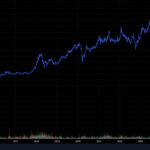

Vietnam’s largest bank, Vietcombank (VCB), had an exciting trading session on August 27, setting multiple new records in a single day.

The VCB stock surged by 7%, reaching a new all-time high of 69,100 VND per share (adjusted price). This was the first time since late February 2022 that the stock hit the maximum daily limit.

Vietcombank’s market capitalization also reached a new record of over VND 577,377 billion (approximately USD 22.2 billion), an increase of VND 37,000 billion from the previous session, solidifying its number one position on the Vietnamese stock exchange. This also marked the first time a Vietnamese enterprise surpassed a market cap of USD 22 billion.

Not only did the stock price increase significantly, but the trading volume on VCB also set a new record. The trading volume exceeded 31 million units, with a corresponding value of VND 2,100 billion, and a buy surplus of 4 million units at the ceiling price.

Apart from VCB’s relatively weaker performance compared to other bank stocks recently, which attracted capital inflows, some positive news reinforced the upward momentum of this stock. Most recently, the government issued Decree No. 232/2025/ND-CP dated August 26, 2025, amending and supplementing a number of articles of Decree No. 24/2012/ND-CP dated April 3, 2012, on gold business management. Notably, Decree 232/2025/ND-CP abolished Clause 3 of Article 4 of Decree 24/2012/ND-CP, eliminating the state monopoly on gold bar production, gold raw material exports, and gold raw material imports for gold bar production.

Accordingly, enterprises wishing to obtain a gold bar production license must have a minimum charter capital of VND 1,000 billion, and banks must have VND 50,000 billion. These entities must be on the list of those granted a license by the State Bank of Vietnam to trade in precious metals and must not have been subject to penalties or must have remedied any violations.

Considering the current charter capital scale, only a few leading enterprises have a charter capital of VND 1,000 billion or more, including PNJ, DOJI, and SJC. Among the banks, top-tier names like Vietcombank easily meet the capital requirement of VND 50,000 billion.

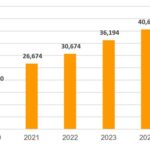

In terms of business performance, for the first six months of the year, pre-tax profit reached VND 21,894 billion, up 5.1%. Vietcombank’s total operating income for the six-month period exceeded VND 35,100 billion, an increase of 3.2%. This growth was driven by foreign exchange trading and other business activities. Meanwhile, net interest income for the six months decreased slightly by 0.5% year-on-year, and service income plunged by 43%.

Operating expenses increased faster than total revenue, causing a year-on-year decline in Vietcombank’s net profit from business operations. However, after deducting risk provisions, Vietcombank still recorded a slight increase in pre-tax profit. This was due to a significant decrease in risk provision expenses, amounting to VND 1,562 billion in the first six months, a reduction of 48% compared to the same period last year.

The Hottest Bank Stock Before Closing Bell

Today (August 27th), while the market returned to a state of tug-of-war, VCB stock stood out by closing at the ceiling, setting a new peak of VND 69,100 per share.

The Crypto Asset Exchange: VIX Securities Leads the Way

On August 26th, the Digital Asset Exchange Floor Joint Stock Company, or VIXEX, was established with a charter capital of 1 trillion VND. This marks a significant move by VIX as Vietnam navigates the path towards piloting licenses for digital asset exchanges.

“SHB Commits to Sustainable Growth, Forging Comprehensive Partnerships for an Enhanced Strategic Ecosystem.”

SHB, or the Saigon – Hanoi Commercial Joint Stock Bank, is committed to a comprehensive and sustainable development strategy. We forge strong partnerships with leading state-owned and private economic groups, both domestic and international, as well as businesses with robust ecosystems, supply chains, and satellite companies. Our focus also extends to small and medium-sized enterprises, and we are dedicated to expanding our reach to individual customers.

The Master Wordsmith: Crafting Captivating Copy that Elevates Your Web Presence

Unveiling the Art of Asset Recovery: How Mr. Truong Gia Binh Retrieved a Whopping $700 Million

FPT’s stock has plummeted by over 31% since the start of the year. This sharp decline has investors concerned about the future prospects of this once-promising company. With such a significant drop, it’s clear that FPT is facing challenges that are impacting its performance and worrying shareholders. The question now is: what steps will FPT take to address this downward trend and reassure its investors?