Illustrative Image

Preliminary statistics from the Customs Department reveal that in July, Vietnam imported over 5.3 million tons of coal, valued at more than $491 million, representing a 17.4% decrease in volume and a 23.9% decrease in value compared to the previous month. Cumulatively, for the first seven months of the year, the country has imported over 43 million tons of coal, valued at over $4.3 billion, reflecting a 6.5% increase in volume but a 14.3% decrease in value compared to the same period last year.

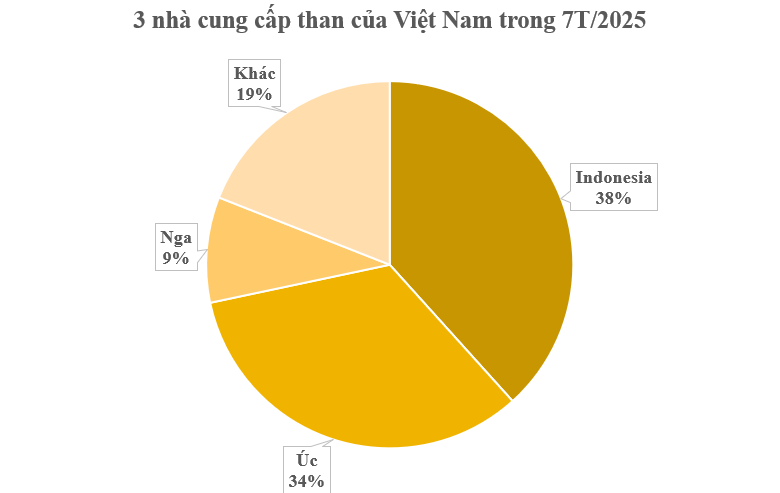

In terms of market sources, Indonesia stands as Vietnam’s largest supplier, providing over 16 million tons of coal, valued at over $1.3 billion, indicating a 1% increase in volume but a 14% decrease in value compared to the previous year. The average price was $80 per ton, a 15% decrease.

Australia is the second-largest supplier, with over 14.4 million tons of coal, valued at over $1.7 billion, reflecting a 1% decrease in volume and a 26% decrease in value compared to 2025. The average price was $119 per ton, a 26% decrease.

Notably, imports from Russia exceeded 4 million tons, valued at over $519 million, representing a 10% increase in volume but a 21% decrease in value. The average price was $129 per ton, a 28% decrease.

Vietnam is among the top five coal-consuming economies in Southeast Asia and the fifth-largest importer globally. Despite its long history of coal production, Vietnam relies on imports due to the inability of domestic supply to meet quality requirements. Most of the locally mined coal serves auxiliary roles, suitable for cement production or small-scale operations. In contrast, modern power plants demand coal with higher calorific value, consistency, and minimal impurities.

Additionally, as easily exploitable domestic reserves are gradually depleting, many mines are forced to dig deeper, leading to increased costs and reduced efficiency. On the other hand, importing cheap coal allows businesses to be flexible with their supply sources while saving production costs.

Currently, imported coal is subject to a standard tax rate (MFN) of approximately 3-5%. The specific MFN rate depends on the type of coal and its corresponding tariff code.

Regarding Russia, Vietnam’s third-largest coal supplier, the country boasts coal reserves sufficient for over 500 years of extraction, as mentioned by Deputy Prime Minister Alexander Novak in an article published in Energy Policy magazine.

Deputy Prime Minister Novak highlighted that the development of new coal mining centers will add 250 million tons to Russia’s production capacity by 2050. He emphasized that the top priority is to ensure that coal reserve extraction is carried out safely and environmentally responsibly.

According to Novak, by 2050, Russia’s coal industry will comprise modern enterprises that utilize advanced technologies and strictly adhere to environmental standards. The power generation capacity from coal in the Siberia and Far East regions is expected to reach approximately 38 gigawatts.

Furthermore, Russia plans to implement “clean coal” technologies and advanced extraction methods to promote the development of diverse by-products from coal and waste coal processing, as well as foster the growth of the coal chemistry industry.

“Fuel for Power: TKV Supplies Over 23 Million Tons of Coal for Electricity Generation in the First Half of 2024”

The Vietnam National Coal-Mineral Industries Group (Vinacomin or TKV) reported that in the first half of the year, coal consumption reached 26.77 million tons, of which 23.47 million tons were supplied to the power sector.