Hanoi-Sai Gon Securities Joint Stock Company (code: SHS, on HNX) has just announced the issuance of 5 million shares under the employee stock ownership plan (ESOP) for 2025.

The shares will be restricted from transfer for one year from the end of the issuance period. The company will receive payment for the shares from September 3 to September 23, 2025.

With an offering price of VND 10,000 per share, the company expects to raise VND 50 billion to supplement its operating capital.

SHS shares closed at VND 29,200 per share on August 29, 2025. Thus, the ESOP offering price is 66% lower than the market price.

According to the previously announced list, a total of 313 employees are eligible to purchase ESOP shares in this offering. Mr. Nguyen Chi Thanh, CEO, has the highest allocation with 624,720 shares. Following him, Mr. Do Quang Vinh, Chairman of the Board of Directors, is offered 200,000 ESOP shares, and Mr. Le Dang Khoa, Board member, is allocated 70,000 shares, and so on.

In May 2025, SHS increased its charter capital from VND 8,131.5 billion to VND 8,944.6 billion after issuing bonus shares and paying dividends for the year 2023.

In terms of business results, in the second quarter of 2025, total operating revenue reached nearly VND 694 billion, an increase of VND 95 billion compared to the same period last year.

Of this, profit from financial assets measured at fair value through profit or loss (FVTPL) accounted for more than VND 417 billion, up 10.9% over the same period in 2024. Profit from loans and receivables amounted to nearly VND 153 billion; securities brokerage revenue was VND 71 billion; and financial advisory revenue exceeded VND 13 billion.

During this period, total operating expenses were VND 156 billion, and interest expenses were over VND 52.5 billion. After deducting taxes and fees, SHS reported a net profit of nearly VND 383 billion in the second quarter of 2025, up 8.2% year-on-year.

For the first six months of 2025, SHS recorded total operating revenue of VND 1,255.4 billion, an increase of nearly 7.9% over the same period last year. Pre-tax profit for the first half of 2025 reached VND 788.7 billion.

For the full year 2025, SHS targets total revenue of VND 2,519.8 billion and pre-tax profit of VND 1,600.6 billion. Thus, the company has already achieved 57.6% of its full-year profit target.

“IPA Seeks Buyers for 50 Million Privately Placed Shares”

Introducing IPA’s latest venture: a proposed private placement of 50 million shares, with a vision to revolutionize the market. The funds raised from this offering are intended to be utilized for the sole purpose of redeeming bonds previously issued in 2024. This strategic move showcases IPA’s commitment to financial prudence and paves the way for a robust future.

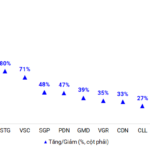

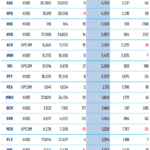

What Color Covered the Second Quarter’s Financial Results?

The second quarter of 2025 has come to a close, and the financial landscape is looking bright. A significant number of listed companies have reported impressive profit growth, outperforming their peers and setting a positive tone for the rest of the year.

The Power of Persuasive Copy: Crafting Compelling Headlines

“MWG Leaders Tease Stock Repurchase Timeline: Prices to Reach Six-Figure Territory”

“Our CEO is pleased to announce that we are in the process of finalizing and submitting our documentation to the relevant regulatory authorities. We are confident in our ability to meet and exceed all requirements, and we look forward to sharing more updates as we progress through this exciting journey.”

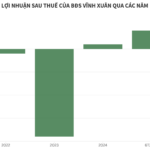

How is Vinh Xuan Real Estate Performing in the First Half of 2025?

As of June 30, 2025, Vinh Xuan Real Estate’s liabilities stood at over VND 1,106 billion, with a significant portion comprising bond debt.