In July 2025, UOA, through its subsidiary UOA Vietnam, signed an agreement to acquire 100% of the shares of CTCP VIAS Hong Ngoc Bao for $68.7 million (equivalent to 1,775 billion VND). As a result, United Overseas Australia Ltd (UOA) will own the rights to a prime plot of land spanning approximately 2,000 sq. m. in District 1, Ho Chi Minh City.

UOA plans to develop a commercial office building on the site as a real estate investment. The project is expected to have a total floor area of 20,160 sq. m., expanding UOA Group’s investment activities in Vietnam. The share purchase agreement is expected to be completed by December 31, 2025, at the latest.

Who is UOA?

United Overseas Australia (UOA) was established in 1987 and is listed on the Australian Stock Exchange. The company focuses on real estate development, construction, investment, and property management. In 1989, UOA relocated its head office and business operations to Kuala Lumpur, Malaysia. UOA Ltd. was listed on the Singapore Stock Exchange in 2008, and its real estate development subsidiary, UOA Development Bhd., was listed on the Bursa Malaysia Stock Exchange in 2011. UOA is currently the largest commercial real estate developer in Kuala Lumpur, offering over 1 million sq. m. of office space.

UOA has a Malaysia-based trust, UOA Real Estate Investment Trust (UOA REIT), established to own and invest in real estate and real estate-related assets used for commercial purposes, directly or indirectly, by owning companies with the sole purpose of owning real estate. The trust’s portfolio is valued at approximately RM 1.74 billion (nearly $360 million) and includes six prime properties in the capital city of Kuala Lumpur.

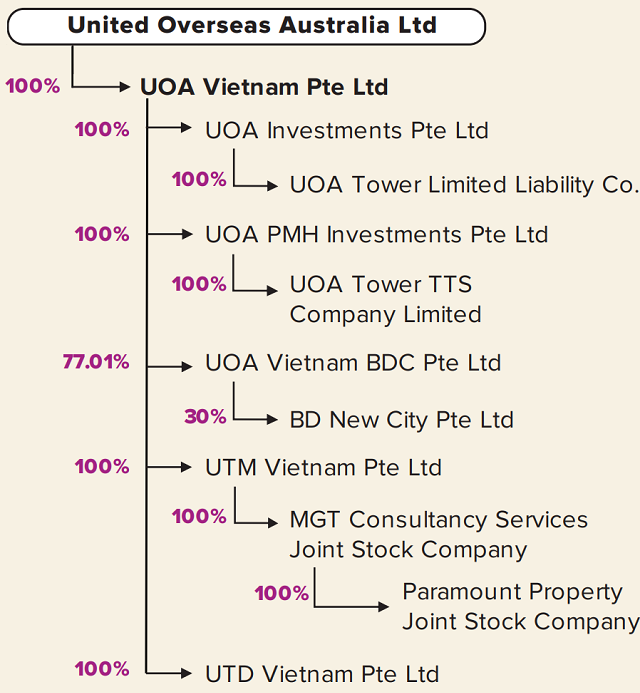

UOA is no stranger to the Vietnamese market. UOA Vietnam was established in 2017 and focuses on three main development services: project development, building management, and real estate investment. The company is currently operating and developing UOA Tower 1, a 23-story building with a gross floor area of nearly 28,500 sq. m., located in the Phu My Hung urban area of Ho Chi Minh City.

Not far from there, UOA Tower 2, developed by UOA Tower TTS, is also under construction. This project spans an area of 5,450 sq. m. and is expected to be a 24-story building with commercial, service, and office functions. According to C&W, UOA Tower 2 will have a floor area of 45,800 sq. m. and is slated for completion in 2027.

UOA Tower 1 and 2 in Phu My Hung – Image: UOA.

|

In late 2023, UOA reached an agreement to acquire a 30% stake in CapitaLand Vietnam, which holds the remaining 70% in BD New City Pte Ltd. – a joint venture developing a portion of the Sycamore Capitaland project in Binh Duong. The project is valued at $247 million, with UOA paying $31.5 million to CapitaLand to partially fund the initial cost. In return, CapitaLand contributed $73.5 million to the joint venture, resulting in a total capital injection of $104 million into the new entity.

