The Vietnamese stock market extended its gains ahead of the 2/9 holiday break. At the close, the VN-Index rose 1.35 points to 1,682.21. Liquidity improved compared to the previous session, with the matching value on HoSE reaching VND 43,170 billion.

In terms of foreign investors’ activities, non-resident investors continued to unexpectedly net sell VND 3,557 billion in the market. Specifically:

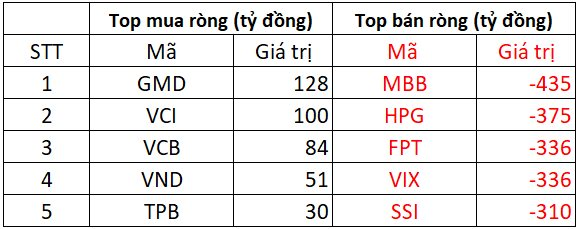

On HoSE, foreign investors net sold approximately VND 3,617 billion

On the buying side, GMD and VCI stocks witnessed the strongest net buying from foreign investors, with respective values of VND 128 billion and VND 100 billion. Foreign investors also net bought between VND 30 billion and VND 84 billion in VCB, VND, and TPB stocks during the session.

Conversely, MBB stock experienced the largest net selling pressure from foreign investors, amounting to VND 435 billion. Other blue-chip stocks that witnessed net selling in the hundreds of billions of VND included HPG (-VND 375 billion), FPT (-VND 336 billion), VIX (-VND 336 billion), and SSI (-VND 310 billion), among others.

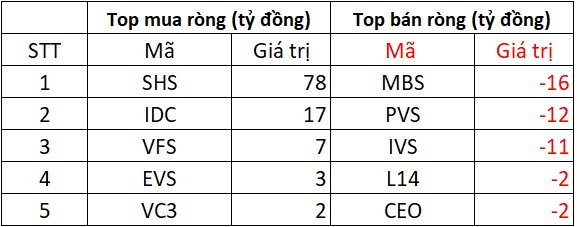

On HNX, foreign investors net bought approximately VND 61 billion

SHS stock witnessed the strongest net buying, with a value of VND 78 billion, followed by IDC stock with a net buying value of VND 17 billion. Additionally, VFS, EVS, and VC3 stocks also received net buying in the range of a few billion VND.

On the opposite side, PVS, IVS, and MBS stocks experienced net selling pressure of over ten billion VND each, while L14 and CEO stocks were net sold for VND 2 billion each.

On UPCOM, foreign investors net sold VND 1 billion

In terms of net buying, MCH stock led with a value of VND 11 billion. Following that, VEA, MPC, F88, and PHP stocks were net bought in the range of a few billion VND each.

Conversely, ACV stock witnessed the highest net selling value of VND 15 billion. OIL and ABI stocks also experienced net selling of VND 2-6 billion, respectively. Additionally, VHG and VCP stocks witnessed minor net selling.

“Aggressive Foreign Sell-Off Ahead of Holiday Lull”

The Vietnamese stock market witnessed another volatile session on August 29th. The VN-Index ended the day slightly higher, gaining just over 1 point. Domestic funds made a strong comeback, boosting liquidity, while foreign investors continued to offload Vietnamese shares, with net sell orders totaling more than VND 3,500 billion.

Unlocking the Power of Words: “336 Million Shares Set Free: Escaping the Confines of Caution”

“The unqualified opinion rendered in the 2025 interim financial report review for Tien Phong Securities showcases a pristine financial standing. This comprehensive review affirms the company’s financial health and stability, instilling confidence in investors and stakeholders alike.”

Stock Market Update for Week of August 25-29, 2025: Foreign Investors Apply Pressure at Peak Levels

The VN-Index concluded its fourth consecutive week of gains despite facing substantial pressure at the peak. However, the recent strong selling trend among foreign investors is a notable concern. August 2025 witnessed the largest foreign net-selling since the beginning of the year, which could hinder the market’s upward trajectory in the short term if the situation doesn’t improve promptly.