In a recent development, LPBank Securities Joint Stock Company (LPBS) announced that September 8, 2025, is the record date for shareholders’ pre-emptive rights to subscribe to new shares.

Specifically, LPBS is offering a total of 878 million shares at a price of 10,000 VND per share. The entitlement ratio is 1,000:2,258.23, meaning that for every 1,000 shares owned, shareholders will have the right to purchase 2,258.23 new shares. The shares will be freely transferable.

The expected proceeds from this offering are 8,780 billion VND, and all funds raised will be allocated to the company’s operations.

Illustrative image

Breakdown of fund usage: 60% of the proceeds will be invested in marketable securities such as bonds and certificates of deposit; 30% will be allocated to margin lending activities; and the remaining 10% will be used for underwriting and other business activities.

If the offering is successful, LPBS’s chartered capital will increase from 3,888 billion VND to 12,668 billion VND.

Regarding business performance, according to the reviewed semi-annual financial statements for 2025, LPBS reported operating revenue of nearly 545.6 billion VND, a 17.7-fold increase compared to the same period last year. After deducting taxes and expenses, the company’s net profit reached nearly 246.6 billion VND, an 18.8-fold increase year-over-year.

According to LPBS’s explanation, the significant growth in the first half of 2025 was attributed to the expansion of its business operations, particularly in proprietary trading and margin lending activities.

As of June 30, 2025, the company’s total assets had increased nearly fourfold since the beginning of the year, reaching 20,197.6 billion VND. Financial assets accounted for a significant portion of the total assets, with financial assets measured at fair value through profit or loss (FVTPL) amounting to over 6,742.6 billion VND (33.4%) and holdings to maturity (HTM) investments totaling 6,854 billion VND (33.9%).

On the liabilities side of the balance sheet, total liabilities stood at 15,963.5 billion VND, a 14.7-fold increase compared to the start of the year. Short-term borrowings accounted for 83.2% of total liabilities, amounting to nearly 13,288.8 billion VND.

“An Cuong Wood Elects New Board Member, Expanding Business Operations”

The Ho Chi Minh City Stock Exchange-listed An Cuong Wood JSC (HOSE: ACG) has announced the appointment of Ms. Vu Hau Giang to its Board of Directors, replacing Mr. Phan Quoc Cong, who has stepped down. The Company has also approved an expansion of its business operations into the industrial machinery and equipment sector.

The Ultimate Guide to Investing: Unlocking the Secrets to Financial Freedom

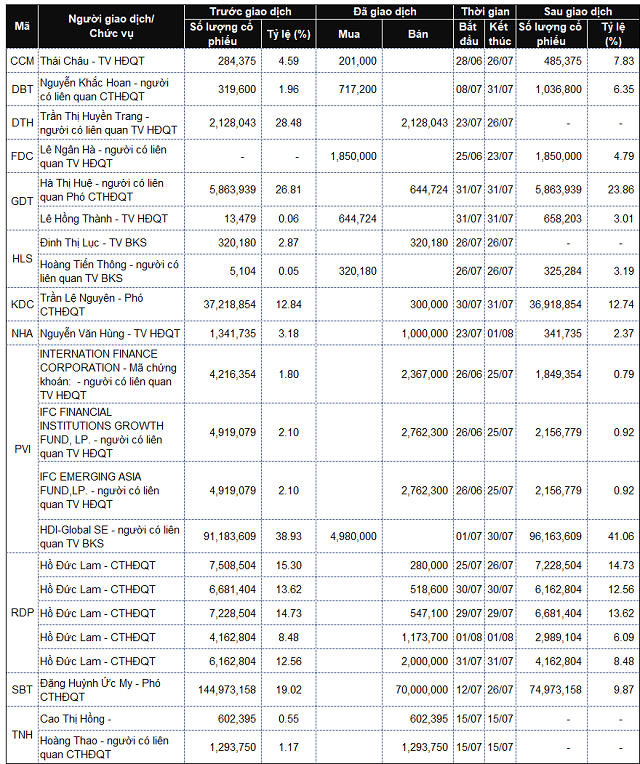

“Former Chairwoman of the Board of Directors of Hong Ha Food Industry Corporation (HOSE: HSL), Ms. Nguyen Thi Tuyet Nhung, has completely divested her 12.44% stake in the company, officially exiting the shareholder registry. This development comes amidst a surge in HSL’s stock price, which has climbed to historic highs, witnessing a remarkable increase of over 275% in just three months.”