|

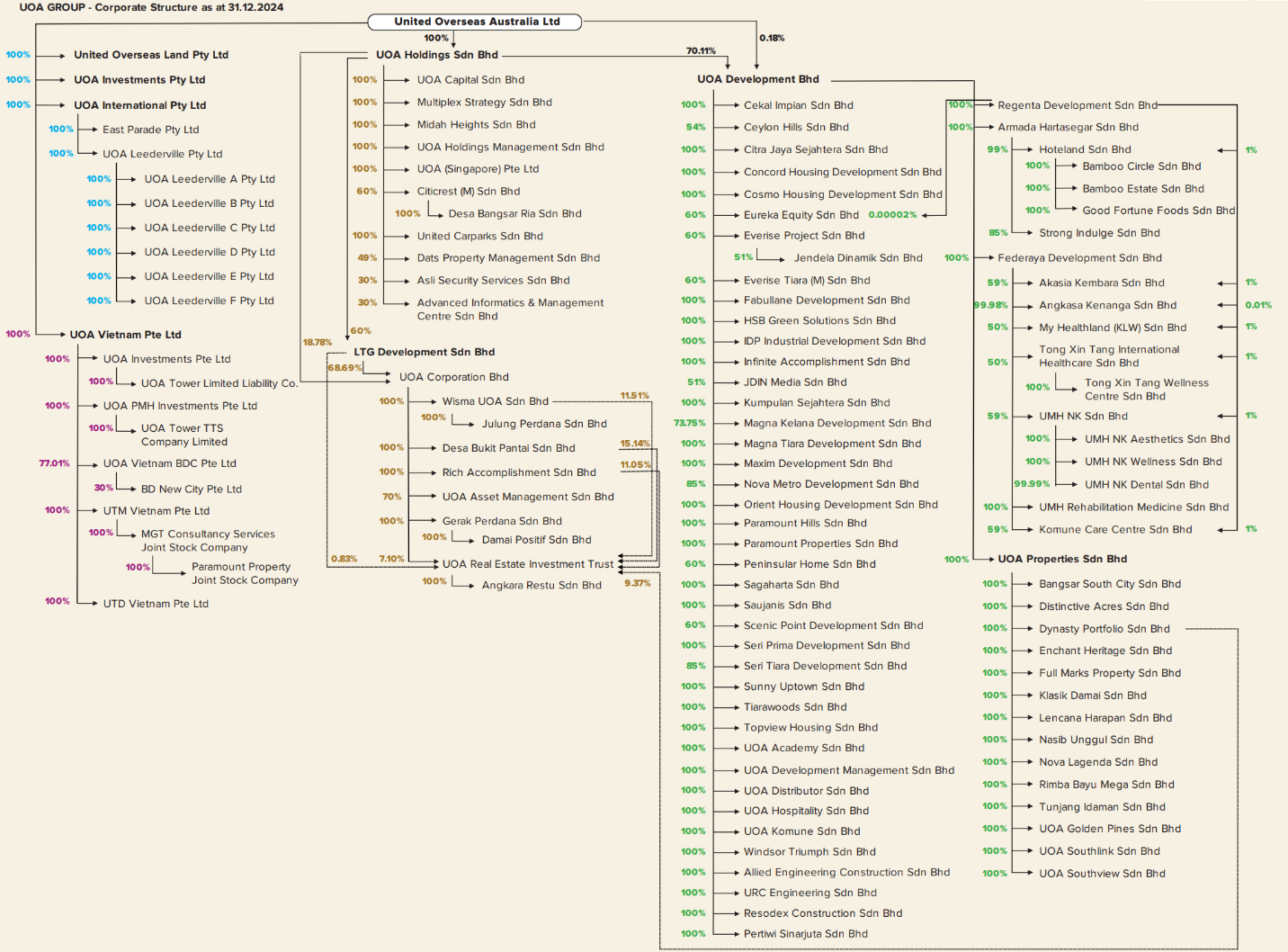

UOA’s global ecosystem

|

|

UOA’s presence in Vietnam

As of December 31, 2024. Source: UOA

|

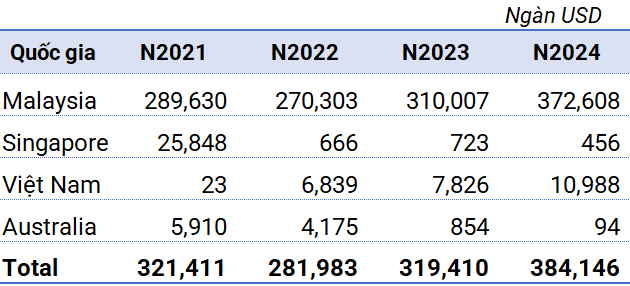

In 2024, UOA’s revenue from real estate and construction reached $120 million, a 31% increase from the previous year, thanks to the completion of several projects in Malaysia. Net profit increased by 11%, amounting to $86.8 million.

