According to information from the State Securities Commission (SSC), the SSC’s Inspection Agency has issued Decision No. 221/QD-XPHC on administrative sanctions in the field of securities and the securities market regarding Loc Troi Group Joint Stock Company.

Specifically, Loc Troi Group was fined VND 85 million for failing to disclose information in English and Vietnamese on the SSC’s disclosure system, the Hanoi Stock Exchange’s (HNX) electronic information portal, and the company’s website for the following documents: Second and consolidated quarterly financial statements for Q2/2024, Q3/2024, Q4/2024, Q1/2025, and Q2/2025; Semi-annual reviewed separate and consolidated financial statements for 2024; Separate and consolidated audited financial statements for 2024; and the 2024 Annual Report.

Illustrative image

The company disclosed information with incorrect timing on the SSC’s disclosure system, HNX’s electronic information portal, and the company’s website for the 2024 Corporate Governance Report in English, as stipulated in Clause a, Point 4, Article 42 of the Government’s Decree No. 156/2020/ND-CP dated December 31, 2020, on administrative sanctions in the field of securities and the securities market (Decree No. 156/2020/ND-CP).

The company was also fined VND 125 million for misrepresenting the consolidated after-tax profit (PAT) figure for 2023 in the self-prepared consolidated financial statements for Q4/2023. Specifically, the PAT for 2023 in the consolidated financial statements for Q4/2023 was VND 265,095,628,755, but the PAT for 2023 in the audited consolidated financial statements for 2023 was VND 16,493,205,625.

Loc Troi Group is required to take remedial measures by canceling or rectifying the information as prescribed in Clause 6, Article 42 of Decree No. 156/2020/ND-CP, amended and supplemented according to the provisions in Point d, Clause 33, Article 1 of Decree No. 128/2021/ND-CP, regarding the act of disclosing inaccurate information.

The Pharma Giants Shine in Q2

The pharmaceutical industry in the second quarter of 2025 built on the positive momentum from the previous quarter, with many companies reporting impressive double-digit growth. Building on policy advantages, most of the big players in the industry witnessed a significant surge in their performance. However, not all businesses shared this success, as some encountered mixed results.

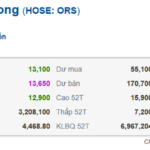

“ORS Stock Soars After Addressing Warning Issues”

On August 22nd, TPS Joint Stock Securities Company (TPS, HOSE: ORS) sent an explanation letter to the Ho Chi Minh City Stock Exchange (HOSE) regarding the resolution of issues that had led to a warning on their stock. Following this news, ORS shares surged to the ceiling price during the August 25th trading session.

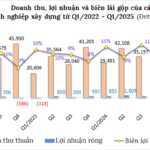

The Construction Industry’s Profit Crunch: Burdened by Outstanding Debts

The Q2 2025 financial results paint a varied picture of the construction industry. While some businesses are thriving with exponential profit growth, others are mired in a cycle of losses and mounting debt. This quarter’s performance reveals a sector with a diverse range of fortunes, highlighting the complex and dynamic nature of the construction industry.

Dabaco Takes Over Another Livestock Company in Thanh Hoa

“Dabaco is set to acquire a 98% stake in Lam Son Nhu Xuan CNC Agriculture Joint Stock Company, a Thanh Hoa-based enterprise. This acquisition involves the transfer of 9.8 million shares, representing a significant step for Dabaco as it expands its presence in the dynamic and thriving agricultural sector of Vietnam.”