On August 29, the day before the four-day National Day holiday, Phat Dat Real Estate Development Joint Stock Company (Phat Dat – PDR) unexpectedly announced that Mr. Nguyen Van Dat, Chairman of the Board, registered to sell 88 million PDR shares through a matching transaction. The expected transaction period is from September 5 to October 3.

If the transaction is completed, Mr. Dat’s ownership of PDR will decrease from over 359 million shares, holding 36.72% of the charter capital, to 271 million shares, equivalent to 27.7%. This information immediately caused concern among shareholders and investors due to the large volume of shares Mr. Dat registered to sell, amounting to over VND 2,000 billion at market price.

Previously, in early June, Mr. Dat’s son, Nguyen Tan Danh, registered to sell all 3.4 million shares he held. During that period, PDR was trading at VND 17,000-18,000 per share.

Earlier this year, Mr. Bui Quang Anh Vu, CEO of Phat Dat, also announced selling all his shares, leaving him with no stake in the company.

Mr. Nguyen Van Dat, Chairman of Phat Dat

However, on the company’s website, Mr. Dat explained that by selling his shares, he could “sacrifice short-term gains for longer-term, more sustainable benefits for both Phat Dat and its shareholders.” This is because the nature of this transaction is a proactive choice.

Nevertheless, the sale of shares by senior executives, regardless of the rationale, may cause concern among PDR investors, especially those currently holding the stock.

On the stock exchange, PDR shares have seen a significant increase since the beginning of the year. At the close of the trading session on August 29, PDR shares were priced at VND 24,550 per share, a slight increase of 0.61%. At this price, Mr. Dat is expected to receive approximately VND 2,100 billion after selling 88 million shares.

Is Now the Time to Buy Bank Stocks?

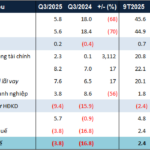

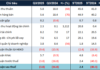

The banking sector stocks witnessed a sharp sell-off for the second consecutive session, reversing course after a scorching rally. As the VN-Index retreats from its peak, will this sector’s momentum persist or falter?

The Chairman of Ladophar seeks to offload a significant portion of his holdings as the company’s shares soar to new heights.

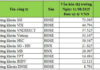

Mr. Pham Trung Kien, Chairman of the Board of Directors of Ladophar, a leading pharmaceutical company in Vietnam, has recently filed to sell over 1.08 million shares of the company’s stock, equivalent to 8.1% of its capital. If the transaction is successful, Mr. Kien’s ownership will decrease to 0.7%, and he will no longer be a major shareholder. The sale is intended for portfolio restructuring and will be executed through matched orders and/or put-through transactions between August 29 and September 27.