The Vietnamese market contributed $7.3 million in 2024, accounting for approximately 2.9% of the Group’s consolidated revenue. This included $5.5 million from leasing, $0.4 million from other services, and $1.5 million from revaluation gains on investment properties. Additionally, long-term assets in Vietnam were valued at $28.6 million.

UOA’s overall growth in 2024 was driven by the Malaysian market, but Vietnam stood out for its rapid growth rate. Leasing in Vietnam was a significant contributor, reflecting the stable demand for premium office space. The revaluation gains on investment properties in Vietnam further increased the country’s contribution, indicating a higher valuation of assets in the region. Although Vietnam’s share of total revenue is still small (less than 3%), its growth rate surpasses the overall average, and there is potential to increase profit contribution through the expansion of the rental asset portfolio.

|

Revenue from external customers

Source: Author’s compilation

|

As of the end of 2024, UOA’s net assets were valued at nearly $1.9 billion, with undistributed net profit after tax amounting to $947 million.

A closer look at the prime location

CTCP VIAS Hong Ngoc Bao recently increased its charter capital from over 98.2 billion VND to 1,335 billion VND on July 30, 2025. Of this, 90.2% of the capital (equivalent to 1,204 billion VND) was contributed as the value of land use rights, and the remaining 9.8% in VND. Mr. Tran Nguyen Huan serves as the Chairman of the Board, and Ms. Ho Thi Anh Nga is the General Director.

The company was established in 2016 and is headquartered at 72 Bis Vo Thi Sau, Tan Dinh Ward, District 1 (former address), Ho Chi Minh City.

According to surveys, the company’s current headquarters is located on a vacant, square plot of land directly across from Le Van Tam Park, with a bustling frontage on the main thoroughfare of Vo Thi Sau. This is perhaps one of the few remaining vacant plots of land in the heart of Ho Chi Minh City.

Location of the land. Image: Google Maps

|

|

|

The company’s signboard with the old name at the entrance of the land. Image: TM

|

|

Inside the land – Image: TM

|

It is possible that this is the plot of land that Hong Ngoc Bao sold to UOA.

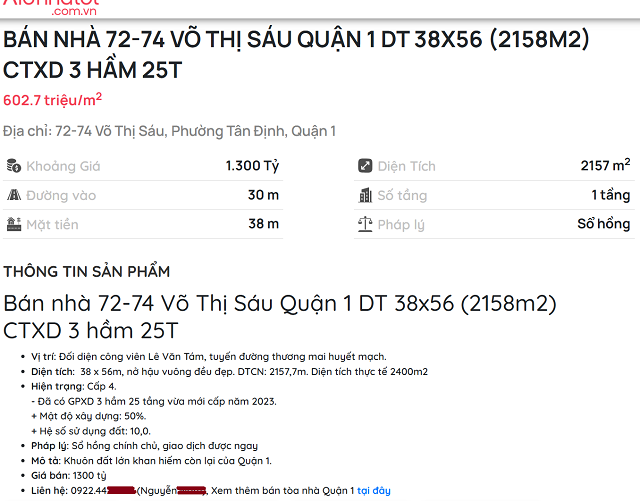

Several websites are advertising the land fund at the address of VIAS Hong Ngoc Bao’s headquarters for 1,300-2,000 billion VND, with a land area of 2,157 sq. m., along with a rendering of a 25-story building.

Screenshot.

|

Thu Minh

– 10:00 31/08/2025

“Asia Infrastructure Investment Bank President Forecasts Double-Digit Growth for Vietnam”

On August 31, during his attendance at the Shanghai Cooperation Organization (SCO) Summit in Tianjin and his official visit to China, Prime Minister Pham Minh Chinh met with the President of the Asian Infrastructure Investment Bank (AIIB), Jin Liqun.

The Ultimate Guide to Property Prices in Tay Ninh: Unveiling the Dual Pricing System

The local authorities in Tay Ninh are taking proactive steps towards efficient land management. On August 28th, the Provincial Department of Agriculture and Rural Development announced their initiative to establish a new land price framework. This framework, currently under development, will be presented to the People’s Committee of Tay Ninh Province for approval and subsequent implementation from January 1st, 2026.

The Power of the Trần Phú TRAFUCO Brand at the Country’s Achievements Exhibition

Celebrating 80 years of national independence at the Country’s Achievements Exhibition, Tran Phu Joint Stock Company (Tran Phu TRAFUCO) solidifies its standing as a leading National Brand. With their renowned electrical wire and cable products, they embody the pride and quality of Vietnamese craftsmanship in this era of integration.