The Investment and Development Joint Stock Company I.P.A (coded as IPA on HNX) has just announced the Resolution of the Board of Directors on passing the contents of the written shareholder vote.

The purpose of the shareholder vote is to approve the private placement of the company’s shares. The voting period will be from August 29, 2025, to 5:00 PM on September 19, 2025.

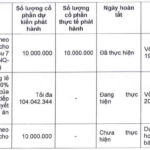

In the shareholder proposal, IPA stated that the 2025 Annual General Meeting of Shareholders approved the issuance of shares to increase charter capital from owner’s equity.

Accordingly, the company will issue bonus shares to shareholders at a ratio of 20%. However, the issuance of bonus shares will not increase the company’s actual capital receipts but only adjust the capital structure internally.

Illustrative image

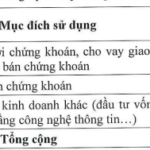

Therefore, to supplement the operating capital and enhance its financial capacity, the Board of Directors proposes that shareholders consider and vote on the plan to offer private placement of shares.

Specifically, the company intends to offer 50 million private placement shares to professional securities investors. The offering price will not be lower than VND 20,000/share and not lower than 90% of the average closing price of the last 10 consecutive trading sessions before the Board of Directors decides to approve the detailed issuance plan.

All proceeds from the offering will be used by IPA to repurchase bonds issued by the company in 2024 ahead of schedule.

The expected implementation time is in 2025 and/or 2026, after the State Securities Commission (SSC) announces the receipt of complete documents for the private placement of shares to professional securities investors by the company.

If the offering is successful, IPA’s charter capital is expected to increase from nearly VND 2,138.4 billion to nearly VND 2,638.4 billion.

In terms of business results, according to the consolidated financial statements for Q2 2025, IPA recorded net revenue of nearly VND 85 billion, down 48% over the same period last year. Gross profit reached nearly VND 38.7 billion, down 55.3%.

In this period, the company earned nearly VND 233.1 billion in financial revenue, 6.7 times higher than the same period last year.

After deducting taxes and expenses, IPA reported a net profit of over VND 129.4 billion, up 47.2% compared to Q2 2024.

For the first six months of 2025, IPA’s net revenue was over VND 190.6 billion, down 23.5% compared to the first six months of 2024, and after-tax profit was nearly VND 149.8 billion, down 22.3%.

As of June 30, 2025, IPA’s total assets increased by VND 298 billion compared to the beginning of the year, reaching VND 8,969.3 billion. Long-term financial investments accounted for 64.5% of total assets, amounting to nearly VND 5,781.2 billion.

On the liability side of the balance sheet, total liabilities were nearly VND 4,425.2 billion, up 6.1% from the beginning of the year. Of which, loans and finance leases amounted to nearly VND 3,704.5 billion, accounting for 83.7% of total liabilities.

The Sea Port Business: A Lucrative Venture with Record-Breaking Profits and Deposits

The second quarter of 2025 saw an impressive growth in revenue and profits for port operators, with many setting new records. This boom was driven by an increase in export activities as businesses rushed to ship goods before the implementation of retaliatory tariffs by the US.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.

The Largest Shareholder of SSI Securities Wants to Accumulate an Additional 16 Million Shares

Daiwa Securities Group Inc. is seeking to acquire nearly 16 million SSI shares directly from the issuer in a private placement. This move underscores Daiwa’s confidence in the potential of SSI and its commitment to strengthening its presence in the market. With this significant investment, Daiwa positions itself as a key player in SSI’s growth story, signaling a promising future for both companies.