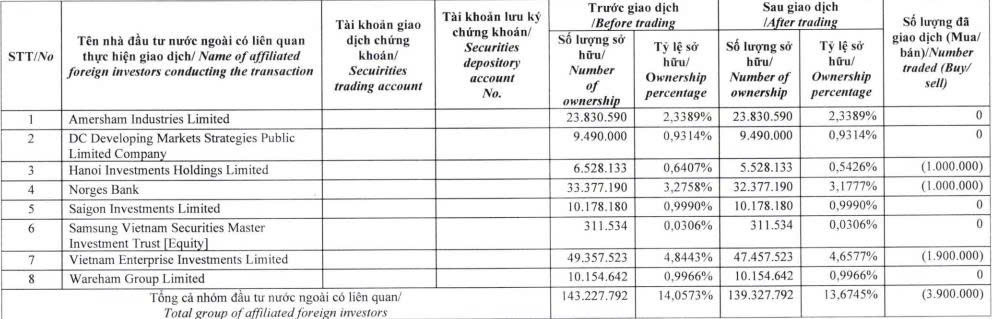

Dragon Capital, a prominent foreign investment fund, has reported a change in ownership among its group of affiliated foreign investors holding more than a 5% stake in DXG, the stock symbol for the real estate group, on the HoSE exchange.

On August 25, 2025, Dragon Capital, through three of its member funds, purchased a total of 3.9 million DXG shares. Hanoi Investments Holdings Limited sold 1 million shares, Norges Bank sold 1 million, and Vietnam Enterprise Investments Limited sold 1.9 million.

Source: DXG

Following this transaction, Dragon Capital’s holdings in DXG decreased from over 143.2 million shares to over 139.3 billion, reducing their ownership stake from 14.0573% to 13.6745% in the real estate group.

Based on the closing price of DXG shares on August 25, 2025, of VND 20,450 per share, Dragon Capital is estimated to have earned nearly VND 79.8 billion from this sale.

Previously, on August 22, 2025, Dragon Capital also executed trades in DXG shares through its member funds, with Norges Bank purchasing 300,000 shares and Vietnam Enterprise Investments Limited acquiring 500,000. Conversely, Samsung Vietnam Securities Master Investment Trust [Equity] sold 190,000 shares.

As a result of these transactions, Dragon Capital increased its ownership stake in the real estate group from 13.9974% (over 142.6 million shares) to 14.0573% (over 143.2 million shares).

In recent times, several executives of the real estate group have also conducted transactions to reduce their holdings in DXG shares. From August 4, 2025, to August 26, 2025, Mr. Ha Duc Hieu, a member of the group’s board of directors, successfully sold nearly 6.4 million shares that he had previously registered for sale, reducing his ownership from nearly 6.8 million shares to 414,033, or 0.04% of the group’s capital.

Additionally, Mr. Bui Ngoc Duc, the group’s CEO, sold 744,418 DXG shares between July 24, 2025, and August 19, 2025, through matched orders and/or automatic trades, leaving him with 952,000 DXG shares, equivalent to 0.09% of the company’s charter capital.

Unlocking Profits: Navigating the VN-Index’s Surge Past the 1,600-Point Milestone

“During the week of August 11–15, 2025, selling pressure from investment funds intensified as the VN-Index rallied for four consecutive sessions, breaching the psychological threshold of 1,600 points and approaching the 1,660 zone. However, the index faced corrective pressures during the week’s final trading session.”

Dragon Capital: After a Strong Rally, Sensitivity to Negative Factors May Increase

Overall, Dragon Capital maintains a positive outlook. The firm believes that the recent setbacks are only temporary and that the economy will rebound in the coming months. With a strong foundation and positive fundamentals, the future looks bright, and Dragon Capital is confident in the potential for growth and success.