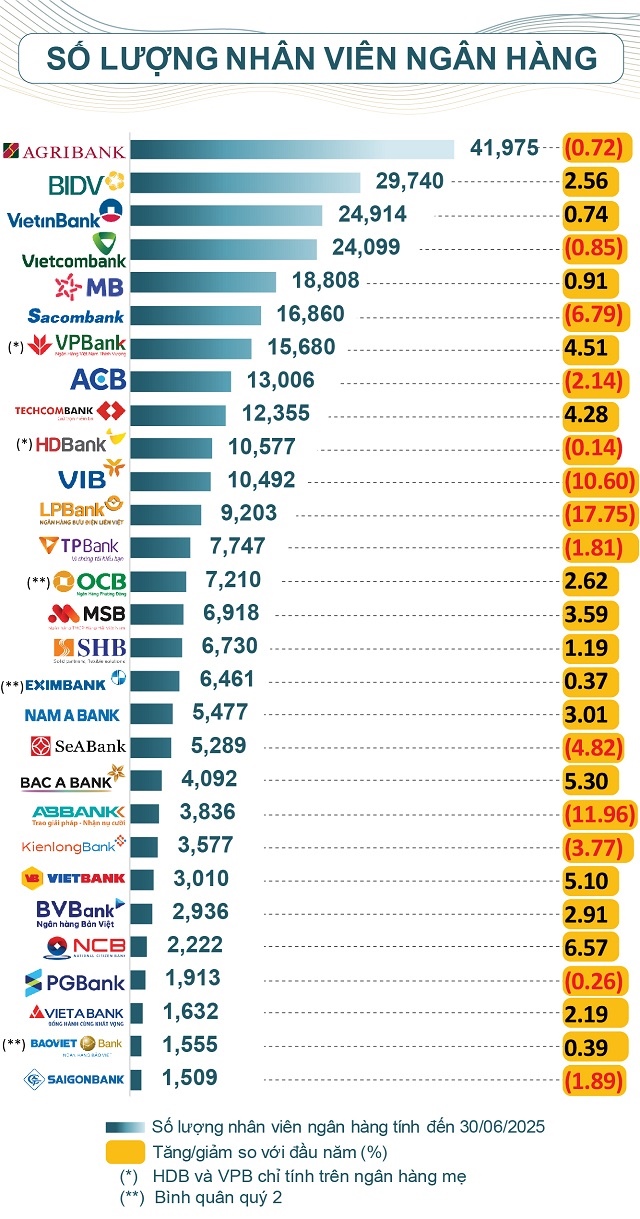

Data from VietstockFinance shows that as of Q2 2025, the total number of employees at 29 banks decreased by 2,795. Specifically, 13 out of 29 banks reduced their workforce compared to the beginning of the year, with an average reduction of nearly 5%.

Among them, LPBank (LPB) made the most significant cut, letting go of 1,986 employees, an 18% reduction, leaving them with a total headcount of 9,203. This was followed by ABBank (ABB), which decreased its staff by almost 12%, leaving them with 3,836 employees. VIB and Sacombank also reduced their headcount by 1,244 and 1,228 employees, respectively.

On the other hand, the remaining banks continued to expand their workforce, with an average growth rate of nearly 3%. NCB (NVB) hired the most, increasing its headcount by nearly 7% to 2,222 employees. This was closely followed by Bac A Bank (BAB), which grew its staff by over 5%, reaching a total of 4,092 people.

As of June 30, 2025, the state-owned group maintained its lead in terms of personnel size, with Agribank at the top (41,975 employees), followed by BIDV (29,740), VietinBank (CTG, 24,914), and Vietcombank (VCB, 24,099).

MB led the private banking group with 18,808 employees (+0.91%), followed by Sacombank with 16,860 people, despite a nearly 7% reduction.

Source: VietstockFinance

|

MB Records Highest Employee Income

In the first half of the year, in line with the government’s directives, banks continued to streamline operating costs and reduce interest rates to support businesses in their recovery efforts. However, only 4 out of 29 banks reduced staff costs.

Techcombank recorded the most significant decrease (-13%), with personnel expenses totaling 3,175 billion VND. This was followed by KLB, which reduced its staff costs by over 9%, amounting to 563 billion VND.

Conversely, VPBank witnessed the most substantial increase in staff expenses, with a nearly 40% surge. NVB and MBB followed closely behind, with increments of 33% and 21%, respectively.

|

Banks’ Staff Costs in the First Half of 2025 (in billion VND)

