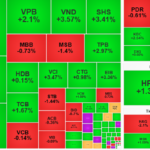

Securities stocks attract cash flow, many codes break through the ceiling. VND, ORS, AGR, TVB, and TCI hit the ceiling. VIX had the highest liquidity on the exchange, reaching nearly VND 2,500 billion, but its market price fell by nearly 2%.

VN-Index maintains its gains above the 1,680-point mark ahead of the September 2nd holiday.

Meanwhile, the leading banking stocks were dominated by VPB. Bui Cam Thi, the daughter of Bui Hai Quan – Vice Chairman of VPBank’s Board of Directors, has completed the purchase of 20 million VPB shares from August 25-27. Prior to this transaction, Ms. Thi did not own any shares in the bank.

MBB, HDB, SHB, and STB provided additional market momentum. More than 20 banking codes were covered in green, while the two Big4 representatives, VCB and CTG, declined. SHB led in terms of trading volume, with over 124 million units traded.

The real estate sector witnessed a mixed performance, with DIG, PDR, KDH, and CEO posting slight gains, while VHM, VRE, KBC, and NLG underwent adjustments, prompting a cautious market sentiment.

As the market headed into the September 2nd holiday, the VN-Index retained its gains above the 1,680-point level, indicating the continued strengthening of the market’s recovery efforts. Despite the divergence among stock groups, the active rotation of cash flows helped sustain the upward trajectory and gradually solidify support zones.

At the close, the VN-Index rose 1.35 points (0.08%) to 1,682.21. The HNX-Index climbed 3.35 points (1.21%) to 279.98, and the UPCoM-Index gained 0.38 points (0.34%) to reach 111. Trading liquidity increased, with the HoSE value exceeding VND44,800 billion. Foreign investors net sold over VND 3,500 billion, focusing on MBB, HPG, FPT, SSI, and VIX, among others.

The Stock Market Surge: Expert Tips on Stocks to Boost Your Portfolio

Despite predictions to the contrary, the VN-Index has been on a remarkable upward trajectory, consistently reaching new highs. This has left investors pondering which stock sectors to invest in for the remainder of the year.

Stock Market Update for Week of August 25-29, 2025: Foreign Investors Apply Pressure at Peak Levels

The VN-Index concluded its fourth consecutive week of gains despite facing substantial pressure at the peak. However, the recent strong selling trend among foreign investors is a notable concern. August 2025 witnessed the largest foreign net-selling since the beginning of the year, which could hinder the market’s upward trajectory in the short term if the situation doesn’t improve promptly.

“Technical Analysis for the Session Ahead: On the Cusp of History”

The VN-Index has been on a remarkable growth trajectory, inching closer to its historical peak. With a high probability of breaching the old peak zone of 1,680-1,693 points, the index is poised for a potential breakthrough. Meanwhile, the HNX-Index has also been on an upward trend, forming a Big White Candle pattern, indicating strong buying pressure and potential for further gains.

Market Beat: Lackluster Liquidity Ahead of Holidays, VN-Index Stuck in a Tug-of-War

The trading session concluded with a modest gain in the VN-Index, which rose by 1.35 points (+0.08%), closing at 1,682.21. The HNX-Index also witnessed a positive movement, climbing 3.35 points (+1.21%) to finish at 279.98. The market breadth tilted towards the bulls, as evidenced by 436 advancing stocks against 315 declining ones. However, the large-cap sector told a different story, with the VN30 basket showing a slight dominance of red, as 15 stocks fell, 13 advanced, and 2 remained unchanged.