Source: VietstockFinance

|

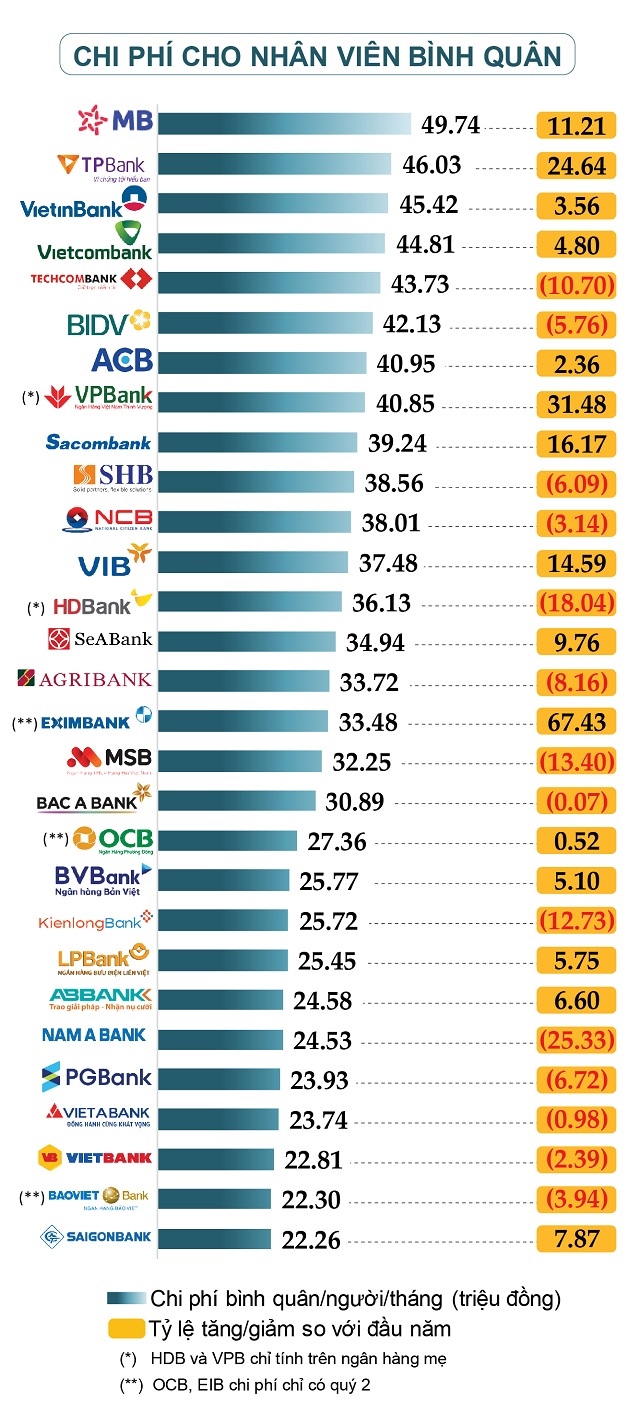

MB maintained its top position, with an average staff cost of 49.74 million VND per person per month, reflecting an increase of over 11% compared to the beginning of the year.

TPBank ranked second with an average of 46.03 million VND per person per month, marking a nearly 25% jump. VietinBank came in third with 45.42 million VND, followed by Techcombank (43.73 million VND) and BIDV (42.13 million VND).

Saigonbank (SGB) recorded the lowest average monthly income in the system at 22.26 million VND per person, despite an almost 8% increase from the beginning of the year.

Source: VietstockFinance

|

A representative from VietinBank shared that in the first six months of 2025, the bank focused on streamlining and reorganizing its structure and network optimization as part of its digital transformation journey. VietinBank also implemented initiatives for customer journey digitization, process automation for employees, robotic process automation, and the development of supporting tools to enhance automation, reduce time and costs, and ultimately improve labor productivity and customer and employee experience.

A spokesperson from UOB Vietnam highlighted that many traditional positions in the banking industry are being rapidly automated, leading to a significant shift in personnel structure. In the past, opening an account at a branch might have required up to 10 staff members to process the paperwork. Now, with digital banking platforms, customers can complete the process independently, significantly reducing the required headcount to 2-3 personnel.

This reduction is not a sign of contraction but rather a reallocation of resources. As back-office and administrative functions are streamlined, reducing the headcount by 50-70 people, recruitment needs are redirected toward value-creating roles in sales, financial advisory, and customer care.

However, the spokesperson emphasized that the human element remains irreplaceable. While technology efficiently handles repetitive and routine tasks, roles requiring communication skills, persuasive abilities, and relationship-building still rely on people. This is where the new generation of bank employees comes into play, acting as the bridge between technology and customers.

Sharing the same viewpoint, Mr. Nguyễn Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, stated that the recent wave of staff reductions in banks is not merely a reflection of cost pressures but a sign of strategic shift in the digital era.

As Vietnam aspires to become an international financial center, the simultaneous restructuring of human resources by banks indicates a comprehensive operational model overhaul. The banking system, being the core driver of capital, is actively innovating to promote integration and growth.

Mr. Huy commented, “The current staff reduction is mainly aimed at reorganizing towards a more agile and lean structure, with technology as the foundation. Instead of contracting, banks are preparing for an expansion in terms of scale and service quality, especially as the economy’s financial needs become increasingly diverse and complex.”

He further analyzed that technology, particularly Artificial Intelligence (AI) and automation, is fundamentally transforming the industry. Repetitive jobs are being replaced by digital tools, and banks are investing in reskilling their employees. As a result, the sector’s demand for human resources is not diminishing but undergoing a substantial shift in quality. Modern bank employees are expected to be data analysts, strategic advisors, and omnichannel customer care specialists. The future workforce needs to master AI tools, understand digital user behavior, and possess data-driven business acumen.

– August 29, 2025

“Techcombank: Showcasing Excellence at the Country’s Achievement Exhibition”

On the morning of August 28th, a grand opening ceremony was held at the Vietnam Exhibition Center for the exhibition titled “80 Years of Independence, Freedom and Happiness.” This event not only celebrated the country’s proud history but also aimed to inspire patriotism, national pride, and a desire to strive for progress. The exhibition showcased Vietnam’s potential and its rising stature on the path of renewal, integration, and sustainable development.

“VIB and the ‘Trendsetting Card Strategy’: From Vision to Vanguard.”

International Bank (VIB) has reached a remarkable milestone of 1 million credit cards, a testament to the success of its enduring “Leading the Card Trend” strategy implemented over the past 7 years.